Data visualization dashboards in accounting provide real-time insights through interactive graphs and charts, enhancing decision-making by transforming complex financial data into intuitive visuals. Audit trails systematically record all financial transactions, ensuring transparency, accuracy, and regulatory compliance by maintaining a secure and chronological log of activities. Explore how integrating dashboards and audit trails can revolutionize your accounting processes for improved accuracy and strategic planning.

Why it is important

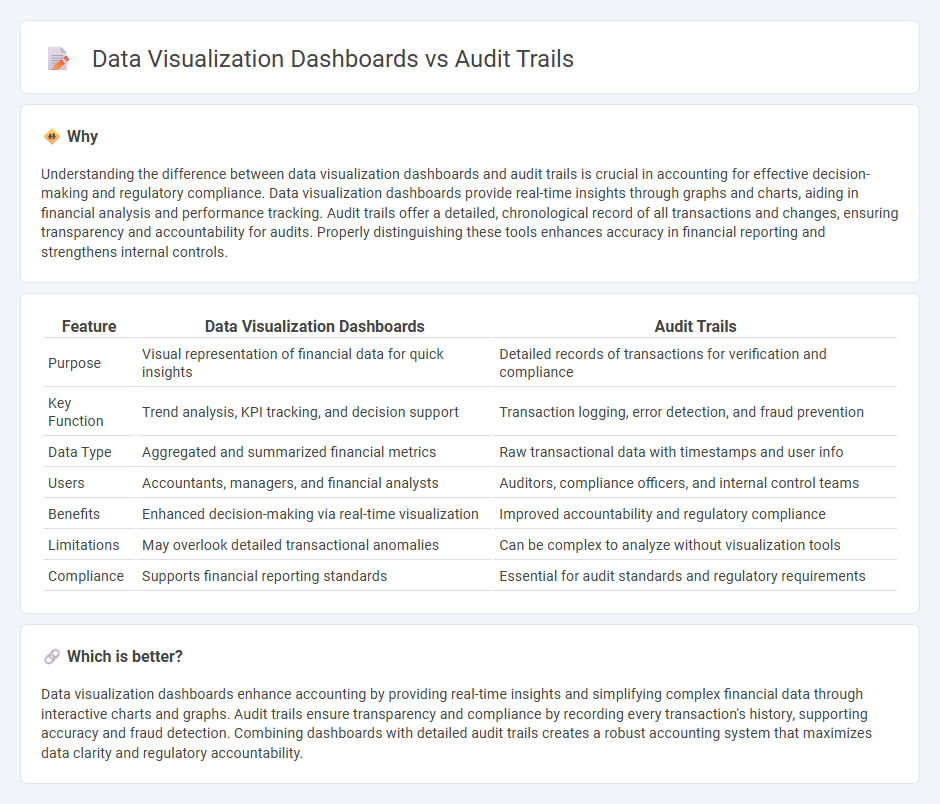

Understanding the difference between data visualization dashboards and audit trails is crucial in accounting for effective decision-making and regulatory compliance. Data visualization dashboards provide real-time insights through graphs and charts, aiding in financial analysis and performance tracking. Audit trails offer a detailed, chronological record of all transactions and changes, ensuring transparency and accountability for audits. Properly distinguishing these tools enhances accuracy in financial reporting and strengthens internal controls.

Comparison Table

| Feature | Data Visualization Dashboards | Audit Trails |

|---|---|---|

| Purpose | Visual representation of financial data for quick insights | Detailed records of transactions for verification and compliance |

| Key Function | Trend analysis, KPI tracking, and decision support | Transaction logging, error detection, and fraud prevention |

| Data Type | Aggregated and summarized financial metrics | Raw transactional data with timestamps and user info |

| Users | Accountants, managers, and financial analysts | Auditors, compliance officers, and internal control teams |

| Benefits | Enhanced decision-making via real-time visualization | Improved accountability and regulatory compliance |

| Limitations | May overlook detailed transactional anomalies | Can be complex to analyze without visualization tools |

| Compliance | Supports financial reporting standards | Essential for audit standards and regulatory requirements |

Which is better?

Data visualization dashboards enhance accounting by providing real-time insights and simplifying complex financial data through interactive charts and graphs. Audit trails ensure transparency and compliance by recording every transaction's history, supporting accuracy and fraud detection. Combining dashboards with detailed audit trails creates a robust accounting system that maximizes data clarity and regulatory accountability.

Connection

Data visualization dashboards enhance accounting by providing real-time insights into financial data, enabling auditors to quickly identify anomalies and trends. Audit trails support this process by offering a detailed, chronological record of all transactions and changes, ensuring transparency and traceability. Together, they improve accuracy, compliance, and decision-making in financial reporting and auditing.

Key Terms

**Audit Trails:**

Audit trails provide a detailed, chronological record of every action taken within a system, ensuring accountability and transparency essential for compliance and forensic analysis. They capture user activities, system changes, and data access to help detect unauthorized activities and maintain data integrity. Explore more to understand how audit trails enhance security and regulatory adherence.

Transaction Logs

Transaction logs serve as detailed audit trails, capturing every modification, deletion, and access event within a system to ensure data integrity and compliance. Unlike data visualization dashboards that provide aggregated, high-level insights through graphical representations, audit trails offer granular, chronological records essential for forensic analysis and regulatory audits. Explore further to understand how transaction logs enhance security monitoring and operational transparency.

Access Records

Audit trails meticulously record access events, capturing detailed logs of who accessed specific data, when, and what actions were performed, essential for compliance and security monitoring. Data visualization dashboards synthesize these access records into intuitive graphical formats, enabling quick identification of trends, anomalies, and user behaviors across systems. Explore how integrating audit trails with dynamic dashboards enhances real-time insights and strengthens access control frameworks.

Source and External Links

What is an Audit Trail? | HR & Payroll Glossary - Paylocity - An audit trail is a secure, chronological record of financial transactions and activity that supports data accuracy, accountability, and fraud prevention, playing a crucial role in compliance and internal reviews.

What Is an Audit Trail and What Purpose Does it Serve? - ZenGRC - Audit trails capture detailed records of actions on transactions and files, including timestamps and user activities, to ensure process accuracy, monitor user behavior, and support auditing processes.

What Is an Audit Trail? Everything You Need to Know - AuditBoard - Audit trails are detailed, chronological records of financial data and user activity essential for regulatory compliance, fraud prevention, and streamlined auditing in financial organizations.

dowidth.com

dowidth.com