Fractional ownership platforms allow buyers to purchase a defined share of a property, granting them increased control, equity growth potential, and flexible usage compared to traditional timeshares, which offer limited usage rights without property equity. Unlike timeshares, fractional ownership typically involves joint ownership with legal title, enabling investors to benefit from property appreciation and rental income. Explore the advantages of fractional ownership platforms to understand how they can enhance your real estate investment strategy.

Why it is important

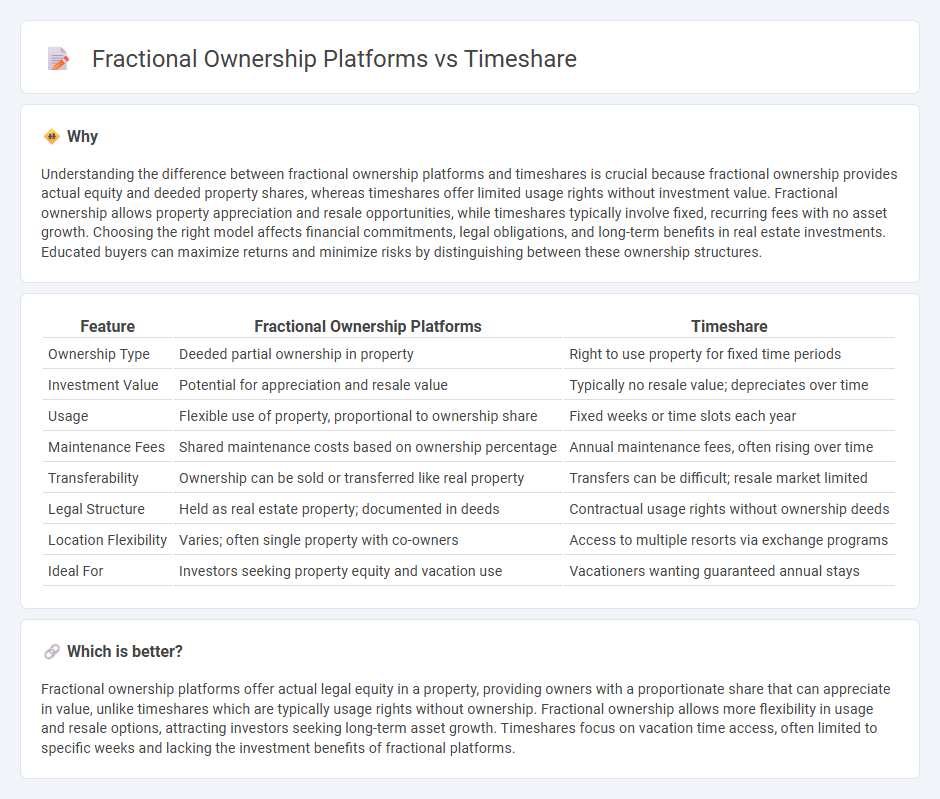

Understanding the difference between fractional ownership platforms and timeshares is crucial because fractional ownership provides actual equity and deeded property shares, whereas timeshares offer limited usage rights without investment value. Fractional ownership allows property appreciation and resale opportunities, while timeshares typically involve fixed, recurring fees with no asset growth. Choosing the right model affects financial commitments, legal obligations, and long-term benefits in real estate investments. Educated buyers can maximize returns and minimize risks by distinguishing between these ownership structures.

Comparison Table

| Feature | Fractional Ownership Platforms | Timeshare |

|---|---|---|

| Ownership Type | Deeded partial ownership in property | Right to use property for fixed time periods |

| Investment Value | Potential for appreciation and resale value | Typically no resale value; depreciates over time |

| Usage | Flexible use of property, proportional to ownership share | Fixed weeks or time slots each year |

| Maintenance Fees | Shared maintenance costs based on ownership percentage | Annual maintenance fees, often rising over time |

| Transferability | Ownership can be sold or transferred like real property | Transfers can be difficult; resale market limited |

| Legal Structure | Held as real estate property; documented in deeds | Contractual usage rights without ownership deeds |

| Location Flexibility | Varies; often single property with co-owners | Access to multiple resorts via exchange programs |

| Ideal For | Investors seeking property equity and vacation use | Vacationers wanting guaranteed annual stays |

Which is better?

Fractional ownership platforms offer actual legal equity in a property, providing owners with a proportionate share that can appreciate in value, unlike timeshares which are typically usage rights without ownership. Fractional ownership allows more flexibility in usage and resale options, attracting investors seeking long-term asset growth. Timeshares focus on vacation time access, often limited to specific weeks and lacking the investment benefits of fractional platforms.

Connection

Fractional ownership platforms and timeshare both enable multiple parties to share rights to a property, reducing individual costs and increasing access to high-value real estate. Fractional ownership typically grants equity stakes and longer usage periods, while timeshares often involve fixed or floating weeks without equity interest. Both models leverage digital platforms to streamline transaction processes, property management, and resale opportunities, enhancing liquidity and user experience in the real estate market.

Key Terms

Usage Rights

Timeshare platforms offer buyers fixed or floating weeks, granting limited usage rights primarily for vacation stays, which can restrict flexibility and resale value. Fractional ownership platforms provide proportional equity shares, enabling extended usage rights, greater control, and potential financial returns through property appreciation. Explore our detailed comparison to understand which option aligns best with your vacation and investment goals.

Deeded Ownership

Deeded ownership in timeshares and fractional ownership platforms provides buyers with legally recognized property rights, ensuring long-term investment security and transferable ownership. Timeshare platforms typically offer fixed or floating week intervals, while fractional ownership platforms grant a percentage interest in the entire property, often with enhanced usage flexibility and potential for higher property appreciation. Explore the key differences and benefits of deeded ownership in these models to make informed investment decisions.

Exchange Programs

Timeshare platforms offer fixed-week or floating-week exchange programs within a network of affiliated resorts, enabling owners to trade their allotted time for different destinations and seasons. Fractional ownership platforms provide more exclusive exchange options, often involving higher-end properties with longer-term stays and equity participation, enhancing investment flexibility. Explore the nuances of timeshare and fractional ownership exchange programs to determine the best fit for your vacation and investment goals.

Source and External Links

What is a timeshare and how does it work? - Wise - A timeshare is a vacation property ownership model where multiple buyers share the same property, each entitled to use it for a specific time every year, usually 1 or 2 weeks, and owners pay an upfront purchase price plus yearly maintenance fees; common models include fixed week, floating week, and points-based systems.

Timeshares, Vacation Clubs, and Related Scams | Consumer Advice - Timeshares offer the right to use a vacation property for a specific period and may be deeded (owned as real property) or points-based, but consumers should beware of pressure sales tactics and ongoing maintenance fees, and understand timeshares are generally a vacation use asset rather than an investment.

Timeshare - Wikipedia - Timeshares originated in the 1960s in the UK as divided vacation property ownership, evolving from family-shared seasonal vacation homes, with the first US timeshare starting in 1974 offering a vacation license model in the Virgin Islands.

dowidth.com

dowidth.com