Tipflation describes the rising costs and increased tipping expectations impacting consumer spending, while stagflation refers to the simultaneous occurrence of stagnant economic growth, high unemployment, and inflation. Both phenomena challenge economic stability by affecting purchasing power and market confidence in different ways. Explore the detailed impacts of tipflation and stagflation to understand their effects on the economy.

Why it is important

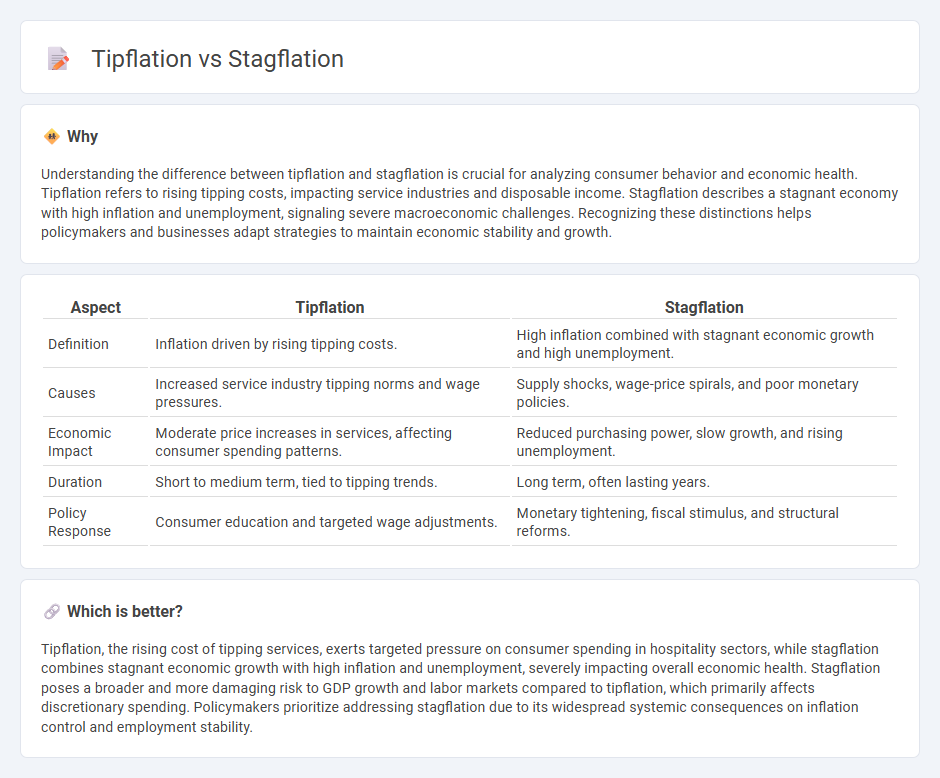

Understanding the difference between tipflation and stagflation is crucial for analyzing consumer behavior and economic health. Tipflation refers to rising tipping costs, impacting service industries and disposable income. Stagflation describes a stagnant economy with high inflation and unemployment, signaling severe macroeconomic challenges. Recognizing these distinctions helps policymakers and businesses adapt strategies to maintain economic stability and growth.

Comparison Table

| Aspect | Tipflation | Stagflation |

|---|---|---|

| Definition | Inflation driven by rising tipping costs. | High inflation combined with stagnant economic growth and high unemployment. |

| Causes | Increased service industry tipping norms and wage pressures. | Supply shocks, wage-price spirals, and poor monetary policies. |

| Economic Impact | Moderate price increases in services, affecting consumer spending patterns. | Reduced purchasing power, slow growth, and rising unemployment. |

| Duration | Short to medium term, tied to tipping trends. | Long term, often lasting years. |

| Policy Response | Consumer education and targeted wage adjustments. | Monetary tightening, fiscal stimulus, and structural reforms. |

Which is better?

Tipflation, the rising cost of tipping services, exerts targeted pressure on consumer spending in hospitality sectors, while stagflation combines stagnant economic growth with high inflation and unemployment, severely impacting overall economic health. Stagflation poses a broader and more damaging risk to GDP growth and labor markets compared to tipflation, which primarily affects discretionary spending. Policymakers prioritize addressing stagflation due to its widespread systemic consequences on inflation control and employment stability.

Connection

Tipflation and stagflation both reflect economic pressures that reduce consumer purchasing power and increase the overall cost of living. Tipflation occurs when businesses raise tipping expectations, indirectly escalating service costs, while stagflation combines stagnant economic growth with high inflation and unemployment. Together, these phenomena exacerbate financial strain on households and slow economic recovery.

Key Terms

Inflation

Stagflation is characterized by high inflation, stagnant economic growth, and rising unemployment, creating a challenging economic environment. Tipflation specifically refers to inflation impacting tipping practices, where increased prices lead consumers to adjust or reduce gratuities given to service workers. Explore the nuances between these inflation types to understand their distinct effects on the economy and consumer behavior.

Unemployment

Stagflation is characterized by high inflation, stagnant economic growth, and rising unemployment rates, creating a challenging environment for policymakers. Tipflation, a less common term, refers specifically to inflationary pressures in the tipping economy, which may influence employment levels in service sectors but does not directly cause widespread unemployment. Understanding the differences and impact on job markets can provide valuable insights for economic planning and forecasting. Learn more about how stagflation and tipflation affect unemployment trends.

Consumer Prices

Stagflation occurs when inflation rises alongside stagnant economic growth and high unemployment, causing consumer prices to increase despite reduced demand. Tipflation refers to the rising costs specifically related to tipping practices, which can put additional pressure on consumer spending without broad economic stagnation. Explore more to understand how these inflation types uniquely impact consumer prices and economic behavior.

Source and External Links

Overview, Examples, Why Stagflation is Feared - Stagflation refers to an economic situation marked by high inflation, slow or stagnant economic growth, and persistently high unemployment, posing significant challenges for policymakers.

Stagflation - Wikipedia - Stagflation is characterized by the simultaneous occurrence of high inflation, stagnant or declining economic growth, and elevated unemployment, defying the traditional inverse relationship between inflation and unemployment described by the Phillips Curve.

What Is Stagflation (and Why Should You Care)? - Fordham Now - Stagflation occurs when prices continue to rise (inflation) while the economy slows down (stagnation), making it harder for people to find jobs and increasing the financial strain on households.

dowidth.com

dowidth.com