Zero-knowledge proofs in accounting enable verification of financial data without revealing sensitive details, enhancing privacy and security. Forensic accounting primarily focuses on investigating financial discrepancies and fraud through detailed examination of records and transactions. Explore more to understand how these distinct approaches impact modern accounting practices.

Why it is important

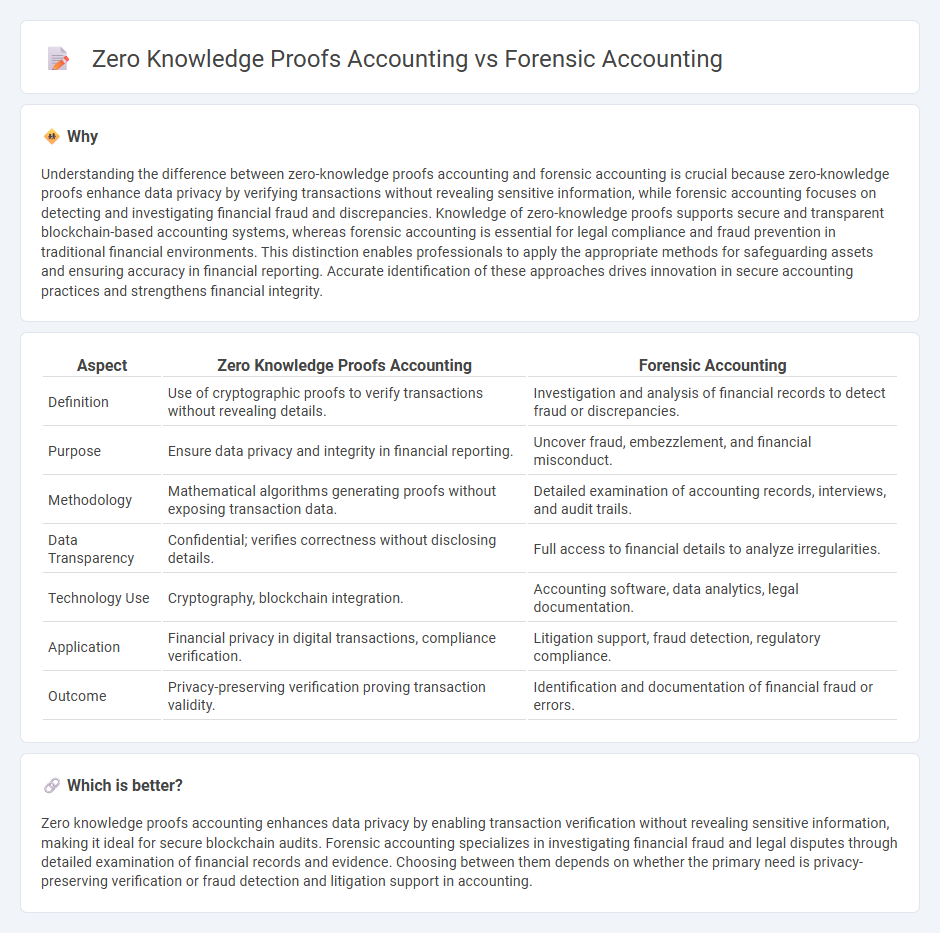

Understanding the difference between zero-knowledge proofs accounting and forensic accounting is crucial because zero-knowledge proofs enhance data privacy by verifying transactions without revealing sensitive information, while forensic accounting focuses on detecting and investigating financial fraud and discrepancies. Knowledge of zero-knowledge proofs supports secure and transparent blockchain-based accounting systems, whereas forensic accounting is essential for legal compliance and fraud prevention in traditional financial environments. This distinction enables professionals to apply the appropriate methods for safeguarding assets and ensuring accuracy in financial reporting. Accurate identification of these approaches drives innovation in secure accounting practices and strengthens financial integrity.

Comparison Table

| Aspect | Zero Knowledge Proofs Accounting | Forensic Accounting |

|---|---|---|

| Definition | Use of cryptographic proofs to verify transactions without revealing details. | Investigation and analysis of financial records to detect fraud or discrepancies. |

| Purpose | Ensure data privacy and integrity in financial reporting. | Uncover fraud, embezzlement, and financial misconduct. |

| Methodology | Mathematical algorithms generating proofs without exposing transaction data. | Detailed examination of accounting records, interviews, and audit trails. |

| Data Transparency | Confidential; verifies correctness without disclosing details. | Full access to financial details to analyze irregularities. |

| Technology Use | Cryptography, blockchain integration. | Accounting software, data analytics, legal documentation. |

| Application | Financial privacy in digital transactions, compliance verification. | Litigation support, fraud detection, regulatory compliance. |

| Outcome | Privacy-preserving verification proving transaction validity. | Identification and documentation of financial fraud or errors. |

Which is better?

Zero knowledge proofs accounting enhances data privacy by enabling transaction verification without revealing sensitive information, making it ideal for secure blockchain audits. Forensic accounting specializes in investigating financial fraud and legal disputes through detailed examination of financial records and evidence. Choosing between them depends on whether the primary need is privacy-preserving verification or fraud detection and litigation support in accounting.

Connection

Zero knowledge proofs enhance forensic accounting by enabling secure verification of financial transactions without revealing sensitive data, thereby protecting confidentiality while ensuring transparency. This cryptographic method supports fraud detection and compliance audits by validating asset ownership and transaction authenticity in accounting records. Integrating zero knowledge proofs in forensic accounting strengthens data integrity and helps investigators uncover financial anomalies with reduced risk of data exposure.

Key Terms

Forensic accounting:

Forensic accounting involves the application of specialized accounting techniques to investigate financial discrepancies, fraud, and legal disputes by analyzing, interpreting, and presenting complex financial data. This discipline combines accounting, auditing, and investigative skills to provide evidence in court cases and support regulatory compliance. Explore more to understand how forensic accounting detects and prevents financial crimes effectively.

Fraud detection

Forensic accounting leverages detailed financial audits, data analysis, and investigative techniques to detect fraud by uncovering discrepancies and suspicious transactions within accounting records. Zero knowledge proofs accounting enhances fraud detection by enabling confidential verification of financial data without revealing sensitive information, thereby ensuring data integrity and privacy. Explore the advantages of combining both methods to elevate fraud detection capabilities in modern financial systems.

Evidence collection

Forensic accounting specializes in collecting, analyzing, and preserving financial evidence to detect fraud and support legal investigations, emphasizing traceable, auditable transaction trails. Zero knowledge proofs accounting leverages cryptographic techniques to verify financial data accuracy without revealing underlying sensitive information, enhancing privacy while maintaining trustworthiness. Explore how these methodologies revolutionize evidence collection and secure financial verification.

Source and External Links

Forensic Accounting Career Overview - This webpage provides a comprehensive overview of the role of forensic accountants, including their primary duties and the skills required for the profession.

What Is Forensic Accounting? - This article explains what forensic accounting is, detailing its application in investigating financial crimes and the diverse career options available.

Forensic accounting - This Wikipedia page covers the definition, methodologies, and roles of forensic accounting in investigating financial crimes and providing expert testimony.

dowidth.com

dowidth.com