Greedflation occurs when businesses increase prices aggressively to boost profit margins beyond supply and demand pressures, while fiscal inflation stems from excessive government spending and budget deficits driving overall price rises. The interplay of corporate pricing strategies and monetary policy impacts consumer purchasing power and economic stability. Explore how these inflation types influence markets and policy decisions.

Why it is important

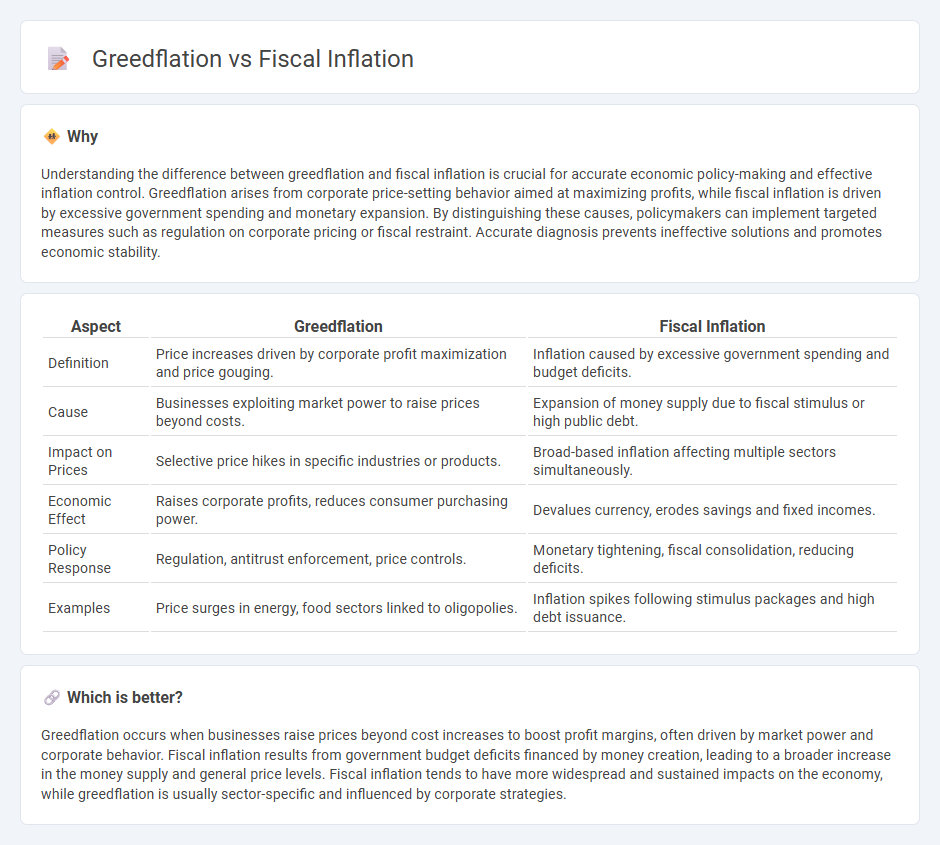

Understanding the difference between greedflation and fiscal inflation is crucial for accurate economic policy-making and effective inflation control. Greedflation arises from corporate price-setting behavior aimed at maximizing profits, while fiscal inflation is driven by excessive government spending and monetary expansion. By distinguishing these causes, policymakers can implement targeted measures such as regulation on corporate pricing or fiscal restraint. Accurate diagnosis prevents ineffective solutions and promotes economic stability.

Comparison Table

| Aspect | Greedflation | Fiscal Inflation |

|---|---|---|

| Definition | Price increases driven by corporate profit maximization and price gouging. | Inflation caused by excessive government spending and budget deficits. |

| Cause | Businesses exploiting market power to raise prices beyond costs. | Expansion of money supply due to fiscal stimulus or high public debt. |

| Impact on Prices | Selective price hikes in specific industries or products. | Broad-based inflation affecting multiple sectors simultaneously. |

| Economic Effect | Raises corporate profits, reduces consumer purchasing power. | Devalues currency, erodes savings and fixed incomes. |

| Policy Response | Regulation, antitrust enforcement, price controls. | Monetary tightening, fiscal consolidation, reducing deficits. |

| Examples | Price surges in energy, food sectors linked to oligopolies. | Inflation spikes following stimulus packages and high debt issuance. |

Which is better?

Greedflation occurs when businesses raise prices beyond cost increases to boost profit margins, often driven by market power and corporate behavior. Fiscal inflation results from government budget deficits financed by money creation, leading to a broader increase in the money supply and general price levels. Fiscal inflation tends to have more widespread and sustained impacts on the economy, while greedflation is usually sector-specific and influenced by corporate strategies.

Connection

Greedflation and fiscal inflation are interconnected through their impact on overall price levels, where greedflation arises from firms increasing prices beyond cost pressures to maximize profits, while fiscal inflation is driven by excessive government spending and budget deficits that boost aggregate demand. Both phenomena contribute to sustained inflationary pressures by influencing supply and demand dynamics in the economy. Understanding their link helps policymakers design targeted interventions to control inflation without undermining economic growth.

Key Terms

Government Spending

Fiscal inflation often results from increased government spending that injects more money into the economy, leading to a demand-pull effect and rising prices. Greedflation occurs when companies raise prices excessively beyond cost increases, exploiting market power rather than underlying economic factors. Explore the detailed impacts of government expenditure on these inflation types to understand their distinct economic implications.

Corporate Profit Margins

Fiscal inflation stems from excessive government spending and monetary expansion, driving prices up through increased aggregate demand. Greedflation occurs when corporations intentionally raise prices beyond cost increases to expand profit margins, exploiting inflationary environments. Explore how corporate profit margins reveal the true impact of greedflation on the economy.

Price Levels

Fiscal inflation occurs when government spending and borrowing increase the money supply, leading to higher price levels across the economy. Greedflation refers to price hikes driven by businesses exploiting inflationary conditions to boost profit margins rather than reflecting genuine cost increases. Explore the detailed impacts of these inflation types on consumer prices and economic stability to understand their nuances better.

Source and External Links

A Fiscal Theory of Persistent Inflation - This paper develops a model where unfunded fiscal shocks lead to persistent inflation as the monetary authority accommodates such shocks while the fiscal authority stabilizes debt, explaining recent inflation dynamics including pandemic-era effects.

Inflation as a Fiscal Limit - Inflation persistence depends largely on fiscal authorities' credibility to stabilize debt; lack of credible fiscal plans can cause expectations of rising inflation to sustain fiscal sustainability.

Fiscal policy and the pandemic-era surge in US inflation - Massive fiscal expansion during the COVID-19 pandemic increased demand beyond supply capacity, driving a significant inflation surge, indicating fiscal stimulus's strong influence on inflation.

dowidth.com

dowidth.com