Fractional CFOs offer flexible, cost-effective financial leadership for growing businesses without the full-time expense of an in-house CFO, enabling access to expert strategic planning and financial oversight on demand. In-house CFOs provide dedicated, immersive management with comprehensive involvement in daily operations, fostering deeper company-specific insights and continuous financial guidance. Explore the benefits and drawbacks of each option to determine the best fit for your organization's financial leadership needs.

Why it is important

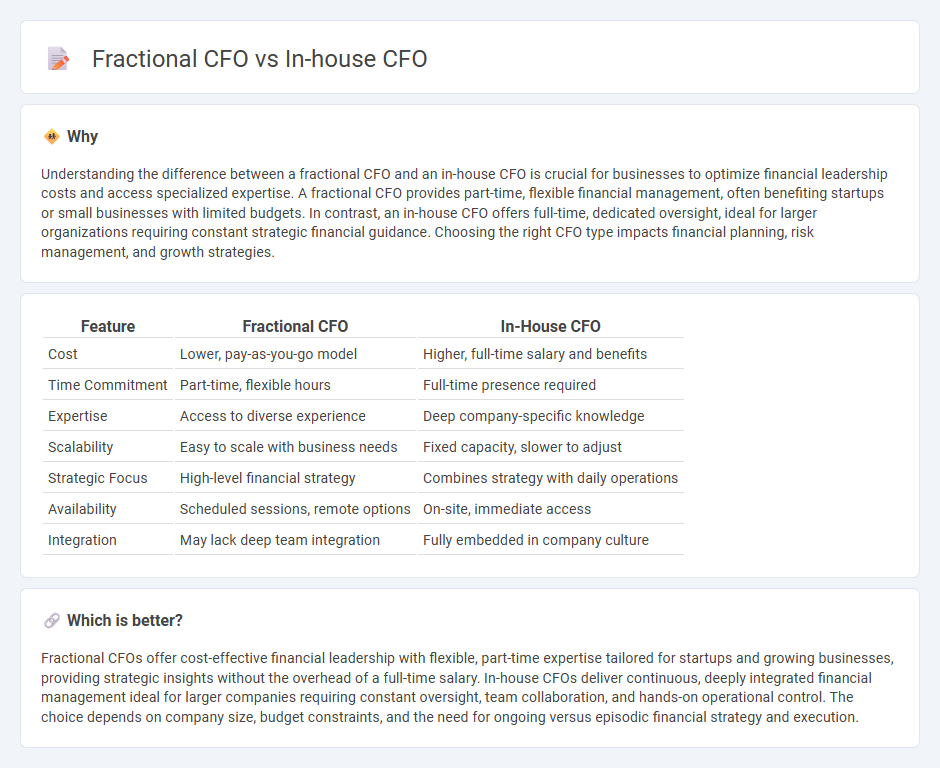

Understanding the difference between a fractional CFO and an in-house CFO is crucial for businesses to optimize financial leadership costs and access specialized expertise. A fractional CFO provides part-time, flexible financial management, often benefiting startups or small businesses with limited budgets. In contrast, an in-house CFO offers full-time, dedicated oversight, ideal for larger organizations requiring constant strategic financial guidance. Choosing the right CFO type impacts financial planning, risk management, and growth strategies.

Comparison Table

| Feature | Fractional CFO | In-House CFO |

|---|---|---|

| Cost | Lower, pay-as-you-go model | Higher, full-time salary and benefits |

| Time Commitment | Part-time, flexible hours | Full-time presence required |

| Expertise | Access to diverse experience | Deep company-specific knowledge |

| Scalability | Easy to scale with business needs | Fixed capacity, slower to adjust |

| Strategic Focus | High-level financial strategy | Combines strategy with daily operations |

| Availability | Scheduled sessions, remote options | On-site, immediate access |

| Integration | May lack deep team integration | Fully embedded in company culture |

Which is better?

Fractional CFOs offer cost-effective financial leadership with flexible, part-time expertise tailored for startups and growing businesses, providing strategic insights without the overhead of a full-time salary. In-house CFOs deliver continuous, deeply integrated financial management ideal for larger companies requiring constant oversight, team collaboration, and hands-on operational control. The choice depends on company size, budget constraints, and the need for ongoing versus episodic financial strategy and execution.

Connection

Fractional CFOs and in-house CFOs both provide strategic financial leadership, with fractional CFOs offering part-time, flexible expertise to organizations unable to support a full-time role. Fractional CFOs complement in-house CFOs by filling gaps in experience or capacity during high-growth phases or transitional periods, ensuring continuous financial oversight. Businesses leverage this connection to optimize financial management, balancing cost efficiency and executive-level decision-making.

Key Terms

Cost Efficiency

Hiring an in-house CFO typically involves a higher fixed cost due to salary, benefits, and overhead expenses, whereas a fractional CFO offers a flexible, cost-effective solution by providing expertise on an as-needed basis. Fractional CFOs enable startups and small to mid-sized companies to access high-level financial strategy without the financial burden of a full-time executive. Explore detailed cost-benefit analyses to determine which CFO model best fits your financial efficiency goals.

Availability

An in-house CFO typically offers full-time availability, fully integrating with company teams and managing daily financial operations. Fractional CFOs provide flexible, part-time engagement, allowing businesses to access high-level expertise without the commitment of a full-time salary. Explore how these availability models impact your company's financial strategy and growth potential.

Strategic Involvement

An in-house CFO offers deep, continuous strategic involvement by embedding within the company's leadership team and driving long-term financial planning, budgeting, and risk management. A fractional CFO provides expert strategic guidance on a part-time or project basis, ideal for businesses needing flexible, cost-effective financial leadership without full-time commitment. Discover how choosing between an in-house and fractional CFO can optimize your company's strategic financial growth.

Source and External Links

Outsourced CFO Versus In-House CFO - Discusses the benefits of having an in-house CFO, including immediate availability and deep understanding of the company's operations.

Outsourced CFO vs. In-House CFO - Highlights the advantages of an in-house CFO, such as full-time dedication and long-term commitment to the company's financial strategy.

Virtual vs In-House CFO - Explains that an in-house CFO is employed by the company, dedicated to its financial management, and integrates with business goals.

dowidth.com

dowidth.com