Forensic accounting software specializes in detailed financial investigations, fraud detection, and dispute analysis, utilizing advanced analytics to identify irregularities and ensure compliance. Accounts receivable software focuses on managing incoming payments, tracking outstanding invoices, and automating billing processes to optimize cash flow and customer relations. Explore more about how each software enhances financial management and security.

Why it is important

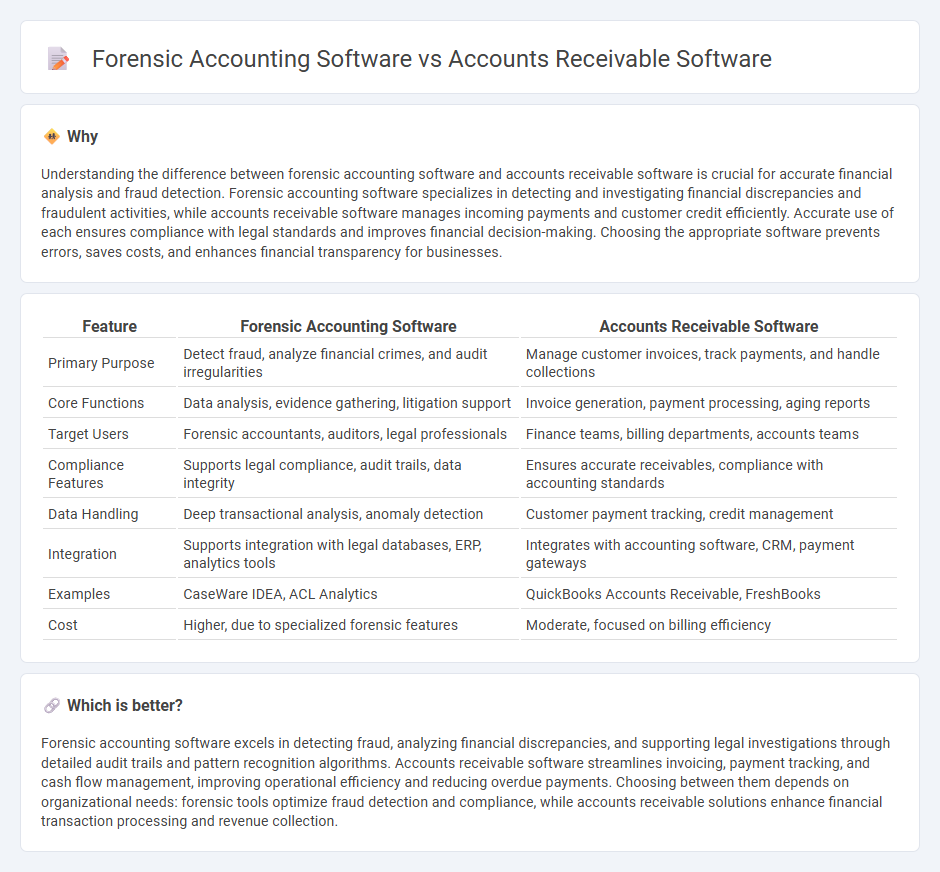

Understanding the difference between forensic accounting software and accounts receivable software is crucial for accurate financial analysis and fraud detection. Forensic accounting software specializes in detecting and investigating financial discrepancies and fraudulent activities, while accounts receivable software manages incoming payments and customer credit efficiently. Accurate use of each ensures compliance with legal standards and improves financial decision-making. Choosing the appropriate software prevents errors, saves costs, and enhances financial transparency for businesses.

Comparison Table

| Feature | Forensic Accounting Software | Accounts Receivable Software |

|---|---|---|

| Primary Purpose | Detect fraud, analyze financial crimes, and audit irregularities | Manage customer invoices, track payments, and handle collections |

| Core Functions | Data analysis, evidence gathering, litigation support | Invoice generation, payment processing, aging reports |

| Target Users | Forensic accountants, auditors, legal professionals | Finance teams, billing departments, accounts teams |

| Compliance Features | Supports legal compliance, audit trails, data integrity | Ensures accurate receivables, compliance with accounting standards |

| Data Handling | Deep transactional analysis, anomaly detection | Customer payment tracking, credit management |

| Integration | Supports integration with legal databases, ERP, analytics tools | Integrates with accounting software, CRM, payment gateways |

| Examples | CaseWare IDEA, ACL Analytics | QuickBooks Accounts Receivable, FreshBooks |

| Cost | Higher, due to specialized forensic features | Moderate, focused on billing efficiency |

Which is better?

Forensic accounting software excels in detecting fraud, analyzing financial discrepancies, and supporting legal investigations through detailed audit trails and pattern recognition algorithms. Accounts receivable software streamlines invoicing, payment tracking, and cash flow management, improving operational efficiency and reducing overdue payments. Choosing between them depends on organizational needs: forensic tools optimize fraud detection and compliance, while accounts receivable solutions enhance financial transaction processing and revenue collection.

Connection

Forensic accounting software and accounts receivable software intersect through their shared focus on accurate financial data analysis and fraud detection. Forensic accounting software scrutinizes accounts receivable transactions to identify discrepancies, irregularities, and potential fraudulent activities. Integrating accounts receivable software with forensic tools enhances the ability to monitor payment histories, detect anomalies, and ensure compliance with financial regulations.

Key Terms

Invoicing

Accounts receivable software streamlines invoicing by automating invoice generation, tracking payments, and managing customer account balances to improve cash flow efficiency. Forensic accounting software focuses on detailed invoice analysis and audit trails to detect fraud, discrepancies, and ensure compliance during financial investigations. Explore how these software solutions optimize invoice management for enhanced financial control.

Audit Trail

Accounts receivable software manages billing and collections, ensuring accurate financial records by maintaining an organized audit trail of customer transactions and payments. Forensic accounting software emphasizes detecting fraud and discrepancies by providing a detailed, tamper-proof audit trail for thorough investigation and litigation support. Discover how the audit trail capabilities differ between these tools to enhance financial transparency and security.

Fraud Detection

Accounts receivable software primarily automates the tracking and management of outstanding invoices, enhancing cash flow accuracy but offering limited fraud detection capabilities beyond basic anomaly alerts. Forensic accounting software is specifically designed to identify financial discrepancies, uncover fraudulent activities, and support legal investigations through advanced data analytics and audit trail examination. Discover how integrating forensic tools with accounts receivable systems can strengthen fraud detection and safeguard your finances.

Source and External Links

Top 13 Accounts Receivable (AR) Software Solutions for 2025 - Lists leading AR software options like Younium, Versapay, and FreshBooks, highlighting features such as automated invoicing, payment tracking, and mobile accessibility for small businesses.

20 top accounts receivable softwares (& how to choose the best fit) - Outlines essential features of top AR software, including automated invoice generation, intelligent payment tracking, real-time reporting, and integrated invoice financing for improved cash flow.

Accounts Receivable Software - Smart AR Automation | Sage US - Describes how Sage's AR software automates invoicing, collections, and payment acceptance, offers multi-currency support, and provides advanced reporting for better financial visibility and decision-making.

dowidth.com

dowidth.com