Real-time audits leverage continuous data monitoring and advanced analytics to provide immediate insights into financial activities, enhancing accuracy and fraud detection. External audits, conducted periodically by independent firms, focus on verifying the accuracy and compliance of financial statements with regulatory standards. Explore how these auditing methods transform financial transparency and decision-making.

Why it is important

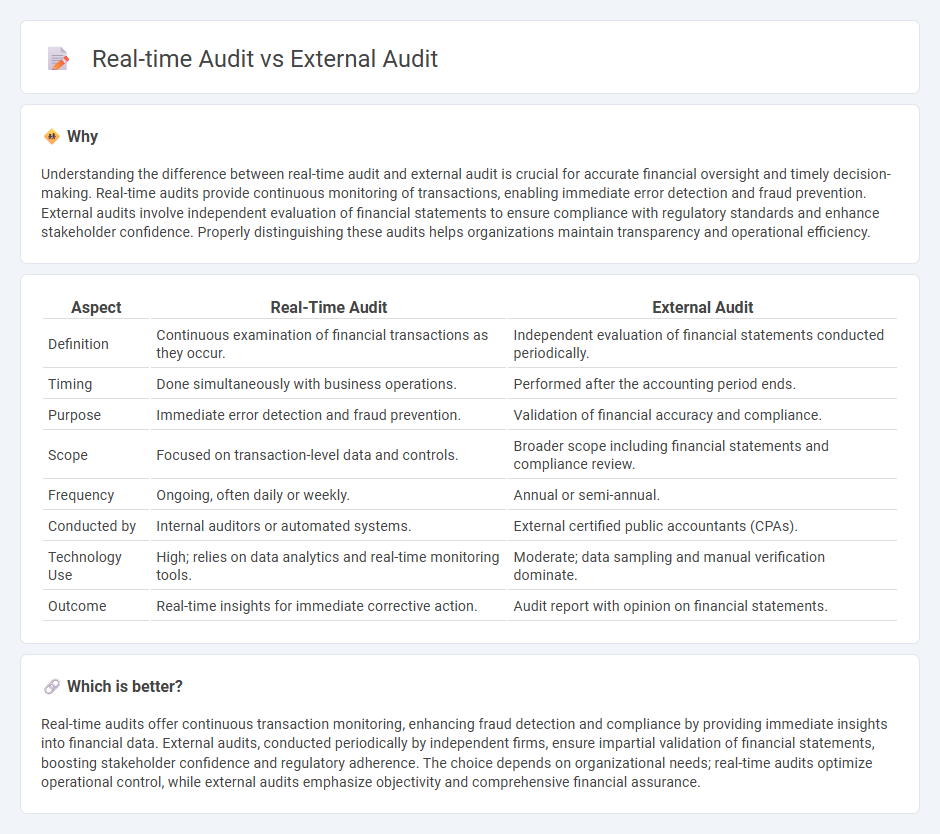

Understanding the difference between real-time audit and external audit is crucial for accurate financial oversight and timely decision-making. Real-time audits provide continuous monitoring of transactions, enabling immediate error detection and fraud prevention. External audits involve independent evaluation of financial statements to ensure compliance with regulatory standards and enhance stakeholder confidence. Properly distinguishing these audits helps organizations maintain transparency and operational efficiency.

Comparison Table

| Aspect | Real-Time Audit | External Audit |

|---|---|---|

| Definition | Continuous examination of financial transactions as they occur. | Independent evaluation of financial statements conducted periodically. |

| Timing | Done simultaneously with business operations. | Performed after the accounting period ends. |

| Purpose | Immediate error detection and fraud prevention. | Validation of financial accuracy and compliance. |

| Scope | Focused on transaction-level data and controls. | Broader scope including financial statements and compliance review. |

| Frequency | Ongoing, often daily or weekly. | Annual or semi-annual. |

| Conducted by | Internal auditors or automated systems. | External certified public accountants (CPAs). |

| Technology Use | High; relies on data analytics and real-time monitoring tools. | Moderate; data sampling and manual verification dominate. |

| Outcome | Real-time insights for immediate corrective action. | Audit report with opinion on financial statements. |

Which is better?

Real-time audits offer continuous transaction monitoring, enhancing fraud detection and compliance by providing immediate insights into financial data. External audits, conducted periodically by independent firms, ensure impartial validation of financial statements, boosting stakeholder confidence and regulatory adherence. The choice depends on organizational needs; real-time audits optimize operational control, while external audits emphasize objectivity and comprehensive financial assurance.

Connection

Real-time audit enhances external audit efficiency by providing continuous, up-to-date financial data, enabling auditors to detect discrepancies and risks promptly. This connection reduces the lag between transaction occurrence and audit review, improving the accuracy and reliability of external audit reports. Integrating real-time audit systems supports compliance with regulatory standards and fosters transparency in financial reporting.

Key Terms

Independence

External audits are conducted by independent third parties to ensure objectivity and impartiality in financial reporting, reinforcing corporate governance and stakeholder trust. Real-time audits involve continuous monitoring by internal or external auditors, which may challenge independence due to closer organizational involvement and potential conflicts of interest. Explore the key differences in independence between external and real-time audits to understand their impact on audit quality and reliability.

Continuous Monitoring

External audit evaluates financial statements periodically to ensure compliance with accounting standards, typically conducted annually or quarterly by independent auditors. Real-time audit emphasizes continuous monitoring through automated systems, enabling immediate detection of irregularities and enhancing risk management efficiency. Explore how continuous monitoring transforms audit processes and elevates organizational transparency.

Audit Trail

External audits rely on a comprehensive audit trail to verify historical financial records and ensure regulatory compliance, emphasizing accuracy and completeness over a defined period. Real-time audits utilize continuous monitoring and immediate data capture within the audit trail to detect discrepancies or fraud as transactions occur, enhancing immediate risk management. Explore the advantages and applications of audit trail technologies in both external and real-time audit processes for deeper insights.

Source and External Links

Understanding the Purpose and Benefits of External Audits - Concur - An external audit assesses the accuracy of financial reporting, evaluates internal controls, identifies risks, and provides detailed reports with recommendations to improve company compliance and decision-making.

External Audit vs. Internal Audit: What's the Difference? - Hilbert - External audits are independent reviews by certified accountants verifying the fairness and accuracy of financial statements for stakeholders, ensuring compliance with laws, and delivering an unbiased opinion.

External auditor - Wikipedia - An external auditor is an independent professional who performs audits of financial statements in accordance with laws and standards to provide unbiased reports for investors and the public, often mandated by legislation for public companies.

dowidth.com

dowidth.com