Economic uncertainty drives many households to weigh doom spending against frugal living strategies, influencing financial stability and consumer behavior patterns. Doom spending often involves impulsive purchases aimed at immediate gratification, while frugal living focuses on deliberate saving and mindful consumption to build long-term wealth. Explore the impacts of these contrasting approaches on personal finance and economic resilience.

Why it is important

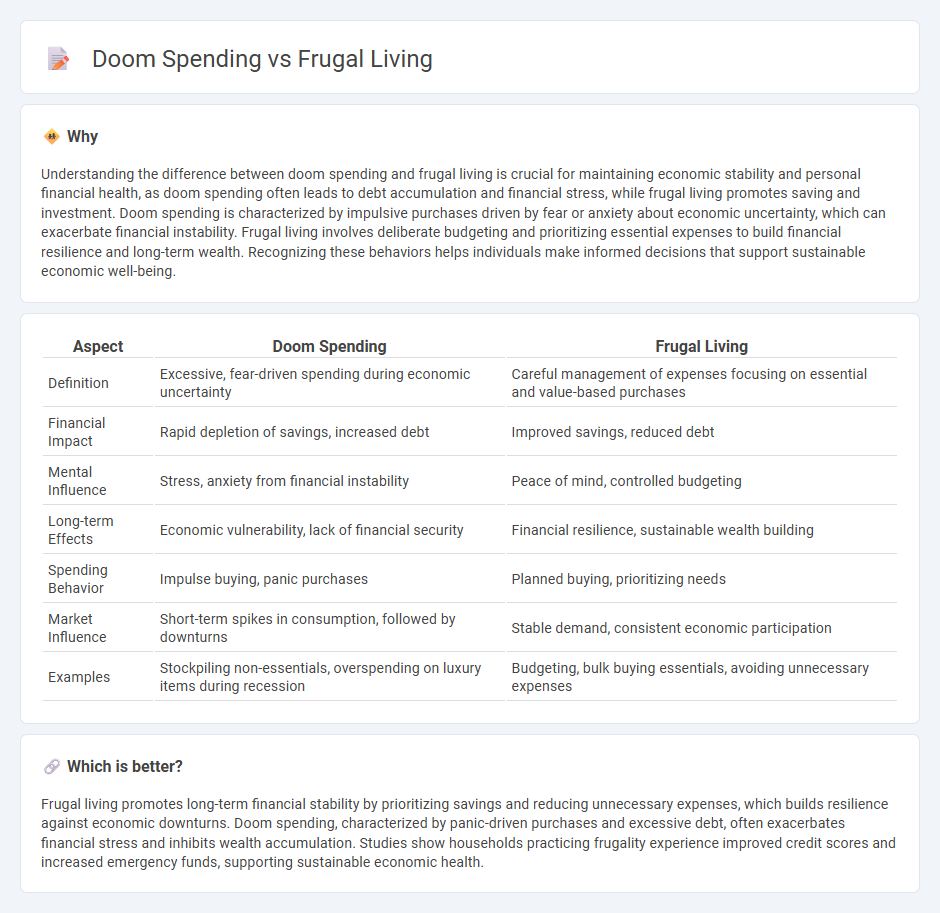

Understanding the difference between doom spending and frugal living is crucial for maintaining economic stability and personal financial health, as doom spending often leads to debt accumulation and financial stress, while frugal living promotes saving and investment. Doom spending is characterized by impulsive purchases driven by fear or anxiety about economic uncertainty, which can exacerbate financial instability. Frugal living involves deliberate budgeting and prioritizing essential expenses to build financial resilience and long-term wealth. Recognizing these behaviors helps individuals make informed decisions that support sustainable economic well-being.

Comparison Table

| Aspect | Doom Spending | Frugal Living |

|---|---|---|

| Definition | Excessive, fear-driven spending during economic uncertainty | Careful management of expenses focusing on essential and value-based purchases |

| Financial Impact | Rapid depletion of savings, increased debt | Improved savings, reduced debt |

| Mental Influence | Stress, anxiety from financial instability | Peace of mind, controlled budgeting |

| Long-term Effects | Economic vulnerability, lack of financial security | Financial resilience, sustainable wealth building |

| Spending Behavior | Impulse buying, panic purchases | Planned buying, prioritizing needs |

| Market Influence | Short-term spikes in consumption, followed by downturns | Stable demand, consistent economic participation |

| Examples | Stockpiling non-essentials, overspending on luxury items during recession | Budgeting, bulk buying essentials, avoiding unnecessary expenses |

Which is better?

Frugal living promotes long-term financial stability by prioritizing savings and reducing unnecessary expenses, which builds resilience against economic downturns. Doom spending, characterized by panic-driven purchases and excessive debt, often exacerbates financial stress and inhibits wealth accumulation. Studies show households practicing frugality experience improved credit scores and increased emergency funds, supporting sustainable economic health.

Connection

Doom spending often arises from economic uncertainty, where consumers hurriedly purchase goods fearing future scarcity or price hikes. Frugal living counters this by promoting mindful budgeting, resource conservation, and prioritizing essential expenditures to maintain financial stability. Both behaviors reflect responses to economic stress but differ fundamentally in mindset and long-term financial impact.

Key Terms

Budgeting

Frugal living emphasizes deliberate budgeting strategies to prioritize essential expenses and maximize savings, contrasting sharply with doom spending, where impulsive purchases undermine financial stability. Effective budgeting involves tracking income, categorizing expenses, and setting realistic financial goals to avoid the pitfalls of emotional spending commonly seen in doom spending behaviors. Explore expert tips and practical tools to master budgeting and achieve lasting financial control.

Consumer behavior

Frugal living emphasizes mindful spending, prioritizing value, savings, and long-term financial goals, whereas doom spending reflects impulsive purchases driven by stress or anxiety, often resulting in temporary relief but long-term financial strain. Consumer behavior in frugality involves careful budgeting, delayed gratification, and strategic financial planning, while doom spending is characterized by emotional triggers and lack of self-control. Explore deeper insights into how psychological factors shape these contrasting consumer spending habits.

Financial literacy

Frugal living emphasizes mindful budgeting, prioritizing essential expenses, and maximizing savings to build long-term financial stability. Doom spending is characterized by impulsive purchases driven by stress or emotional triggers, often leading to debt and financial strain. Explore effective financial literacy strategies to distinguish healthy saving habits from harmful spending behaviors.

Source and External Links

Frugal Living Comprehensive Guide: 37 Ways to Find Serious Savings - Frugal living is a money-saving lifestyle focused on being resourceful through meal planning, buying generic brands, growing your own food, and dining out less to save money for valued goals like retirement or travel.

20 frugal living tips | Fidelity - Practical tips for frugal living include living in less trendy neighborhoods, buying needed items during sales, and comparing unit prices to spend efficiently while prioritizing long-term savings.

A Day in the Life of Our Family's Frugal Living - Fun Cheap or Free - Key frugal strategies include setting and sticking to a family budget, especially on groceries, and mastering "shelf cooking" to use what you already have before buying more groceries to reduce waste and expenses.

dowidth.com

dowidth.com