Cryptocurrency valuation presents unique challenges due to its high volatility and lack of standardized metrics, contrasting with the established principles of fair value accounting that rely on market-based measurements. Fair value accounting offers a framework for assessing assets by reflecting current market conditions, yet cryptocurrencies often require tailored approaches to capture their dynamic and decentralized nature. Explore further to understand how accounting standards adapt to the evolving landscape of digital assets.

Why it is important

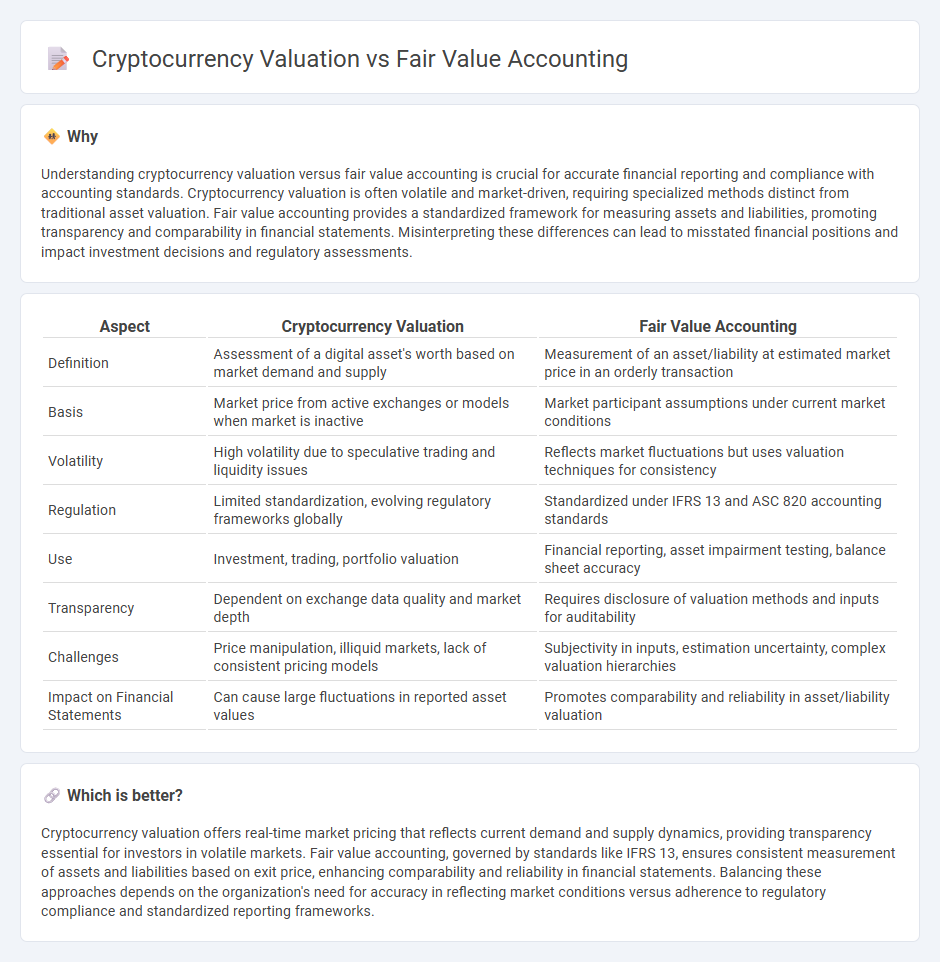

Understanding cryptocurrency valuation versus fair value accounting is crucial for accurate financial reporting and compliance with accounting standards. Cryptocurrency valuation is often volatile and market-driven, requiring specialized methods distinct from traditional asset valuation. Fair value accounting provides a standardized framework for measuring assets and liabilities, promoting transparency and comparability in financial statements. Misinterpreting these differences can lead to misstated financial positions and impact investment decisions and regulatory assessments.

Comparison Table

| Aspect | Cryptocurrency Valuation | Fair Value Accounting |

|---|---|---|

| Definition | Assessment of a digital asset's worth based on market demand and supply | Measurement of an asset/liability at estimated market price in an orderly transaction |

| Basis | Market price from active exchanges or models when market is inactive | Market participant assumptions under current market conditions |

| Volatility | High volatility due to speculative trading and liquidity issues | Reflects market fluctuations but uses valuation techniques for consistency |

| Regulation | Limited standardization, evolving regulatory frameworks globally | Standardized under IFRS 13 and ASC 820 accounting standards |

| Use | Investment, trading, portfolio valuation | Financial reporting, asset impairment testing, balance sheet accuracy |

| Transparency | Dependent on exchange data quality and market depth | Requires disclosure of valuation methods and inputs for auditability |

| Challenges | Price manipulation, illiquid markets, lack of consistent pricing models | Subjectivity in inputs, estimation uncertainty, complex valuation hierarchies |

| Impact on Financial Statements | Can cause large fluctuations in reported asset values | Promotes comparability and reliability in asset/liability valuation |

Which is better?

Cryptocurrency valuation offers real-time market pricing that reflects current demand and supply dynamics, providing transparency essential for investors in volatile markets. Fair value accounting, governed by standards like IFRS 13, ensures consistent measurement of assets and liabilities based on exit price, enhancing comparability and reliability in financial statements. Balancing these approaches depends on the organization's need for accuracy in reflecting market conditions versus adherence to regulatory compliance and standardized reporting frameworks.

Connection

Cryptocurrency valuation relies heavily on fair value accounting principles, which require assets to be measured based on current market prices or estimated market values. This approach ensures that cryptocurrency holdings reflect real-time economic conditions, enhancing transparency and accuracy in financial reporting. Fair value accounting helps manage the volatility inherent in digital assets by providing standardized guidelines for recognizing gains and losses.

Key Terms

Market Price

Fair value accounting relies on market price as a primary indicator to measure assets, providing a real-time valuation benchmark crucial for financial reporting. Cryptocurrency valuation, however, faces challenges due to high market volatility and varying liquidity, complicating accurate market price assessments. Explore further to understand how evolving standards aim to address these valuation complexities.

Volatility

Fair value accounting measures assets based on current market prices, providing real-time valuation but often amplifying volatility, especially in speculative markets like cryptocurrency. Cryptocurrency valuation faces extreme price fluctuations due to market sentiment, regulatory uncertainties, and liquidity constraints, challenging the consistency of fair value measurements. Explore detailed insights on how volatility impacts financial reporting and investment decisions in digital assets.

Measurement Basis

Fair value accounting measures assets and liabilities based on current market prices, reflecting real-time economic conditions for accurate financial reporting. In contrast, cryptocurrency valuation is challenged by extreme volatility and lack of standardized pricing, which complicates the application of traditional fair value methods. Explore detailed strategies to optimize cryptocurrency valuation within fair value frameworks and improve financial transparency.

Source and External Links

Fair Value - Wikipedia - Fair value in accounting is a rational and unbiased estimate of the potential market price of a good, service, or asset.

Why "Fair Value" Is the Rule - Harvard Business Review - This article discusses the rise of fair value accounting over the past decades as a departure from historical cost reporting.

IFRS 13 Fair Value Measurement - IFRS Foundation - IFRS 13 defines fair value as the price to sell an asset or paid to transfer a liability in an orderly transaction between market participants.

dowidth.com

dowidth.com