Greenflation refers to rising costs driven by the transition to sustainable energy and environmental policies, while climate finance focuses on mobilizing investments to support climate change mitigation and adaptation projects. As economies shift towards greener technologies, balancing inflationary pressures with effective funding mechanisms becomes critical for sustainable growth. Explore further to understand how greenflation and climate finance shape the future economic landscape.

Why it is important

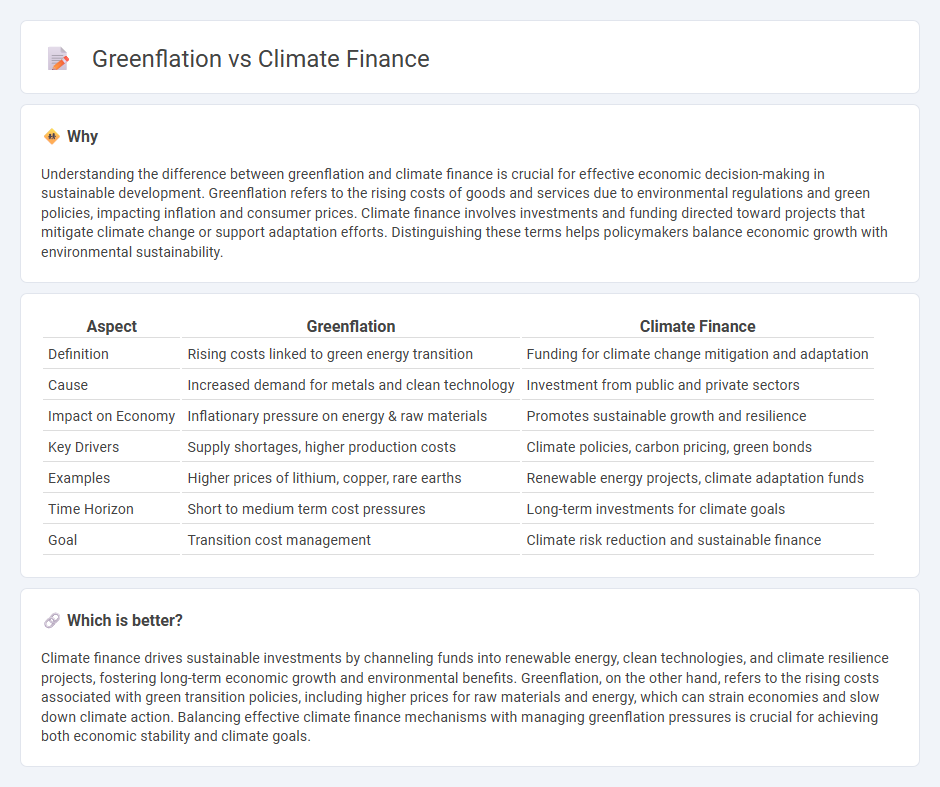

Understanding the difference between greenflation and climate finance is crucial for effective economic decision-making in sustainable development. Greenflation refers to the rising costs of goods and services due to environmental regulations and green policies, impacting inflation and consumer prices. Climate finance involves investments and funding directed toward projects that mitigate climate change or support adaptation efforts. Distinguishing these terms helps policymakers balance economic growth with environmental sustainability.

Comparison Table

| Aspect | Greenflation | Climate Finance |

|---|---|---|

| Definition | Rising costs linked to green energy transition | Funding for climate change mitigation and adaptation |

| Cause | Increased demand for metals and clean technology | Investment from public and private sectors |

| Impact on Economy | Inflationary pressure on energy & raw materials | Promotes sustainable growth and resilience |

| Key Drivers | Supply shortages, higher production costs | Climate policies, carbon pricing, green bonds |

| Examples | Higher prices of lithium, copper, rare earths | Renewable energy projects, climate adaptation funds |

| Time Horizon | Short to medium term cost pressures | Long-term investments for climate goals |

| Goal | Transition cost management | Climate risk reduction and sustainable finance |

Which is better?

Climate finance drives sustainable investments by channeling funds into renewable energy, clean technologies, and climate resilience projects, fostering long-term economic growth and environmental benefits. Greenflation, on the other hand, refers to the rising costs associated with green transition policies, including higher prices for raw materials and energy, which can strain economies and slow down climate action. Balancing effective climate finance mechanisms with managing greenflation pressures is crucial for achieving both economic stability and climate goals.

Connection

Greenflation, characterized by rising costs due to the transition to environmentally friendly technologies, directly impacts climate finance by increasing the capital required for sustainable projects. The escalating expenses for renewable energy infrastructure and clean technologies necessitate larger investments, driving demand for innovative climate finance mechanisms. Effective allocation of climate finance is critical to mitigating greenflation's economic pressures and accelerating the shift toward a low-carbon economy.

Key Terms

Carbon Pricing

Carbon pricing is a pivotal mechanism in climate finance, assigning a monetary value to carbon emissions to incentivize reduction. While it drives investments in sustainable projects, it can also contribute to greenflation by increasing the cost of goods and services reliant on carbon-intensive inputs. Explore the complexities of carbon pricing's dual role in shaping economic and environmental policies.

Sustainable Investment

Sustainable investment is increasingly influenced by climate finance, which channels funds toward projects that reduce greenhouse gas emissions and promote environmental resilience. Greenflation, driven by rising costs of raw materials for clean technologies, poses challenges to the affordability and scalability of sustainable projects. Explore how balancing climate finance and greenflation impacts the future of green investments.

Supply Chain Constraints

Climate finance plays a crucial role in addressing supply chain constraints by funding sustainable technologies and infrastructure to reduce carbon emissions, while greenflation refers to the rising costs of goods and services driven by the transition to greener economies. Supply chain disruptions caused by raw material scarcity, increased demand for renewable components, and regulatory changes contribute significantly to greenflation pressures. Explore more insights on how strategic climate finance investments can mitigate greenflation and optimize sustainable supply chains for long-term economic resilience.

Source and External Links

What is climate finance and why do we need more of it? - Climate finance consists of financial resources and instruments that support climate change actions like mitigation and adaptation, coming from public or private sources, and is essential for transitioning to a low-carbon economy and building resilience, but current flows must triple to meet Paris Agreement goals.

Climate finance - Wikipedia - Climate finance broadly covers loans, grants, and budget allocations for climate mitigation and adaptation, involving public and private funds, with major challenges including tracking flows and ensuring equitable support to developing nations.

Global Landscape of Climate Finance 2025 - CPI - Global climate finance reached about USD 1.9 trillion in 2023 and surpassed USD 2 trillion in 2024, with private investment exceeding public finance for the first time, although emerging economies face barriers to affordable capital.

dowidth.com

dowidth.com