Digital twin accounting leverages real-time data, AI, and simulation technology to create a virtual replica of financial processes, enabling predictive analysis and dynamic decision-making. Management accounting focuses on internal financial insights, budgeting, and performance evaluation to support strategic planning and operational control. Explore how integrating digital twin accounting can transform traditional management accounting methods for enhanced financial agility.

Why it is important

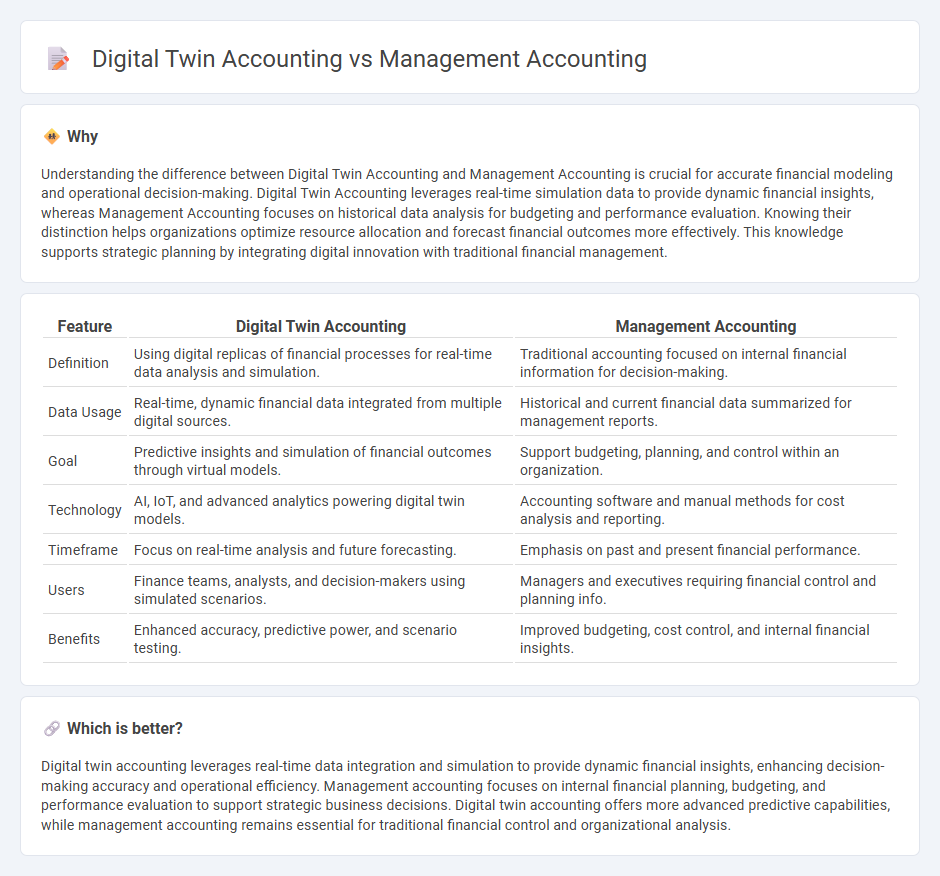

Understanding the difference between Digital Twin Accounting and Management Accounting is crucial for accurate financial modeling and operational decision-making. Digital Twin Accounting leverages real-time simulation data to provide dynamic financial insights, whereas Management Accounting focuses on historical data analysis for budgeting and performance evaluation. Knowing their distinction helps organizations optimize resource allocation and forecast financial outcomes more effectively. This knowledge supports strategic planning by integrating digital innovation with traditional financial management.

Comparison Table

| Feature | Digital Twin Accounting | Management Accounting |

|---|---|---|

| Definition | Using digital replicas of financial processes for real-time data analysis and simulation. | Traditional accounting focused on internal financial information for decision-making. |

| Data Usage | Real-time, dynamic financial data integrated from multiple digital sources. | Historical and current financial data summarized for management reports. |

| Goal | Predictive insights and simulation of financial outcomes through virtual models. | Support budgeting, planning, and control within an organization. |

| Technology | AI, IoT, and advanced analytics powering digital twin models. | Accounting software and manual methods for cost analysis and reporting. |

| Timeframe | Focus on real-time analysis and future forecasting. | Emphasis on past and present financial performance. |

| Users | Finance teams, analysts, and decision-makers using simulated scenarios. | Managers and executives requiring financial control and planning info. |

| Benefits | Enhanced accuracy, predictive power, and scenario testing. | Improved budgeting, cost control, and internal financial insights. |

Which is better?

Digital twin accounting leverages real-time data integration and simulation to provide dynamic financial insights, enhancing decision-making accuracy and operational efficiency. Management accounting focuses on internal financial planning, budgeting, and performance evaluation to support strategic business decisions. Digital twin accounting offers more advanced predictive capabilities, while management accounting remains essential for traditional financial control and organizational analysis.

Connection

Digital twin accounting integrates real-time data replication of financial processes with management accounting to enhance precision in budgeting, forecasting, and decision-making. By creating virtual models of financial operations, it allows management accountants to analyze potential outcomes and optimize resource allocation efficiently. This connection drives improved strategic planning and risk management through synchronized digital insights and managerial reporting.

Key Terms

**Management accounting:**

Management accounting provides detailed financial insights and operational data to help organizations plan, control, and make informed decisions for strategic growth. It focuses on budgeting, forecasting, performance evaluation, and cost management through historical and real-time financial data analysis. Explore more on how management accounting transforms business efficiency and decision-making processes.

Budgeting

Management accounting emphasizes budgeting through historical data analysis, cost control, and variance analysis to optimize financial performance. Digital twin accounting integrates real-time data from virtual replicas of physical processes, allowing dynamic budget adjustments and predictive financial planning. Discover how digital twin technology transforms budgeting accuracy and strategic decision-making.

Cost analysis

Management accounting emphasizes cost analysis by tracking, controlling, and allocating expenses to optimize financial performance and support strategic decision-making. Digital twin accounting enhances this process through real-time simulation and predictive analytics, enabling more precise cost forecasting and operational efficiency improvements. Explore how integrating digital twin technology revolutionizes cost analysis in modern businesses.

Source and External Links

What Is Management Accounting? - Management accounting prepares reports on business operations to assist managers in making short- and long-term decisions, including forecasting, make-or-buy decisions, cash flow forecasting, performance variance analysis, and evaluating rates of return.

Managerial Accounting - Definition, Objectives & Techniques - Managerial accounting generates internal reports and data analysis to help management plan, organize, direct, and control company operations, supporting goal achievement through budgeting, cost control, and qualitative as well as quantitative information.

What Is Management Accounting? Types and Key ... - Management accounting aids planning and decision-making by analyzing financial data, budgeting, forecasting, make-or-buy decisions, cash flow projections, and variance analysis to optimize business performance.

dowidth.com

dowidth.com