Neobank reconciliation involves matching digital bank transaction records with internal financial statements to ensure accuracy and prevent errors or fraud. Intercompany reconciliation focuses on verifying and aligning financial transactions and balances between different entities within the same corporate group to maintain consolidated financial integrity. Explore the key differences and best practices for efficient reconciliation in modern accounting.

Why it is important

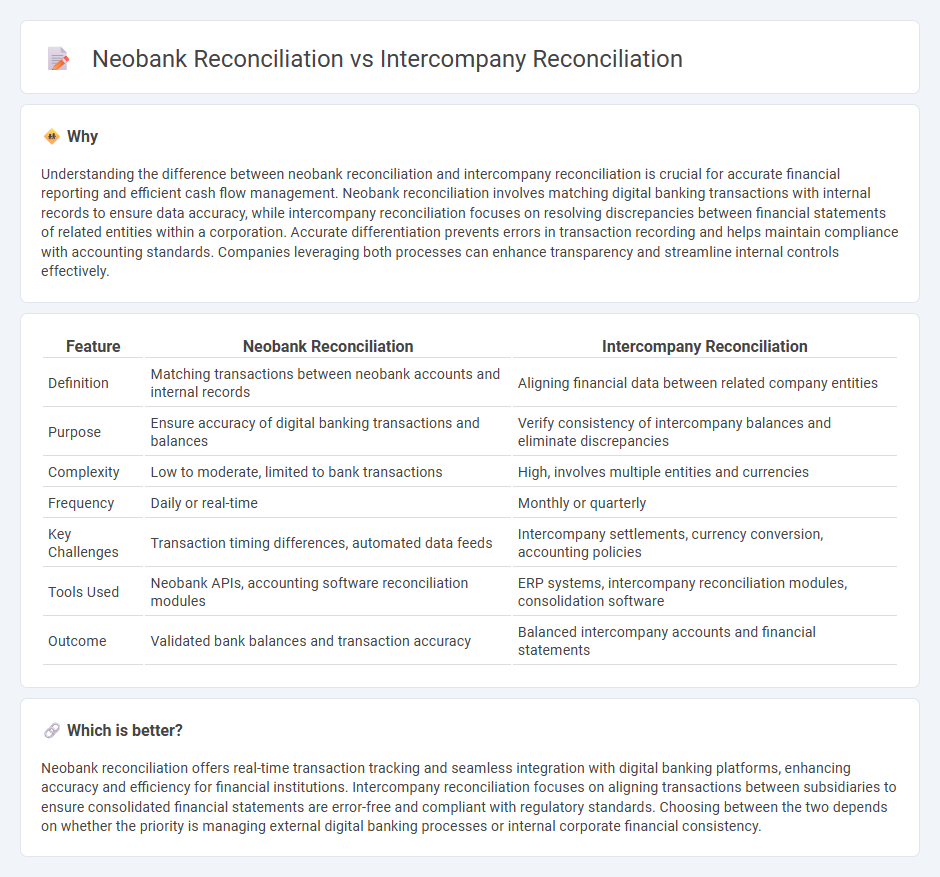

Understanding the difference between neobank reconciliation and intercompany reconciliation is crucial for accurate financial reporting and efficient cash flow management. Neobank reconciliation involves matching digital banking transactions with internal records to ensure data accuracy, while intercompany reconciliation focuses on resolving discrepancies between financial statements of related entities within a corporation. Accurate differentiation prevents errors in transaction recording and helps maintain compliance with accounting standards. Companies leveraging both processes can enhance transparency and streamline internal controls effectively.

Comparison Table

| Feature | Neobank Reconciliation | Intercompany Reconciliation |

|---|---|---|

| Definition | Matching transactions between neobank accounts and internal records | Aligning financial data between related company entities |

| Purpose | Ensure accuracy of digital banking transactions and balances | Verify consistency of intercompany balances and eliminate discrepancies |

| Complexity | Low to moderate, limited to bank transactions | High, involves multiple entities and currencies |

| Frequency | Daily or real-time | Monthly or quarterly |

| Key Challenges | Transaction timing differences, automated data feeds | Intercompany settlements, currency conversion, accounting policies |

| Tools Used | Neobank APIs, accounting software reconciliation modules | ERP systems, intercompany reconciliation modules, consolidation software |

| Outcome | Validated bank balances and transaction accuracy | Balanced intercompany accounts and financial statements |

Which is better?

Neobank reconciliation offers real-time transaction tracking and seamless integration with digital banking platforms, enhancing accuracy and efficiency for financial institutions. Intercompany reconciliation focuses on aligning transactions between subsidiaries to ensure consolidated financial statements are error-free and compliant with regulatory standards. Choosing between the two depends on whether the priority is managing external digital banking processes or internal corporate financial consistency.

Connection

Neobank reconciliation streamlines transaction verification by leveraging real-time digital banking data, enhancing accuracy and efficiency in financial records. Intercompany reconciliation involves matching transactions between subsidiaries within the same organization to ensure consistency and eliminate discrepancies. Integrating neobank reconciliation tools with intercompany reconciliation processes allows seamless consolidation of digital transactions, reducing errors and accelerating financial close cycles.

Key Terms

**Intercompany Reconciliation:**

Intercompany reconciliation involves matching and eliminating transactions between subsidiaries or entities within the same corporate group to ensure accurate consolidated financial statements. This process addresses discrepancies in intercompany loans, expenses, and revenues to prevent overstated assets or liabilities. Explore detailed techniques to streamline intercompany reconciliation and enhance financial transparency.

Consolidation

Intercompany reconciliation in consolidation involves matching and eliminating intercompany transactions to ensure accurate consolidated financial statements, often requiring detailed adjustments for intra-group balances and profit eliminations. Neobank reconciliation focuses on automating transaction matching and validation across multiple digital accounts to streamline real-time financial reporting and compliance. Explore more to understand how these reconciliation processes impact overall financial consolidation and reporting efficiency.

Intercompany transactions

Intercompany reconciliation involves verifying and matching transactions between different entities within the same corporate group to ensure consistent financial reporting and eliminate duplication. Neobank reconciliation focuses on the accurate matching of digital banking transactions, often with a higher emphasis on real-time data and automation, but typically does not encompass the complexities of intercompany entries. Explore how integrating advanced reconciliation tools can streamline intercompany transaction accuracy and enhance overall financial integrity.

Source and External Links

What is Intercompany Reconciliation? - This article explains that intercompany reconciliation ensures all financial transactions between corporate entities are accurately recorded and balanced, crucial for financial reporting and compliance.

Intercompany Reconciliation: How to Reconcile Multi-Entity Environments - This guide outlines the importance of correctly reconciling transactions between entities for accurate financial statements, providing a step-by-step approach to the reconciliation process.

What is Intercompany Reconciliation: Process and Examples - This blog post discusses the process of ensuring that intercompany transactions are accurately recorded and balanced, highlighting its importance for financial integrity and compliance.

dowidth.com

dowidth.com