Intercompany automation streamlines financial transactions between subsidiaries by automating reconciliations, approvals, and intercompany billing processes, reducing errors and enhancing efficiency. Transfer pricing management ensures compliance with global regulations by accurately setting and documenting pricing for goods and services exchanged within multinational enterprises. Explore how integrating these solutions can optimize your corporate accounting strategies.

Why it is important

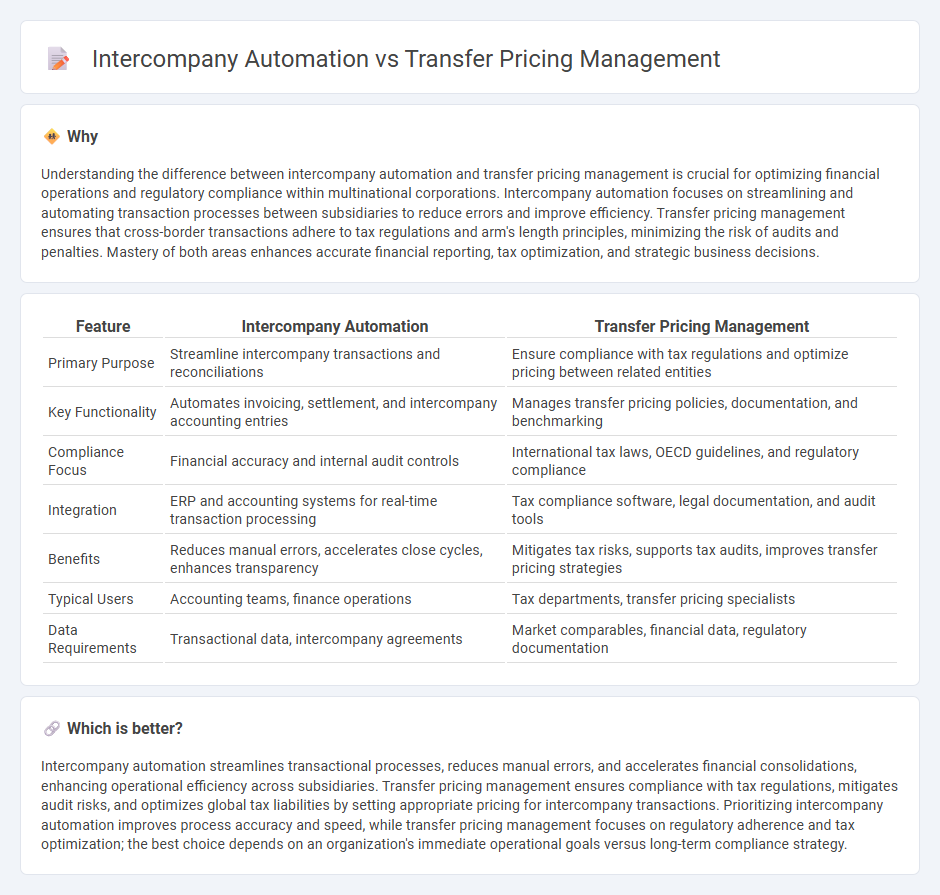

Understanding the difference between intercompany automation and transfer pricing management is crucial for optimizing financial operations and regulatory compliance within multinational corporations. Intercompany automation focuses on streamlining and automating transaction processes between subsidiaries to reduce errors and improve efficiency. Transfer pricing management ensures that cross-border transactions adhere to tax regulations and arm's length principles, minimizing the risk of audits and penalties. Mastery of both areas enhances accurate financial reporting, tax optimization, and strategic business decisions.

Comparison Table

| Feature | Intercompany Automation | Transfer Pricing Management |

|---|---|---|

| Primary Purpose | Streamline intercompany transactions and reconciliations | Ensure compliance with tax regulations and optimize pricing between related entities |

| Key Functionality | Automates invoicing, settlement, and intercompany accounting entries | Manages transfer pricing policies, documentation, and benchmarking |

| Compliance Focus | Financial accuracy and internal audit controls | International tax laws, OECD guidelines, and regulatory compliance |

| Integration | ERP and accounting systems for real-time transaction processing | Tax compliance software, legal documentation, and audit tools |

| Benefits | Reduces manual errors, accelerates close cycles, enhances transparency | Mitigates tax risks, supports tax audits, improves transfer pricing strategies |

| Typical Users | Accounting teams, finance operations | Tax departments, transfer pricing specialists |

| Data Requirements | Transactional data, intercompany agreements | Market comparables, financial data, regulatory documentation |

Which is better?

Intercompany automation streamlines transactional processes, reduces manual errors, and accelerates financial consolidations, enhancing operational efficiency across subsidiaries. Transfer pricing management ensures compliance with tax regulations, mitigates audit risks, and optimizes global tax liabilities by setting appropriate pricing for intercompany transactions. Prioritizing intercompany automation improves process accuracy and speed, while transfer pricing management focuses on regulatory adherence and tax optimization; the best choice depends on an organization's immediate operational goals versus long-term compliance strategy.

Connection

Intercompany automation streamlines financial transactions between subsidiaries by facilitating accurate data exchange, which directly impacts transfer pricing management by ensuring compliance with regulatory requirements and minimizing tax risks. Effective automation of intercompany processes improves transparency and consistency in pricing strategies, aiding in the accurate allocation of profits across jurisdictions. Integration of automated systems with transfer pricing frameworks enhances audit readiness and reduces the complexity of managing cross-border financial operations.

Key Terms

**Transfer Pricing Management:**

Transfer Pricing Management involves establishing, documenting, and monitoring prices for transactions between related entities within a multinational corporation to ensure compliance with tax regulations and avoid penalties. This process requires meticulous data analysis, adherence to local and international tax laws, and comprehensive transfer pricing policies to minimize transfer pricing risks and optimize tax efficiencies. Explore how advanced Transfer Pricing Management strategies can enhance your global tax compliance and financial accuracy.

Arm’s Length Principle

Transfer pricing management ensures compliance with the Arm's Length Principle by accurately documenting and analyzing pricing strategies for intercompany transactions to prevent tax base erosion and profit shifting. Intercompany automation streamlines data collection and transaction processing, enhancing accuracy and reducing manual errors while maintaining adherence to regulatory standards. Explore the critical differences and best practices to optimize your transfer pricing and automate intercompany processes effectively.

Comparable Uncontrolled Price (CUP) Method

Transfer pricing management leverages the Comparable Uncontrolled Price (CUP) method to establish arm's length pricing by comparing controlled transactions with comparable uncontrolled transactions, ensuring compliance with tax regulations. Intercompany automation enhances accuracy and efficiency by integrating real-time data analysis and automated documentation, reducing manual errors in applying the CUP method. Discover how combining transfer pricing management with intercompany automation can optimize your tax strategy and compliance.

Source and External Links

Transfer Pricing Methods & Best Practices - This resource provides an overview of transfer pricing, including methods, compliance, documentation, and strategic planning for multinational corporations.

Developing an Effective Transfer Pricing Strategy for Your Business - This article discusses key elements of a successful transfer pricing strategy, including compliance and optimizing tax outcomes.

Understanding Transfer Pricing: A Key to Global Business Success - This insight highlights the importance of transfer pricing in supporting tax compliance, optimizing profits, and improving cash flow for global businesses.

dowidth.com

dowidth.com