Carbon border tax and border adjustment mechanisms are fiscal tools designed to address carbon leakage by levying fees on imported goods based on their carbon emissions, ensuring fair competition while promoting environmental responsibility. These policies aim to incentivize cleaner production methods globally and protect domestic industries adhering to strict climate regulations. Explore further to understand how these economic strategies impact international trade and climate policy.

Why it is important

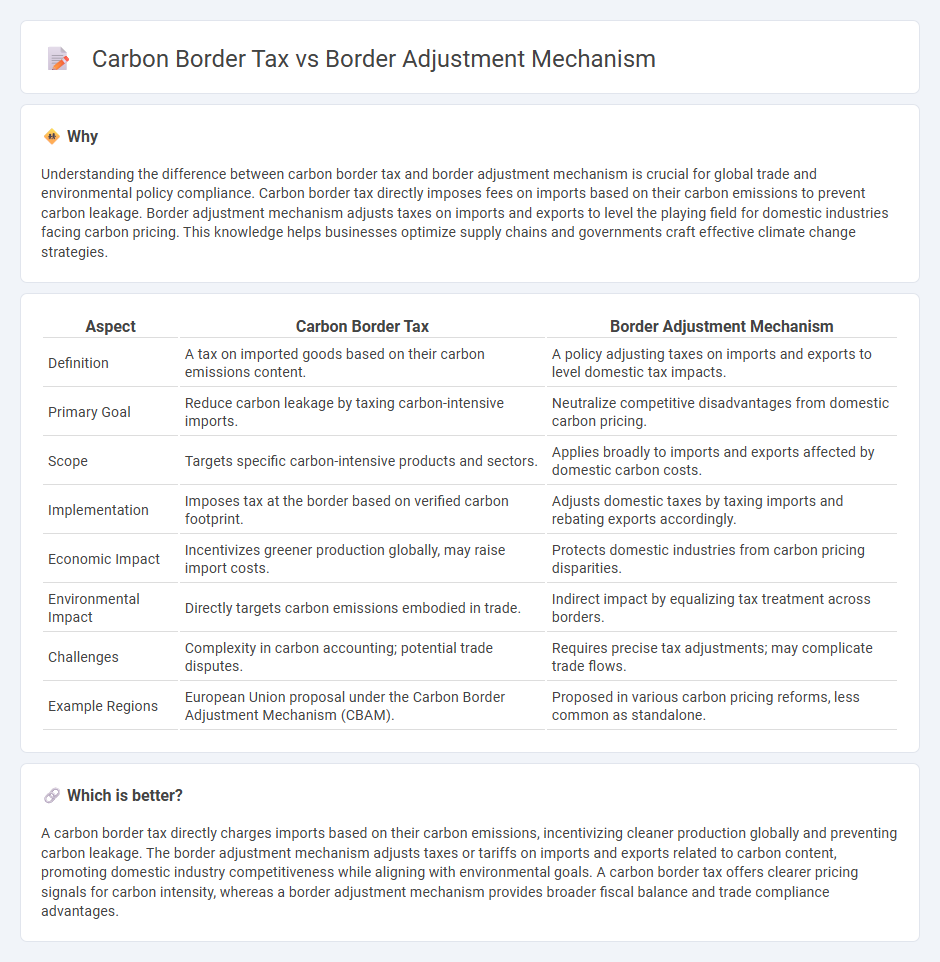

Understanding the difference between carbon border tax and border adjustment mechanism is crucial for global trade and environmental policy compliance. Carbon border tax directly imposes fees on imports based on their carbon emissions to prevent carbon leakage. Border adjustment mechanism adjusts taxes on imports and exports to level the playing field for domestic industries facing carbon pricing. This knowledge helps businesses optimize supply chains and governments craft effective climate change strategies.

Comparison Table

| Aspect | Carbon Border Tax | Border Adjustment Mechanism |

|---|---|---|

| Definition | A tax on imported goods based on their carbon emissions content. | A policy adjusting taxes on imports and exports to level domestic tax impacts. |

| Primary Goal | Reduce carbon leakage by taxing carbon-intensive imports. | Neutralize competitive disadvantages from domestic carbon pricing. |

| Scope | Targets specific carbon-intensive products and sectors. | Applies broadly to imports and exports affected by domestic carbon costs. |

| Implementation | Imposes tax at the border based on verified carbon footprint. | Adjusts domestic taxes by taxing imports and rebating exports accordingly. |

| Economic Impact | Incentivizes greener production globally, may raise import costs. | Protects domestic industries from carbon pricing disparities. |

| Environmental Impact | Directly targets carbon emissions embodied in trade. | Indirect impact by equalizing tax treatment across borders. |

| Challenges | Complexity in carbon accounting; potential trade disputes. | Requires precise tax adjustments; may complicate trade flows. |

| Example Regions | European Union proposal under the Carbon Border Adjustment Mechanism (CBAM). | Proposed in various carbon pricing reforms, less common as standalone. |

Which is better?

A carbon border tax directly charges imports based on their carbon emissions, incentivizing cleaner production globally and preventing carbon leakage. The border adjustment mechanism adjusts taxes or tariffs on imports and exports related to carbon content, promoting domestic industry competitiveness while aligning with environmental goals. A carbon border tax offers clearer pricing signals for carbon intensity, whereas a border adjustment mechanism provides broader fiscal balance and trade compliance advantages.

Connection

The carbon border tax and the border adjustment mechanism are interconnected tools designed to level the economic playing field by imposing tariffs on imported goods based on their carbon emissions. These policies aim to prevent carbon leakage by ensuring that products imported into a country comply with its climate regulations, aligning global trade with environmental goals. By integrating carbon costs into import prices, both measures incentivize cleaner production methods and support the transition to a low-carbon economy.

Key Terms

Carbon Leakage

The Border Adjustment Mechanism (BAM) and Carbon Border Tax (CBT) are designed to address carbon leakage by equalizing the cost of carbon emissions between domestic products and imports, preventing companies from relocating production to countries with laxer emission regulations. BAM adjusts prices at the border based on embedded carbon costs, ensuring fair competition while incentivizing emissions reductions globally, whereas CBT imposes a direct tax on imported goods corresponding to their carbon footprint. Explore further to understand how these tools impact international trade and climate policy dynamics.

Import Tariffs

The Border Adjustment Mechanism (BAM) and Carbon Border Tax (CBT) both aim to regulate import tariffs on carbon-intensive goods, but BAM adjusts tariffs based on carbon content embedded in imports to level the playing field for domestic producers, while CBT imposes a fixed tax rate linked to a product's carbon footprint. BAM operates as a dynamic system reflecting real-time carbon pricing, promoting emissions reduction globally, whereas CBT provides a more straightforward but potentially less flexible approach. Explore detailed comparisons to understand their impact on global trade and climate policy.

Climate Policy

The Border Adjustment Mechanism (BAM) and Carbon Border Tax (CBT) both aim to level the playing field by addressing carbon leakage and encouraging emission reductions globally. The BAM applies carbon pricing adjustments at import and export borders, integrating seamlessly with domestic carbon pricing systems such as the EU Emissions Trading System, while the CBT imposes a direct tax on carbon-intensive imports based on their embedded emissions. Explore the nuances of these climate policies to understand their impact on global trade and emission reduction strategies.

Source and External Links

Crafting a Robust U.S. Carbon Border Adjustment Mechanism - CSIS - A Carbon Border Adjustment Mechanism (CBAM) is a policy tool designed to level the playing field between domestic and imported goods by imposing fees on imports based on their carbon emissions, promoting domestic climate action and incentivizing cleaner production globally, while posing complex design and trade challenges.

Carbon Border Adjustments | MIT Climate Portal - CBAM charges fees on imported goods according to the amount of climate pollution emitted in their production, adjusting for carbon emissions to equalize costs between domestic and foreign goods in carbon pricing schemes.

What is a Carbon Border Adjustment Mechanism? | Brookings - CBAMs impose tariffs on imports based on their carbon emissions to prevent carbon leakage, ensure fair competition for domestic producers, reduce global emissions, and encourage adoption of carbon pricing and cleaner technologies worldwide.

dowidth.com

dowidth.com