Girl math often simplifies financial decisions by focusing on everyday spending hacks and intuitive value judgments, while accountant math relies on precise calculations, standardized methods, and detailed financial analysis. Understanding these differing approaches reveals how personal finance and professional accounting each interpret and manage money uniquely. Explore deeper insights into how girl math contrasts with accountant math in shaping economic perspectives.

Why it is important

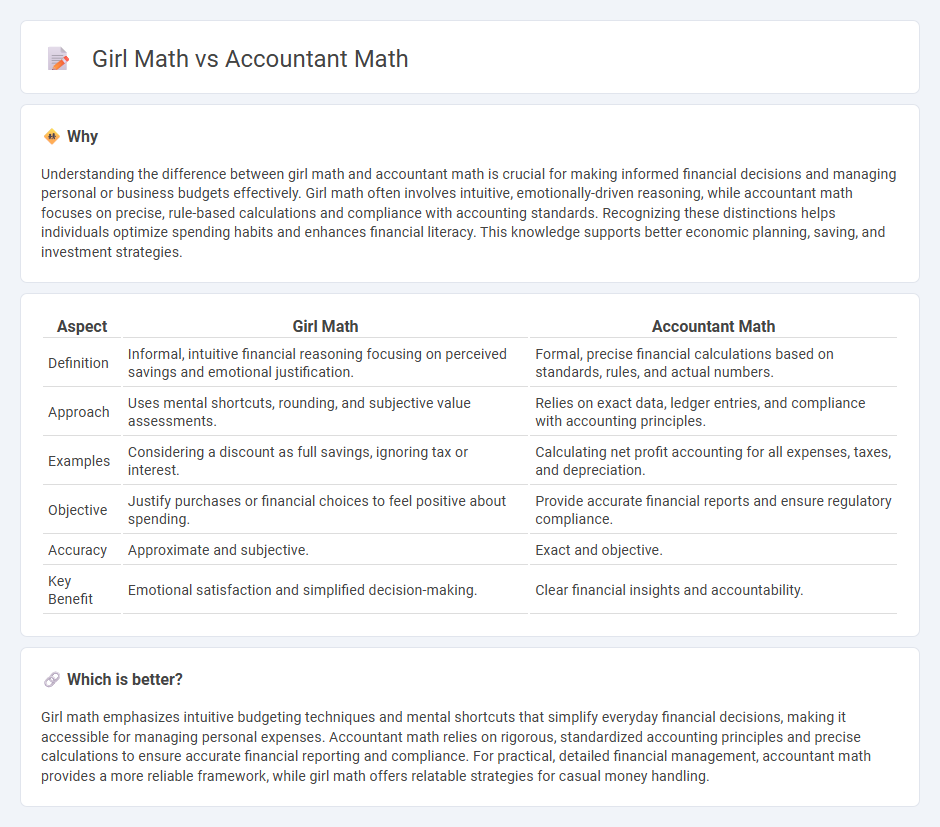

Understanding the difference between girl math and accountant math is crucial for making informed financial decisions and managing personal or business budgets effectively. Girl math often involves intuitive, emotionally-driven reasoning, while accountant math focuses on precise, rule-based calculations and compliance with accounting standards. Recognizing these distinctions helps individuals optimize spending habits and enhances financial literacy. This knowledge supports better economic planning, saving, and investment strategies.

Comparison Table

| Aspect | Girl Math | Accountant Math |

|---|---|---|

| Definition | Informal, intuitive financial reasoning focusing on perceived savings and emotional justification. | Formal, precise financial calculations based on standards, rules, and actual numbers. |

| Approach | Uses mental shortcuts, rounding, and subjective value assessments. | Relies on exact data, ledger entries, and compliance with accounting principles. |

| Examples | Considering a discount as full savings, ignoring tax or interest. | Calculating net profit accounting for all expenses, taxes, and depreciation. |

| Objective | Justify purchases or financial choices to feel positive about spending. | Provide accurate financial reports and ensure regulatory compliance. |

| Accuracy | Approximate and subjective. | Exact and objective. |

| Key Benefit | Emotional satisfaction and simplified decision-making. | Clear financial insights and accountability. |

Which is better?

Girl math emphasizes intuitive budgeting techniques and mental shortcuts that simplify everyday financial decisions, making it accessible for managing personal expenses. Accountant math relies on rigorous, standardized accounting principles and precise calculations to ensure accurate financial reporting and compliance. For practical, detailed financial management, accountant math provides a more reliable framework, while girl math offers relatable strategies for casual money handling.

Connection

Girl math and accountant math both involve unique approaches to managing finances, with girl math focusing on everyday budgeting strategies and mental shortcuts often used in personal finance. Accountant math emphasizes precise calculations, financial reporting, and compliance with accounting standards to ensure accurate business financial insights. Both systems reflect different methods of handling money, blending intuitive spending habits with formal financial analysis.

Key Terms

Cost-Benefit Analysis

Accountant math emphasizes precise cost-benefit analysis by systematically quantifying expenses and revenues to maximize financial efficiency, relying on strict numerical data and accounting principles. Girl math, a playful, informal approach, often frames spending decisions through subjective value perceptions and emotional cost assessments rather than rigorous calculations. Explore deeper insights into these contrasting methods to understand their impact on financial decision-making.

Budgeting

Accountant math in budgeting emphasizes precise calculations, accurate expense tracking, and adherence to financial principles, ensuring every dollar is accounted for with detailed spreadsheets and forecasts. Girl math, on the other hand, often approaches budgeting with a more intuitive and flexible mindset, using mental shortcuts like treating small savings as "found money" or justifying occasional splurges based on emotional value rather than strict cost analysis. Explore the nuances of these budgeting perspectives to enhance your financial planning strategies.

Opportunity Cost

Accountant math emphasizes precise calculations based on opportunity cost, focusing on evaluating the best allocation of resources to maximize financial gain. Girl math, often a playful take on personal finance, simplifies decision-making by prioritizing perceived value and immediate rewards over strict cost-benefit analysis. Explore how understanding opportunity cost bridges both perspectives for smarter financial choices.

Source and External Links

What Math Do You Need for Accounting? - Accountants need proficiency in basic arithmetic (addition, subtraction, multiplication, division), fractions, percentages, ratios, and sometimes more complex calculations for tasks like budgeting, forecasting, and tax planning.

Math Requirements To Become an Accountant - Essential math skills for accountants include a solid understanding of basic arithmetic and the ability to work with fractions and percentages crucial for analyzing financial statements and calculating interest rates.

How can I be an accountant if I'm not good at math? - Basic operations like addition, subtraction, multiplication, and division are sufficient for most accounting jobs, and modern software reduces the need for advanced math skills while emphasizing other professional skills.

dowidth.com

dowidth.com