Tipflation refers to the rising costs and increased frequency of tipping in service industries, contributing to higher consumer expenses and influencing wage dynamics. Disinflation describes the slowdown in the rate of inflation, signaling a potential stabilization of prices and easing of monetary pressures on households and businesses. Explore in-depth analyses to understand how tipflation and disinflation interact within modern economic frameworks.

Why it is important

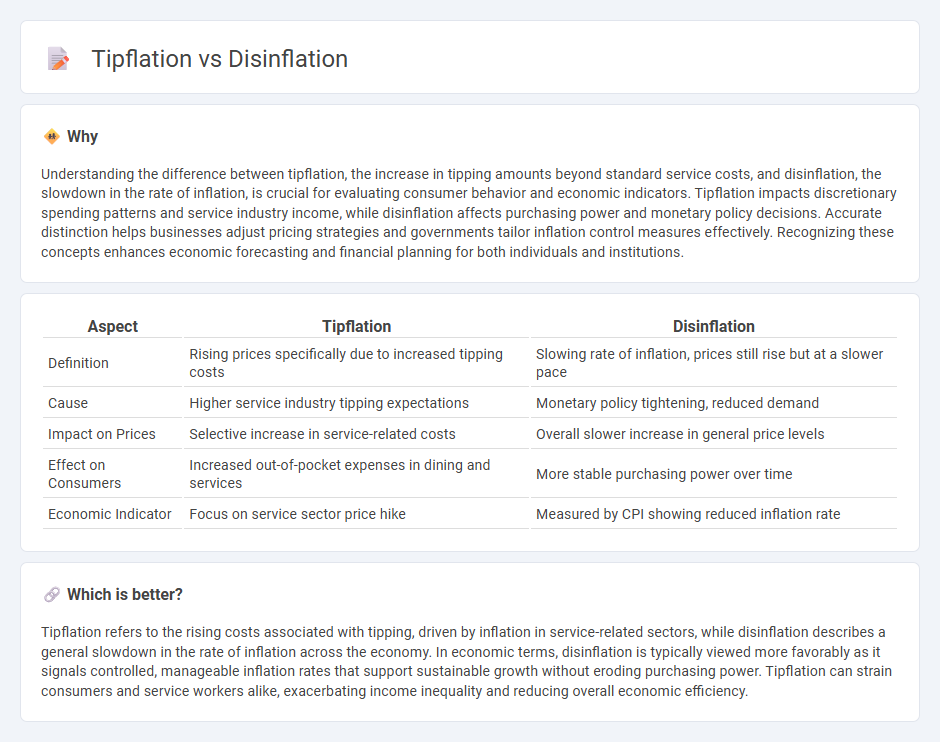

Understanding the difference between tipflation, the increase in tipping amounts beyond standard service costs, and disinflation, the slowdown in the rate of inflation, is crucial for evaluating consumer behavior and economic indicators. Tipflation impacts discretionary spending patterns and service industry income, while disinflation affects purchasing power and monetary policy decisions. Accurate distinction helps businesses adjust pricing strategies and governments tailor inflation control measures effectively. Recognizing these concepts enhances economic forecasting and financial planning for both individuals and institutions.

Comparison Table

| Aspect | Tipflation | Disinflation |

|---|---|---|

| Definition | Rising prices specifically due to increased tipping costs | Slowing rate of inflation, prices still rise but at a slower pace |

| Cause | Higher service industry tipping expectations | Monetary policy tightening, reduced demand |

| Impact on Prices | Selective increase in service-related costs | Overall slower increase in general price levels |

| Effect on Consumers | Increased out-of-pocket expenses in dining and services | More stable purchasing power over time |

| Economic Indicator | Focus on service sector price hike | Measured by CPI showing reduced inflation rate |

Which is better?

Tipflation refers to the rising costs associated with tipping, driven by inflation in service-related sectors, while disinflation describes a general slowdown in the rate of inflation across the economy. In economic terms, disinflation is typically viewed more favorably as it signals controlled, manageable inflation rates that support sustainable growth without eroding purchasing power. Tipflation can strain consumers and service workers alike, exacerbating income inequality and reducing overall economic efficiency.

Connection

Tipflation and disinflation interact as key economic indicators influencing consumer spending behavior and price stability. Tipflation, the increase in tipping amounts beyond expected service value, contributes to perceived inflation pressures by raising overall service costs, while disinflation involves a slowdown in the rate of inflation, indicating moderating price increases across the economy. Together, these phenomena reflect shifting dynamics in inflation trends and consumer expectations, impacting monetary policy decisions and economic forecasting.

Key Terms

Consumer Prices

Disinflation refers to a slowdown in the rate of inflation, where consumer prices still rise but at a decreasing pace, helping to ease purchasing pressures. Tipflation, a less common term, describes the phenomenon where inflation "tips" or shifts the price levels of specific goods and services disproportionately, causing uneven impacts across consumer spending categories. Explore further to understand how these concepts uniquely influence economic policy and household budgets.

Inflation Rate

Disinflation refers to a slowdown in the rate of inflation, indicating that prices are still rising but at a decreasing pace, whereas tipflation is a less common term describing inflationary pressures caused by increased tipping or service-related costs. The inflation rate measures how quickly the general price level of goods and services is rising, with disinflation signaling a cooling in inflation and tipflation highlighting sector-specific cost drivers. Explore more to understand how these concepts impact economic stability and consumer behavior.

Service Fees

Disinflation refers to a slowdown in the rate of inflation, causing service fees to rise at a more moderate pace, whereas tipflation specifically denotes the increasing trend of higher tipping amounts inflating overall expenses in the service sector. Service fees under disinflation may stabilize, but tipflation can lead to unpredictable and escalating costs for consumers. Explore how these contrasting phenomena impact your budgeting and spending patterns in service industries.

Source and External Links

Disinflation - Definition, How It Works, Examples - Disinflation is defined as the slowdown in the rate of inflation, meaning prices are still rising but at a decreasing rate, distinct from deflation which indicates a negative inflation rate.

Disinflation - Wikipedia - Disinflation refers to a decrease in the rate at which prices are increasing, and it can lead to deflation if inflation rates drop below zero; it is the opposite of reflation.

Inflation, Disinflation and Deflation: What Do They All Mean? - Disinflation occurs when inflation slows but remains positive, meaning prices continue to increase but less rapidly than before, unlike deflation where prices actually decrease.

dowidth.com

dowidth.com