Supercore inflation excludes volatile food and energy prices, offering a clearer view of underlying price trends in the economy. Core inflation omits only food and energy, providing a broader measure of sustained price changes affecting consumer goods and services. Explore further to understand how these inflation metrics impact monetary policy and economic forecasting.

Why it is important

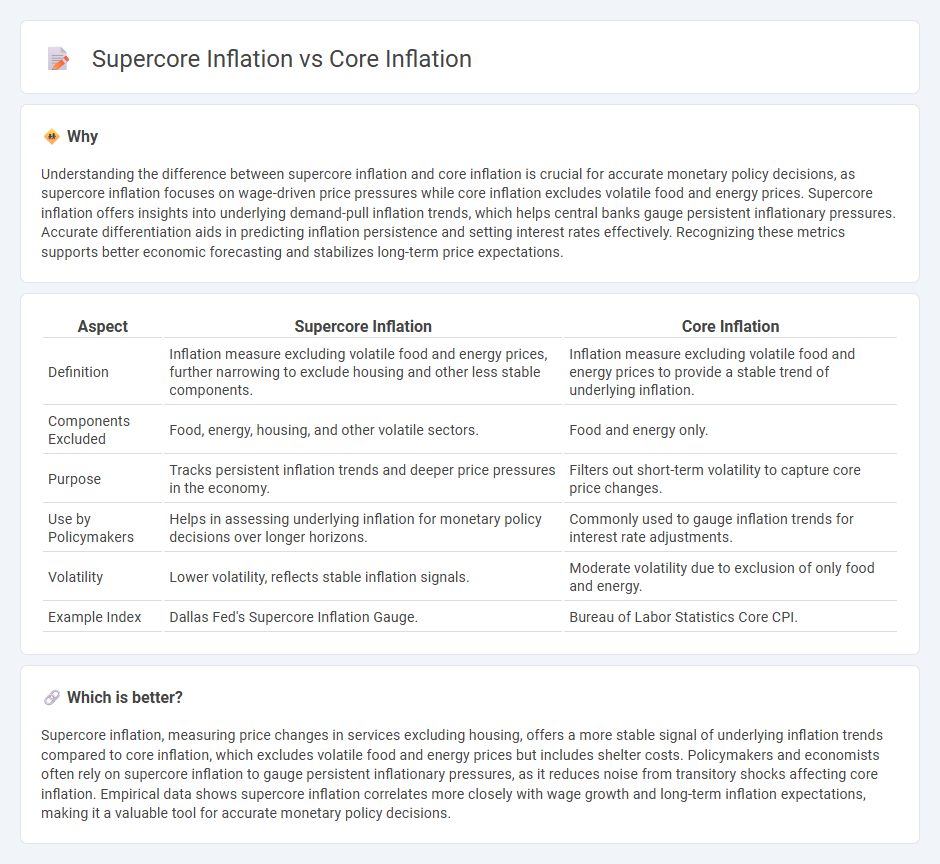

Understanding the difference between supercore inflation and core inflation is crucial for accurate monetary policy decisions, as supercore inflation focuses on wage-driven price pressures while core inflation excludes volatile food and energy prices. Supercore inflation offers insights into underlying demand-pull inflation trends, which helps central banks gauge persistent inflationary pressures. Accurate differentiation aids in predicting inflation persistence and setting interest rates effectively. Recognizing these metrics supports better economic forecasting and stabilizes long-term price expectations.

Comparison Table

| Aspect | Supercore Inflation | Core Inflation |

|---|---|---|

| Definition | Inflation measure excluding volatile food and energy prices, further narrowing to exclude housing and other less stable components. | Inflation measure excluding volatile food and energy prices to provide a stable trend of underlying inflation. |

| Components Excluded | Food, energy, housing, and other volatile sectors. | Food and energy only. |

| Purpose | Tracks persistent inflation trends and deeper price pressures in the economy. | Filters out short-term volatility to capture core price changes. |

| Use by Policymakers | Helps in assessing underlying inflation for monetary policy decisions over longer horizons. | Commonly used to gauge inflation trends for interest rate adjustments. |

| Volatility | Lower volatility, reflects stable inflation signals. | Moderate volatility due to exclusion of only food and energy. |

| Example Index | Dallas Fed's Supercore Inflation Gauge. | Bureau of Labor Statistics Core CPI. |

Which is better?

Supercore inflation, measuring price changes in services excluding housing, offers a more stable signal of underlying inflation trends compared to core inflation, which excludes volatile food and energy prices but includes shelter costs. Policymakers and economists often rely on supercore inflation to gauge persistent inflationary pressures, as it reduces noise from transitory shocks affecting core inflation. Empirical data shows supercore inflation correlates more closely with wage growth and long-term inflation expectations, making it a valuable tool for accurate monetary policy decisions.

Connection

Supercore inflation measures price changes in sectors less affected by temporary shocks, focusing on services like housing and healthcare, while core inflation excludes volatile food and energy prices to provide a clearer view of underlying inflation trends. Both metrics help policymakers identify persistent inflation pressures, with supercore inflation often signaling long-term wage and price dynamics that drive core inflation. Understanding their connection aids central banks in setting effective monetary policies to stabilize the economy.

Key Terms

Consumer Price Index (CPI)

Core inflation, measured by the Consumer Price Index (CPI), excludes volatile food and energy prices to provide a clearer view of underlying inflation trends. Supercore inflation narrows this focus further, tracking the CPI for services excluding housing, capturing persistent price pressures in service sectors. Explore more about their differences and implications for economic policy and market analysis.

Excluding Food and Energy

Core inflation excludes volatile food and energy prices to provide a clearer picture of underlying inflation trends, while supercore inflation further refines this by excluding housing costs, often considered sticky and less responsive to economic shifts. This distinction helps economists and policymakers assess monetary policy impacts more precisely, as supercore inflation reflects price changes in goods and services more sensitive to economic conditions. Explore detailed analyses on how these inflation measures influence financial decision-making and economic forecasting.

Services Inflation

Core inflation excludes volatile food and energy prices, providing a stable measure of underlying inflation trends, while supercore inflation specifically targets services inflation, which often drives persistent price changes due to its sensitivity to wage growth and demand shifts. Services inflation reflects costs in sectors like healthcare, education, and housing, making it a crucial indicator for central banks to assess long-term inflation pressures. Explore deeper insights into how services inflation shapes monetary policy decisions and economic forecasting.

Source and External Links

Core inflation - Wikipedia - Core inflation measures the underlying long-term trend in aggregate price levels by excluding items with volatile short-term price changes, such as food and energy.

Core inflation: a measure of inflation for policy purposes - Core inflation helps policymakers distinguish persistent price trends from temporary fluctuations, making it a crucial tool for guiding monetary policy decisions.

United States Core Inflation Rate - Trading Economics - In June 2025, U.S. core inflation rose 2.9% year-over-year, and is projected to trend around 2.3% by 2027.

dowidth.com

dowidth.com