Cryptotax compliance requires specialized knowledge of digital asset transactions, distinct from traditional double-entry bookkeeping that tracks assets, liabilities, and equity with debits and credits. Accurate tax reporting for cryptocurrencies involves unique considerations such as capital gains, token swaps, and airdrops, which are not typically addressed by standard accounting methods. Explore how integrating cryptotax solutions with double-entry accounting can streamline your financial management and regulatory adherence.

Why it is important

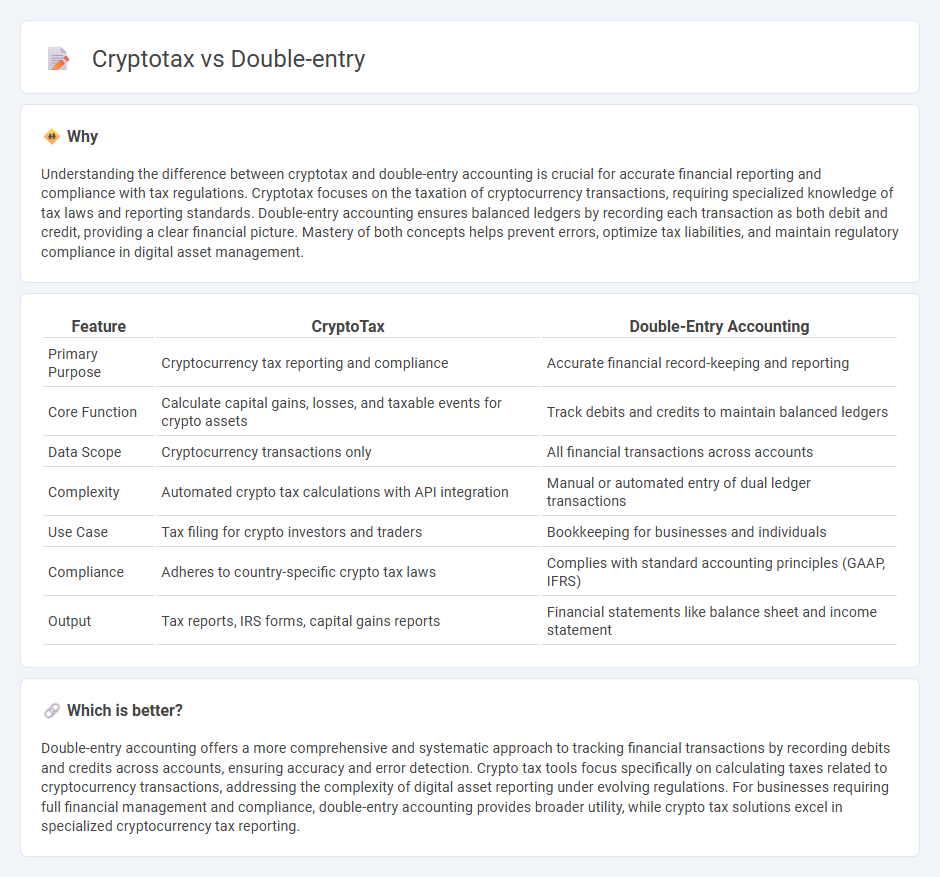

Understanding the difference between cryptotax and double-entry accounting is crucial for accurate financial reporting and compliance with tax regulations. Cryptotax focuses on the taxation of cryptocurrency transactions, requiring specialized knowledge of tax laws and reporting standards. Double-entry accounting ensures balanced ledgers by recording each transaction as both debit and credit, providing a clear financial picture. Mastery of both concepts helps prevent errors, optimize tax liabilities, and maintain regulatory compliance in digital asset management.

Comparison Table

| Feature | CryptoTax | Double-Entry Accounting |

|---|---|---|

| Primary Purpose | Cryptocurrency tax reporting and compliance | Accurate financial record-keeping and reporting |

| Core Function | Calculate capital gains, losses, and taxable events for crypto assets | Track debits and credits to maintain balanced ledgers |

| Data Scope | Cryptocurrency transactions only | All financial transactions across accounts |

| Complexity | Automated crypto tax calculations with API integration | Manual or automated entry of dual ledger transactions |

| Use Case | Tax filing for crypto investors and traders | Bookkeeping for businesses and individuals |

| Compliance | Adheres to country-specific crypto tax laws | Complies with standard accounting principles (GAAP, IFRS) |

| Output | Tax reports, IRS forms, capital gains reports | Financial statements like balance sheet and income statement |

Which is better?

Double-entry accounting offers a more comprehensive and systematic approach to tracking financial transactions by recording debits and credits across accounts, ensuring accuracy and error detection. Crypto tax tools focus specifically on calculating taxes related to cryptocurrency transactions, addressing the complexity of digital asset reporting under evolving regulations. For businesses requiring full financial management and compliance, double-entry accounting provides broader utility, while crypto tax solutions excel in specialized cryptocurrency tax reporting.

Connection

Cryptotax compliance relies heavily on double-entry accounting to accurately track cryptocurrency transactions, ensuring each debit and credit entry reflects real-time changes in asset holdings and tax liabilities. Double-entry accounting provides a detailed ledger system that captures every buy, sell, transfer, or exchange of crypto assets, facilitating precise capital gains calculations and minimizing errors during tax reporting. Maintaining this systematic record supports adherence to regulatory requirements and simplifies audits by providing transparent and verifiable transaction histories.

Key Terms

Ledger

Ledger's double-entry bookkeeping system ensures accurate tracking of every cryptocurrency transaction by recording debits and credits, providing transparency and reducing errors in tax reporting. This method aligns with cryptotax requirements by offering clear audit trails and facilitating compliance with regulatory standards. Explore how Ledger's approach simplifies your cryptocurrency tax management for more detailed insights.

Blockchain

Double-entry bookkeeping provides a systematic method to record all transactions on the blockchain, ensuring transparency and accuracy in crypto asset tracking. CryptoTax solutions leverage blockchain data to automate tax calculations, aligning with regulatory compliance and simplifying reporting for digital asset holders. Explore how integrating blockchain technology optimizes both accounting accuracy and tax management in the cryptocurrency ecosystem.

Tax Reporting

Double-entry accounting ensures precise financial records by logging each transaction in two accounts, which improves accuracy in tax reporting and reconciliations. Cryptotax software automates tax calculations by integrating cryptocurrency transaction data, simplifying the reporting process and compliance with tax regulations. Explore how combining double-entry systems with cryptotax solutions can enhance the efficiency of your tax reporting.

Source and External Links

Double-Entry Accounting: The Complete Guide for Businesses - Fyle - Double-entry accounting is a system where each financial transaction is recorded twice, as a debit and a credit in two separate accounts, providing accuracy and preventing errors or fraud.

Double Entry - Overview, History, How It Works, Example - This bookkeeping method requires every debit entry in one account to be matched by a credit entry in another, balancing the accounting equation and tracing back its origins to Italian merchants in the 13th and 14th centuries.

double-entry accounting | Wex - Law.Cornell.Edu - Double-entry accounting records all business transactions as both debits and credits in two accounts, ensuring the equation assets = liabilities + equity remains balanced and making errors easier to detect.

dowidth.com

dowidth.com