Cryptocurrency auditing focuses on verifying digital asset transactions and blockchain records to ensure accuracy and compliance with regulatory standards. Forensic auditing involves investigating financial records to detect fraud, embezzlement, or other financial crimes, often using specialized techniques to trace illicit activities. Explore deeper insights into how these auditing methods safeguard financial integrity in evolving digital landscapes.

Why it is important

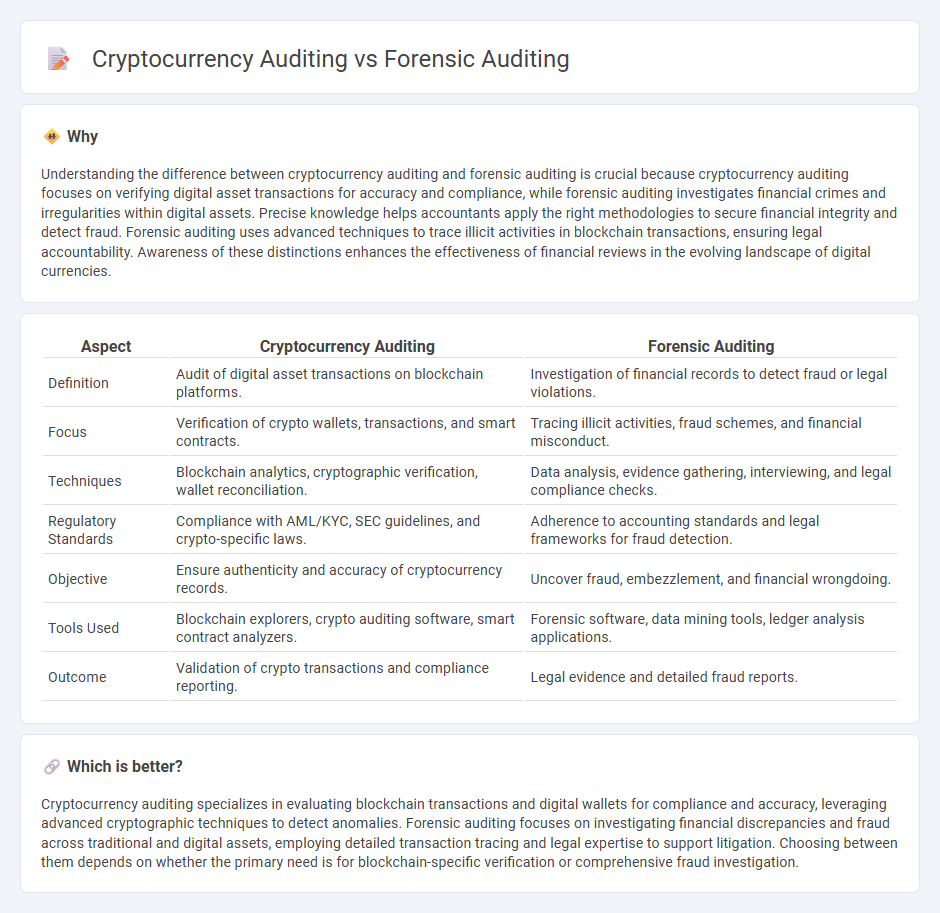

Understanding the difference between cryptocurrency auditing and forensic auditing is crucial because cryptocurrency auditing focuses on verifying digital asset transactions for accuracy and compliance, while forensic auditing investigates financial crimes and irregularities within digital assets. Precise knowledge helps accountants apply the right methodologies to secure financial integrity and detect fraud. Forensic auditing uses advanced techniques to trace illicit activities in blockchain transactions, ensuring legal accountability. Awareness of these distinctions enhances the effectiveness of financial reviews in the evolving landscape of digital currencies.

Comparison Table

| Aspect | Cryptocurrency Auditing | Forensic Auditing |

|---|---|---|

| Definition | Audit of digital asset transactions on blockchain platforms. | Investigation of financial records to detect fraud or legal violations. |

| Focus | Verification of crypto wallets, transactions, and smart contracts. | Tracing illicit activities, fraud schemes, and financial misconduct. |

| Techniques | Blockchain analytics, cryptographic verification, wallet reconciliation. | Data analysis, evidence gathering, interviewing, and legal compliance checks. |

| Regulatory Standards | Compliance with AML/KYC, SEC guidelines, and crypto-specific laws. | Adherence to accounting standards and legal frameworks for fraud detection. |

| Objective | Ensure authenticity and accuracy of cryptocurrency records. | Uncover fraud, embezzlement, and financial wrongdoing. |

| Tools Used | Blockchain explorers, crypto auditing software, smart contract analyzers. | Forensic software, data mining tools, ledger analysis applications. |

| Outcome | Validation of crypto transactions and compliance reporting. | Legal evidence and detailed fraud reports. |

Which is better?

Cryptocurrency auditing specializes in evaluating blockchain transactions and digital wallets for compliance and accuracy, leveraging advanced cryptographic techniques to detect anomalies. Forensic auditing focuses on investigating financial discrepancies and fraud across traditional and digital assets, employing detailed transaction tracing and legal expertise to support litigation. Choosing between them depends on whether the primary need is for blockchain-specific verification or comprehensive fraud investigation.

Connection

Cryptocurrency auditing and forensic auditing intersect in their focus on tracing digital asset transactions to detect fraud or financial discrepancies. Forensic auditing employs specialized techniques to analyze blockchain data, uncovering irregularities and ensuring regulatory compliance within cryptocurrency systems. This connection enhances transparency and accountability in the rapidly evolving digital currency landscape.

Key Terms

Forensic Auditing:

Forensic auditing involves a detailed examination of financial records to detect fraud, embezzlement, and financial misconduct, often used in legal proceedings to provide evidence. It employs specialized techniques such as data mining, transaction tracing, and financial statement analysis to uncover discrepancies and illicit activities in traditional financial environments. Explore more about forensic auditing methodologies and their critical role in enhancing financial transparency and accountability.

Fraud Detection

Forensic auditing targets fraud detection by examining financial records and transactions to uncover illegal activities, manipulation, or misrepresentation, emphasizing detailed evidence collection and legal compliance. Cryptocurrency auditing employs advanced blockchain analysis tools to trace transactions, identify suspicious patterns, and detect illicit activities in decentralized digital assets, leveraging the transparency and immutability of blockchain technology. Explore further to understand the distinct methodologies and technologies enhancing fraud detection in traditional and crypto financial audits.

Evidence Gathering

Forensic auditing meticulously collects and analyzes financial evidence to detect fraud, often using traditional accounting records, emails, and transaction histories, whereas cryptocurrency auditing emphasizes tracing blockchain transactions and digital wallets to uncover illicit activities. The immutable nature of blockchain provides precise timestamps and transparent transaction trails, enhancing evidence reliability compared to conventional methods. Explore how advanced tools and techniques differentiate forensic auditing and cryptocurrency auditing in evidence gathering.

Source and External Links

Forensic Audits: All You Need to Know - Caseware - Forensic auditing is a focused investigation conducted by specialists to uncover fraudulent or illegal financial activity, involving detailed examination, evidence collection, and potentially court testimony.

Forensic Audit Guide - Definition, Steps, Reasons - A forensic audit reviews financial records to gather evidence for legal proceedings, aiming to detect fraud and prove the identity and modus operandi of fraudsters with adequate evidence.

Forensic auditing | P7 Advanced Audit and Assurance - ACCA Global - Forensic auditing involves using specialized audit techniques to collect evidence about fraud schemes, the fraudsters' motives, collusion, and attempts to conceal or destroy evidence, supporting potential court cases.

dowidth.com

dowidth.com