Sustainability assurance evaluates the accuracy and reliability of environmental, social, and governance (ESG) disclosures, ensuring organizations meet stakeholder expectations on sustainability commitments. Non-financial assurance extends beyond financial reporting to verify a variety of non-financial information including ethics, compliance, and social impact. Explore how these assurance types strengthen corporate accountability and transparency.

Why it is important

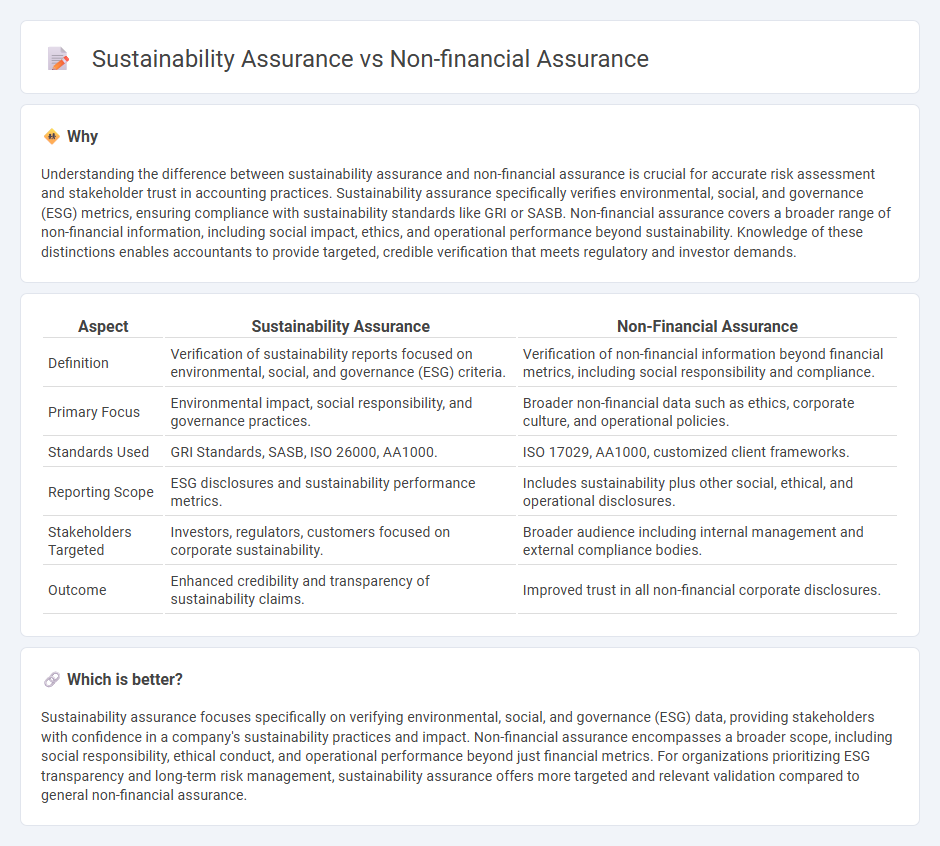

Understanding the difference between sustainability assurance and non-financial assurance is crucial for accurate risk assessment and stakeholder trust in accounting practices. Sustainability assurance specifically verifies environmental, social, and governance (ESG) metrics, ensuring compliance with sustainability standards like GRI or SASB. Non-financial assurance covers a broader range of non-financial information, including social impact, ethics, and operational performance beyond sustainability. Knowledge of these distinctions enables accountants to provide targeted, credible verification that meets regulatory and investor demands.

Comparison Table

| Aspect | Sustainability Assurance | Non-Financial Assurance |

|---|---|---|

| Definition | Verification of sustainability reports focused on environmental, social, and governance (ESG) criteria. | Verification of non-financial information beyond financial metrics, including social responsibility and compliance. |

| Primary Focus | Environmental impact, social responsibility, and governance practices. | Broader non-financial data such as ethics, corporate culture, and operational policies. |

| Standards Used | GRI Standards, SASB, ISO 26000, AA1000. | ISO 17029, AA1000, customized client frameworks. |

| Reporting Scope | ESG disclosures and sustainability performance metrics. | Includes sustainability plus other social, ethical, and operational disclosures. |

| Stakeholders Targeted | Investors, regulators, customers focused on corporate sustainability. | Broader audience including internal management and external compliance bodies. |

| Outcome | Enhanced credibility and transparency of sustainability claims. | Improved trust in all non-financial corporate disclosures. |

Which is better?

Sustainability assurance focuses specifically on verifying environmental, social, and governance (ESG) data, providing stakeholders with confidence in a company's sustainability practices and impact. Non-financial assurance encompasses a broader scope, including social responsibility, ethical conduct, and operational performance beyond just financial metrics. For organizations prioritizing ESG transparency and long-term risk management, sustainability assurance offers more targeted and relevant validation compared to general non-financial assurance.

Connection

Sustainability assurance and non-financial assurance are interconnected through their focus on verifying non-financial information related to environmental, social, and governance (ESG) aspects. Both types of assurance enhance the credibility and reliability of corporate disclosures by providing independent evaluations of sustainability reports, social impact data, and ethical practices. This connection supports stakeholders' decision-making by ensuring transparency and accountability beyond traditional financial metrics.

Key Terms

Non-financial assurance:

Non-financial assurance primarily evaluates the accuracy and reliability of qualitative information such as environmental, social, and governance (ESG) data, corporate social responsibility (CSR) reports, and ethical business practices. It ensures that companies adhere to regulatory requirements and stakeholder expectations without focusing on monetary metrics. Explore how non-financial assurance strengthens transparency and trust in corporate reporting.

Data Integrity

Non-financial assurance primarily evaluates the accuracy and reliability of qualitative information, such as social and governance disclosures, while sustainability assurance focuses explicitly on environmental, social, and governance (ESG) data integrity and performance metrics. Both types of assurance emphasize robust data verification processes to ensure stakeholder trust and regulatory compliance. Explore further to understand how assurance standards enhance transparency in corporate non-financial reporting.

Compliance

Non-financial assurance primarily emphasizes verifying a company's adherence to regulatory and ethical standards beyond financial reporting, ensuring compliance with legal and social obligations. Sustainability assurance extends this by specifically evaluating environmental, social, and governance (ESG) disclosures, measuring the reliability and impact of sustainability claims against established frameworks such as GRI or SASB. Explore our detailed insights to understand how compliance shapes both assurance practices in corporate accountability.

Source and External Links

Non-Financial Assurance Services - Aprio - Aprio offers non-financial assurance services that help businesses mitigate risks and ensure accuracy, reliability, and trustworthiness in their non-financial reporting through detailed, tailored remote audits and technology-enabled collaboration.

A buyer's guide to assurance on non-financial information - This guide explains that non-financial assurance involves verifying information outside audited financial statements, such as sustainability and governance data, clarifying assurance types and helping companies navigate assurance provider quality and costs.

Nonfinancial reporting advisory and assurance | EY - India - EY provides non-financial assurance services aligned with industry standards to increase transparency and stakeholder trust in corporate non-financial disclosures, such as environmental and social metrics, through independent assurance reports.

dowidth.com

dowidth.com