Polycrisis, characterized by the simultaneous impact of multiple global challenges such as inflation, supply chain disruptions, and geopolitical tensions, differs fundamentally from a traditional recession marked by a sustained decline in economic activity. While a recession typically involves reduced consumer spending, rising unemployment, and lower GDP growth, a polycrisis combines these economic stressors with environmental, social, and political factors that compound uncertainties. Explore how these intertwined crises are reshaping economic policies and global markets.

Why it is important

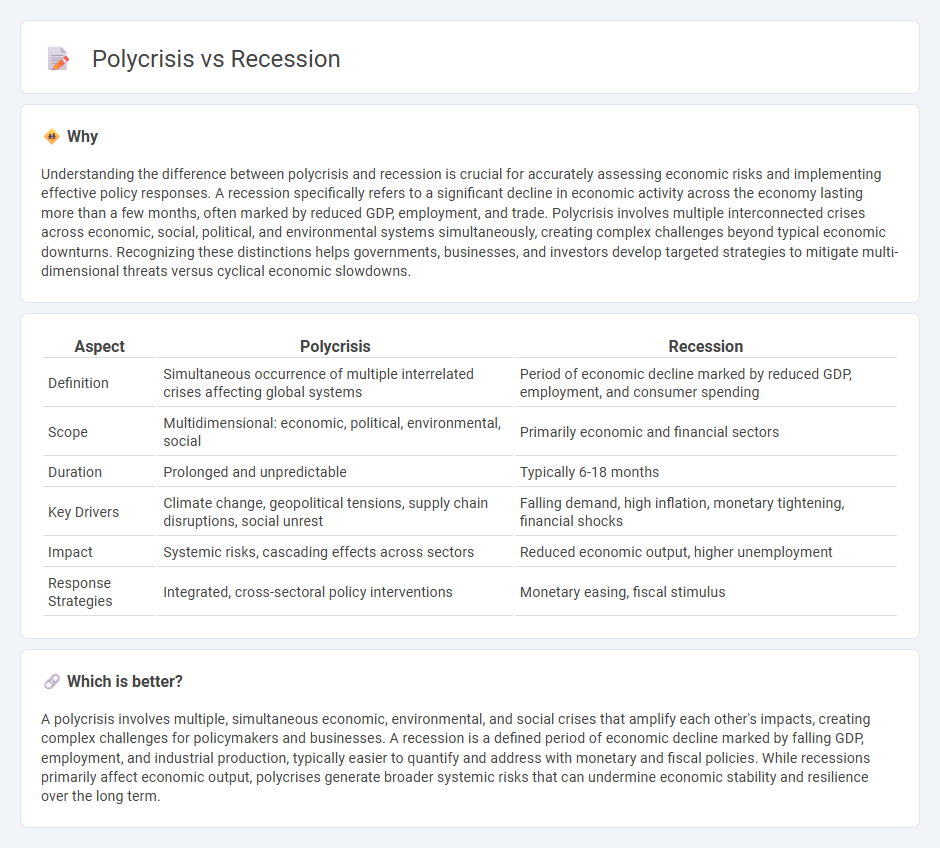

Understanding the difference between polycrisis and recession is crucial for accurately assessing economic risks and implementing effective policy responses. A recession specifically refers to a significant decline in economic activity across the economy lasting more than a few months, often marked by reduced GDP, employment, and trade. Polycrisis involves multiple interconnected crises across economic, social, political, and environmental systems simultaneously, creating complex challenges beyond typical economic downturns. Recognizing these distinctions helps governments, businesses, and investors develop targeted strategies to mitigate multi-dimensional threats versus cyclical economic slowdowns.

Comparison Table

| Aspect | Polycrisis | Recession |

|---|---|---|

| Definition | Simultaneous occurrence of multiple interrelated crises affecting global systems | Period of economic decline marked by reduced GDP, employment, and consumer spending |

| Scope | Multidimensional: economic, political, environmental, social | Primarily economic and financial sectors |

| Duration | Prolonged and unpredictable | Typically 6-18 months |

| Key Drivers | Climate change, geopolitical tensions, supply chain disruptions, social unrest | Falling demand, high inflation, monetary tightening, financial shocks |

| Impact | Systemic risks, cascading effects across sectors | Reduced economic output, higher unemployment |

| Response Strategies | Integrated, cross-sectoral policy interventions | Monetary easing, fiscal stimulus |

Which is better?

A polycrisis involves multiple, simultaneous economic, environmental, and social crises that amplify each other's impacts, creating complex challenges for policymakers and businesses. A recession is a defined period of economic decline marked by falling GDP, employment, and industrial production, typically easier to quantify and address with monetary and fiscal policies. While recessions primarily affect economic output, polycrises generate broader systemic risks that can undermine economic stability and resilience over the long term.

Connection

Polycrisis, characterized by simultaneous economic, social, and environmental challenges, intensifies recession risks by disrupting supply chains, reducing consumer confidence, and constraining fiscal policy effectiveness. Recession, marked by declining GDP and rising unemployment, worsens during a polycrisis as interconnected crises amplify economic instability. The intricate link between polycrisis and recession underscores the importance of resilient economic policies to mitigate compounded shocks.

Key Terms

GDP (Gross Domestic Product)

Recession refers to a period of significant decline in GDP, typically lasting at least two consecutive quarters, indicating reduced economic activity and contraction in output. Polycrisis denotes the simultaneous occurrence of multiple crises--economic, political, social, or environmental--that collectively disrupt GDP growth and create complex challenges beyond a standard recession. Explore the impacts and distinctions of recession and polycrisis on GDP to better understand their economic consequences.

Systemic Risk

Systemic risk during a recession arises from interconnected financial institutions facing widespread insolvency, leading to a contraction in economic activity and increased unemployment. Polycrisis involves multiple, simultaneous crises--such as climate change, geopolitical tensions, and supply chain disruptions--that collectively strain global systems and amplify vulnerabilities beyond traditional economic downturns. Explore how systemic risk evolves in varied crisis landscapes to better understand mitigation strategies.

Economic Shock

Economic shock in a recession typically involves a significant decline in GDP, rising unemployment, and reduced consumer spending, driven primarily by financial market instability or demand contraction. In contrast, a polycrisis consists of overlapping crises--such as climate change, geopolitical tensions, and public health emergencies--that collectively amplify economic shocks, causing prolonged uncertainty and systemic risks across multiple sectors. Explore further to understand how these complex dynamics influence global economic stability.

Source and External Links

Recession - A recession is a business cycle contraction characterized by a broad decline in economic activity such as GDP, income, employment and production, lasting more than a few months; it can be triggered by financial crises, trade shocks, or economic bubbles bursting.

What is a recession and what does it mean for you? - During a recession, the economy shrinks causing lower employment, worsened corporate performance, and decreased consumer spending, often leading to a negative cycle that may require government intervention to correct.

Great Recession - The Great Recession was a severe global economic decline from late 2007 to mid-2009, triggered by the bursting of the US housing bubble and subprime mortgage crisis, leading to a financial meltdown and prolonged economic downturn.

dowidth.com

dowidth.com