Carbon border tax imposes tariffs on imported goods based on their carbon emissions, aiming to equalize costs between domestic producers and foreign competitors. Carbon pricing assigns a cost to carbon emissions within a country, encouraging businesses to reduce their environmental impact through market incentives. Explore how these strategies influence global trade and climate policy to understand their economic implications.

Why it is important

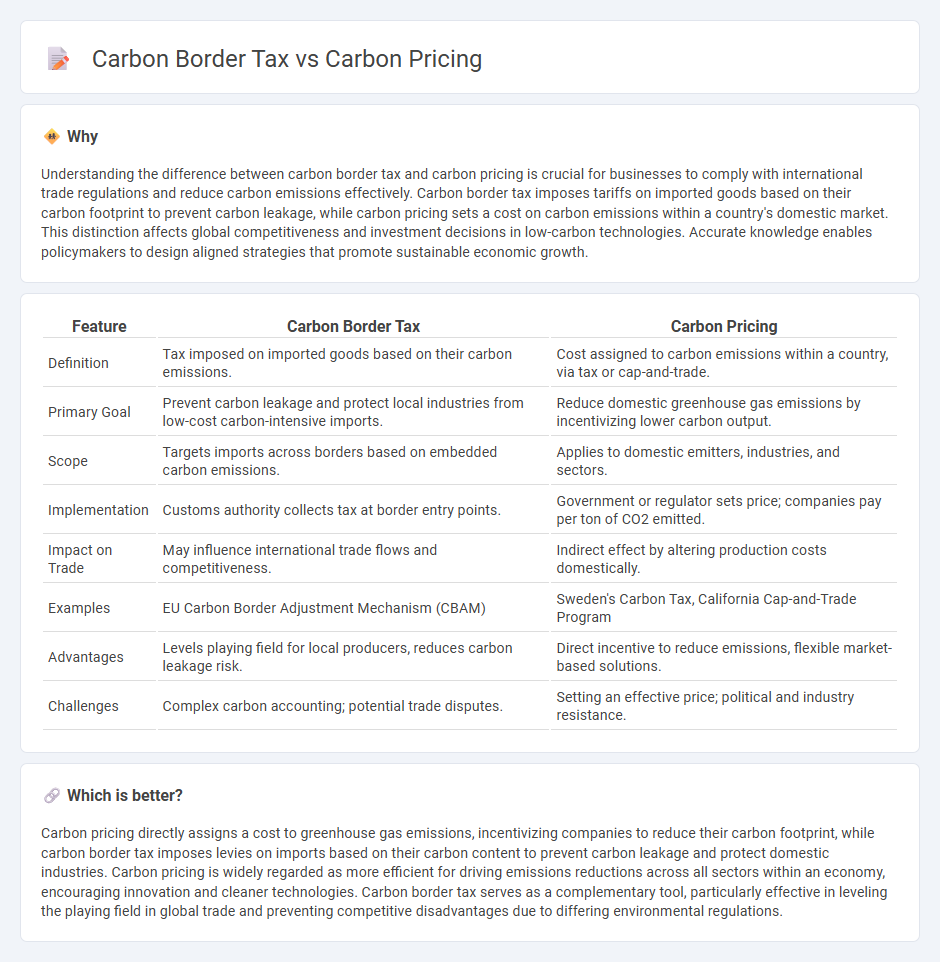

Understanding the difference between carbon border tax and carbon pricing is crucial for businesses to comply with international trade regulations and reduce carbon emissions effectively. Carbon border tax imposes tariffs on imported goods based on their carbon footprint to prevent carbon leakage, while carbon pricing sets a cost on carbon emissions within a country's domestic market. This distinction affects global competitiveness and investment decisions in low-carbon technologies. Accurate knowledge enables policymakers to design aligned strategies that promote sustainable economic growth.

Comparison Table

| Feature | Carbon Border Tax | Carbon Pricing |

|---|---|---|

| Definition | Tax imposed on imported goods based on their carbon emissions. | Cost assigned to carbon emissions within a country, via tax or cap-and-trade. |

| Primary Goal | Prevent carbon leakage and protect local industries from low-cost carbon-intensive imports. | Reduce domestic greenhouse gas emissions by incentivizing lower carbon output. |

| Scope | Targets imports across borders based on embedded carbon emissions. | Applies to domestic emitters, industries, and sectors. |

| Implementation | Customs authority collects tax at border entry points. | Government or regulator sets price; companies pay per ton of CO2 emitted. |

| Impact on Trade | May influence international trade flows and competitiveness. | Indirect effect by altering production costs domestically. |

| Examples | EU Carbon Border Adjustment Mechanism (CBAM) | Sweden's Carbon Tax, California Cap-and-Trade Program |

| Advantages | Levels playing field for local producers, reduces carbon leakage risk. | Direct incentive to reduce emissions, flexible market-based solutions. |

| Challenges | Complex carbon accounting; potential trade disputes. | Setting an effective price; political and industry resistance. |

Which is better?

Carbon pricing directly assigns a cost to greenhouse gas emissions, incentivizing companies to reduce their carbon footprint, while carbon border tax imposes levies on imports based on their carbon content to prevent carbon leakage and protect domestic industries. Carbon pricing is widely regarded as more efficient for driving emissions reductions across all sectors within an economy, encouraging innovation and cleaner technologies. Carbon border tax serves as a complementary tool, particularly effective in leveling the playing field in global trade and preventing competitive disadvantages due to differing environmental regulations.

Connection

Carbon border tax and carbon pricing are interconnected mechanisms aimed at reducing carbon emissions by internalizing the environmental costs of carbon-intensive goods. Carbon pricing sets a cost on emitted carbon, incentivizing companies to lower emissions, while carbon border tax applies this cost to imported goods based on their carbon footprint, preventing carbon leakage and ensuring competitive fairness. Together, these policies support global climate goals by harmonizing carbon costs across domestic production and international trade.

Key Terms

Emissions Trading System (ETS)

Carbon pricing, often implemented through Emissions Trading Systems (ETS), sets a market-driven cost on greenhouse gas emissions, allowing companies to buy and sell emission allowances to meet regulatory limits. Carbon border tax, on the other hand, imposes tariffs on imported goods based on their carbon footprint to prevent carbon leakage and ensure fair competition with domestic producers under strict emissions regulations. Explore how ETS mechanisms integrate with carbon border tax policies to enhance global climate action and economic fairness.

Carbon Leakage

Carbon pricing imposes a direct cost on greenhouse gas emissions within a jurisdiction, incentivizing businesses to reduce their carbon footprint, whereas carbon border tax targets imported goods from regions with less stringent climate policies to prevent carbon leakage. Carbon leakage occurs when companies transfer production to countries with laxer emission regulations, undermining global climate goals. Explore how these mechanisms interplay to address carbon leakage and promote environmental integrity worldwide.

Border Adjustment Mechanism

The Border Adjustment Mechanism (BAM) functions as a carbon border tax aimed at leveling the playing field by imposing charges on imports from countries lacking comparable carbon pricing. This mechanism addresses carbon leakage and promotes global emissions reductions by incentivizing cleaner production standards worldwide. Explore how BAM integrates with international trade policies and its implications for global climate strategy.

Source and External Links

Carbon Pricing | MIT Climate Portal - Carbon pricing is a policy tool to reduce greenhouse gas emissions by putting a tax or price on carbon dioxide through either a carbon tax or a cap-and-trade system, incentivizing emitters to lower emissions and generating government revenue.

Why Put a Price on Carbon? - Citizens' Climate Lobby - Placing a strong, economy-wide price on carbon, typically through a carbon tax assessed at the fossil fuel source, motivates businesses and individuals to shift to clean energy and can significantly reduce carbon pollution.

Carbon price - Wikipedia - Carbon pricing applies a monetary cost to greenhouse gas emissions and is seen as an economically efficient way to address climate change by internalizing the external costs of carbon emissions via carbon taxes or cap-and-trade permits.

dowidth.com

dowidth.com