Tokenized assets accounting leverages blockchain technology to record ownership and transaction history with enhanced transparency and immutability, contrasting with traditional asset accounting that relies on centralized ledgers and periodic reconciliations. Tokenized assets offer real-time tracking, fractional ownership, and increased liquidity, transforming asset management and valuation processes. Discover how tokenized assets are reshaping accounting standards and practices in the financial ecosystem.

Why it is important

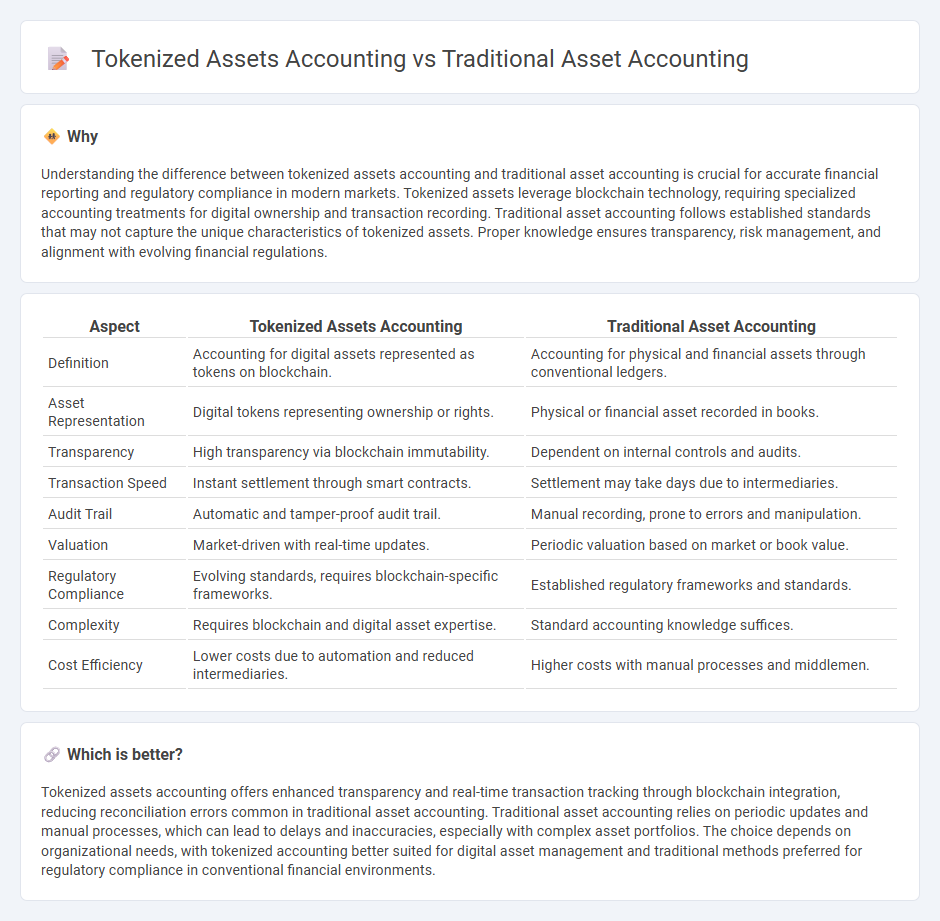

Understanding the difference between tokenized assets accounting and traditional asset accounting is crucial for accurate financial reporting and regulatory compliance in modern markets. Tokenized assets leverage blockchain technology, requiring specialized accounting treatments for digital ownership and transaction recording. Traditional asset accounting follows established standards that may not capture the unique characteristics of tokenized assets. Proper knowledge ensures transparency, risk management, and alignment with evolving financial regulations.

Comparison Table

| Aspect | Tokenized Assets Accounting | Traditional Asset Accounting |

|---|---|---|

| Definition | Accounting for digital assets represented as tokens on blockchain. | Accounting for physical and financial assets through conventional ledgers. |

| Asset Representation | Digital tokens representing ownership or rights. | Physical or financial asset recorded in books. |

| Transparency | High transparency via blockchain immutability. | Dependent on internal controls and audits. |

| Transaction Speed | Instant settlement through smart contracts. | Settlement may take days due to intermediaries. |

| Audit Trail | Automatic and tamper-proof audit trail. | Manual recording, prone to errors and manipulation. |

| Valuation | Market-driven with real-time updates. | Periodic valuation based on market or book value. |

| Regulatory Compliance | Evolving standards, requires blockchain-specific frameworks. | Established regulatory frameworks and standards. |

| Complexity | Requires blockchain and digital asset expertise. | Standard accounting knowledge suffices. |

| Cost Efficiency | Lower costs due to automation and reduced intermediaries. | Higher costs with manual processes and middlemen. |

Which is better?

Tokenized assets accounting offers enhanced transparency and real-time transaction tracking through blockchain integration, reducing reconciliation errors common in traditional asset accounting. Traditional asset accounting relies on periodic updates and manual processes, which can lead to delays and inaccuracies, especially with complex asset portfolios. The choice depends on organizational needs, with tokenized accounting better suited for digital asset management and traditional methods preferred for regulatory compliance in conventional financial environments.

Connection

Tokenized assets accounting integrates blockchain technology to record and manage assets digitally, enhancing transparency and traceability compared to traditional asset accounting. Both methods track asset ownership, valuation, and depreciation, but tokenized assets use smart contracts to automate transactions and updates, reducing manual errors and improving real-time accuracy. This connection enables traditional accounting frameworks to evolve with digital asset management, ensuring compliance while embracing innovative financial reporting standards.

Key Terms

Ownership Record

Traditional asset accounting relies on centralized ledgers and manual reconciliation to track ownership, often leading to delays and errors in record accuracy. Tokenized assets accounting utilizes blockchain technology to provide immutable, real-time ownership records, enhancing transparency and reducing fraud risk. Explore how tokenization revolutionizes asset ownership recording and transforms accounting practices today.

Valuation Method

Traditional asset accounting relies on historical cost or fair value models, using standardized financial statements and regulatory frameworks to determine asset valuation. Tokenized assets accounting leverages blockchain technology, enabling real-time market-driven valuations with enhanced transparency and liquidity through smart contracts. Discover how these evolving valuation methods reshape asset management and reporting standards.

Transfer Mechanism

Traditional asset accounting relies on centralized ledgers and manual transfer processes, often involving intermediaries such as brokers or banks to verify and record ownership changes. In contrast, tokenized assets use blockchain technology to enable instant, automated, and transparent transfer mechanisms through smart contracts, reducing settlement times and counterparty risks. Explore how these differing transfer methods impact efficiency and security in asset management.

Source and External Links

Fixed-Asset Accounting Basics - NetSuite - Traditional asset accounting involves tracking the lifecycle of fixed assets including purchase, depreciation, audits, revaluation, impairment, and disposal, following standards such as GAAP or IFRS to ensure financial statement uniformity.

Alternative assets versus traditional assets - FranShares - Traditional assets are primarily stocks, bonds, and cash, typically traded on public markets and accessible to general investors, often used for portfolio building with relatively stable returns compared to alternative assets.

Get to Know Various Types of Asset Classes - PIMCO - Traditional asset classes include bonds, cash, and stocks, with cash and bonds viewed as defensive assets providing regular income, and stocks providing growth potential with higher risk and reward.

dowidth.com

dowidth.com