Payroll crypto taxation involves the complex process of calculating, reporting, and withholding taxes on employee compensation paid in cryptocurrency, requiring adherence to evolving IRS guidelines and valuation methods. Payroll compliance mandates strict adherence to labor laws, tax regulations, and reporting standards, ensuring accurate tax withholdings and timely remittances for fiat or digital currency payments. Explore detailed insights into payroll crypto taxation and compliance to optimize your accounting practices.

Why it is important

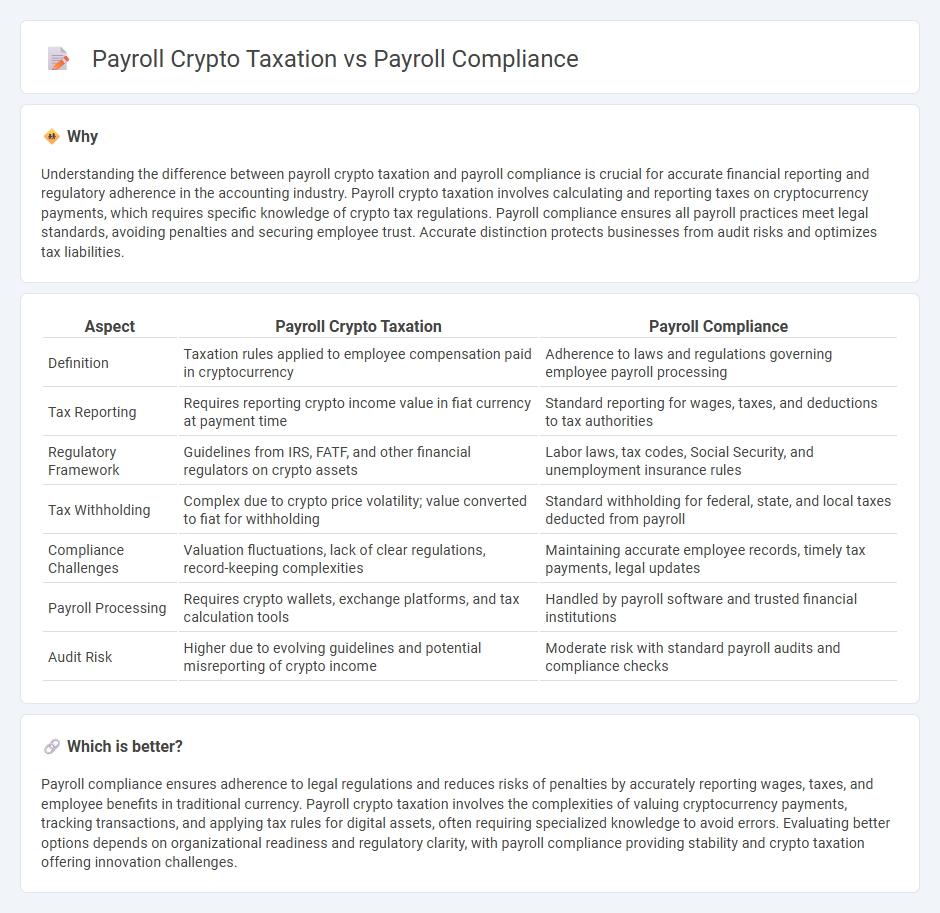

Understanding the difference between payroll crypto taxation and payroll compliance is crucial for accurate financial reporting and regulatory adherence in the accounting industry. Payroll crypto taxation involves calculating and reporting taxes on cryptocurrency payments, which requires specific knowledge of crypto tax regulations. Payroll compliance ensures all payroll practices meet legal standards, avoiding penalties and securing employee trust. Accurate distinction protects businesses from audit risks and optimizes tax liabilities.

Comparison Table

| Aspect | Payroll Crypto Taxation | Payroll Compliance |

|---|---|---|

| Definition | Taxation rules applied to employee compensation paid in cryptocurrency | Adherence to laws and regulations governing employee payroll processing |

| Tax Reporting | Requires reporting crypto income value in fiat currency at payment time | Standard reporting for wages, taxes, and deductions to tax authorities |

| Regulatory Framework | Guidelines from IRS, FATF, and other financial regulators on crypto assets | Labor laws, tax codes, Social Security, and unemployment insurance rules |

| Tax Withholding | Complex due to crypto price volatility; value converted to fiat for withholding | Standard withholding for federal, state, and local taxes deducted from payroll |

| Compliance Challenges | Valuation fluctuations, lack of clear regulations, record-keeping complexities | Maintaining accurate employee records, timely tax payments, legal updates |

| Payroll Processing | Requires crypto wallets, exchange platforms, and tax calculation tools | Handled by payroll software and trusted financial institutions |

| Audit Risk | Higher due to evolving guidelines and potential misreporting of crypto income | Moderate risk with standard payroll audits and compliance checks |

Which is better?

Payroll compliance ensures adherence to legal regulations and reduces risks of penalties by accurately reporting wages, taxes, and employee benefits in traditional currency. Payroll crypto taxation involves the complexities of valuing cryptocurrency payments, tracking transactions, and applying tax rules for digital assets, often requiring specialized knowledge to avoid errors. Evaluating better options depends on organizational readiness and regulatory clarity, with payroll compliance providing stability and crypto taxation offering innovation challenges.

Connection

Payroll crypto taxation directly impacts payroll compliance by requiring businesses to accurately report employee compensation in cryptocurrency according to IRS guidelines. Failure to properly calculate and withhold taxes on crypto payroll can lead to penalties and legal risks, highlighting the necessity of integrating specialized tax software for compliance. Ensuring adherence to payroll regulations safeguards organizations from audits and supports transparent financial reporting in the evolving digital asset landscape.

Key Terms

**Payroll Compliance:**

Payroll compliance ensures adherence to federal and state regulations regarding employee wage reporting, tax withholdings, and timely filings, minimizing legal risks and penalties for businesses. It involves accurate calculation of employee earnings, benefits, and deductions in line with labor laws and IRS requirements. Explore the nuances of payroll compliance to safeguard your business operations effectively.

Withholding Taxes

Payroll compliance ensures accurate calculation and timely remittance of withholding taxes to regulatory authorities, adhering to labor laws and tax codes. Payroll crypto taxation introduces complexities in withholding due to the volatile nature and classification of cryptocurrencies as assets or income under varying tax jurisdictions. Explore the nuances of withholding tax obligations in payroll crypto transactions to maintain compliance and avoid penalties.

Employment Laws

Payroll compliance ensures adherence to employment laws, tax regulations, and timely wage payments, protecting both employers and employees from legal penalties. Payroll crypto taxation involves reporting and withholding obligations on cryptocurrency payments, requiring specialized knowledge of tax codes and evolving regulations. Explore further to understand how employment laws intersect with payroll and crypto tax obligations for seamless compliance.

Source and External Links

2025 Payroll Compliance Checklist and Tax Law Guide - Payroll compliance means adhering to all federal, state, and local government regulations on employee payment, including worker classification, tax withholding, wage and hour laws, depositing funds, and tax filing to avoid IRS penalties.

How to ensure payroll compliance - Payroll compliance involves following tax laws, employment regulations, GDPR data protection, compensation rules, mandatory reporting and deductions, and maintaining payroll records across federal, state, and local levels.

A Complete Guide to Payroll Compliance in 2025 - Payroll compliance requires businesses to comply with laws on payroll and payroll taxes, such as the Fair Labor Standards Act, to avoid fines, audits, lawsuits, and ensure fair employee treatment.

dowidth.com

dowidth.com