Green leases focus on sustainability by allocating responsibilities for energy efficiency and environmental performance between landlords and tenants, promoting reduced utility costs and lower carbon footprints. Absolute net leases impose full financial responsibility on tenants for property expenses, including taxes, insurance, and maintenance, offering landlords predictable income with minimal management duties. Explore the key differences and benefits of green leases versus absolute net leases to optimize your real estate investments.

Why it is important

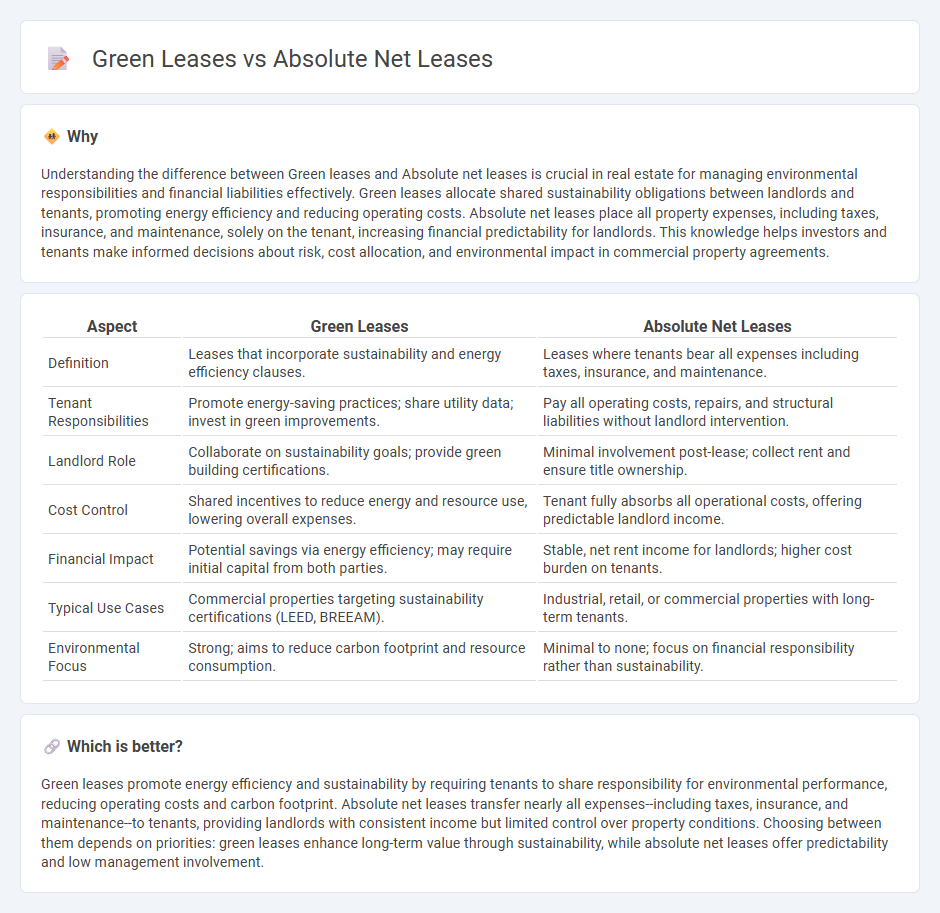

Understanding the difference between Green leases and Absolute net leases is crucial in real estate for managing environmental responsibilities and financial liabilities effectively. Green leases allocate shared sustainability obligations between landlords and tenants, promoting energy efficiency and reducing operating costs. Absolute net leases place all property expenses, including taxes, insurance, and maintenance, solely on the tenant, increasing financial predictability for landlords. This knowledge helps investors and tenants make informed decisions about risk, cost allocation, and environmental impact in commercial property agreements.

Comparison Table

| Aspect | Green Leases | Absolute Net Leases |

|---|---|---|

| Definition | Leases that incorporate sustainability and energy efficiency clauses. | Leases where tenants bear all expenses including taxes, insurance, and maintenance. |

| Tenant Responsibilities | Promote energy-saving practices; share utility data; invest in green improvements. | Pay all operating costs, repairs, and structural liabilities without landlord intervention. |

| Landlord Role | Collaborate on sustainability goals; provide green building certifications. | Minimal involvement post-lease; collect rent and ensure title ownership. |

| Cost Control | Shared incentives to reduce energy and resource use, lowering overall expenses. | Tenant fully absorbs all operational costs, offering predictable landlord income. |

| Financial Impact | Potential savings via energy efficiency; may require initial capital from both parties. | Stable, net rent income for landlords; higher cost burden on tenants. |

| Typical Use Cases | Commercial properties targeting sustainability certifications (LEED, BREEAM). | Industrial, retail, or commercial properties with long-term tenants. |

| Environmental Focus | Strong; aims to reduce carbon footprint and resource consumption. | Minimal to none; focus on financial responsibility rather than sustainability. |

Which is better?

Green leases promote energy efficiency and sustainability by requiring tenants to share responsibility for environmental performance, reducing operating costs and carbon footprint. Absolute net leases transfer nearly all expenses--including taxes, insurance, and maintenance--to tenants, providing landlords with consistent income but limited control over property conditions. Choosing between them depends on priorities: green leases enhance long-term value through sustainability, while absolute net leases offer predictability and low management involvement.

Connection

Green leases and absolute net leases intersect in commercial real estate by aligning tenant and landlord responsibilities with sustainability goals while allocating operational costs. Both lease types influence energy efficiency and environmental performance, as green leases mandate sustainable building practices and shared utility cost savings, whereas absolute net leases place full expense burdens on tenants, incentivizing efficient resource use. Integrating green provisions in absolute net leases fosters collaboration to reduce environmental impact and optimize long-term value in real estate investments.

Key Terms

Operating Expenses

Absolute net leases require tenants to cover all operating expenses, including property taxes, insurance, and maintenance, providing landlords with predictable net income and minimal financial responsibility. Green leases integrate sustainability measures by allocating operating expenses based on energy use and environmental impact, encouraging tenants and landlords to collaborate on reducing carbon footprints and improving building efficiency. Explore how these lease structures influence operating costs and tenant-landlord relationships in commercial real estate.

Sustainability Clauses

Absolute net leases place full responsibility for property expenses, including sustainability upgrades and energy efficiency improvements, on tenants, ensuring clear cost allocation but limited landlord involvement. Green leases incorporate specific sustainability clauses that promote energy conservation, waste reduction, and eco-friendly operations, encouraging collaborative efforts between landlords and tenants to meet environmental goals. Explore how integrating sustainability clauses in lease agreements can optimize financial and ecological benefits for all stakeholders.

Maintenance Responsibility

Absolute net leases transfer full maintenance responsibility to tenants, including structural repairs, property taxes, and insurance, ensuring landlords face minimal financial obligations. Green leases incorporate maintenance responsibilities that emphasize sustainable practices, requiring tenants and landlords to collaborate on energy efficiency, waste reduction, and environmentally friendly property management. Discover detailed insights on balancing maintenance duties and sustainability in lease agreements.

Source and External Links

Understanding the Absolute Net Lease in Commercial Real Estate - An absolute net lease is a commercial real estate agreement where the tenant assumes all financial responsibilities, including property taxes, insurance, maintenance, and structural repairs.

What is Absolute Net Lease in Commercial Real Estate - In an absolute net lease, the tenant takes on all property expenses without exceptions, including real estate taxes, insurance, maintenance, and major repairs.

What is an absolute net lease in real estate - An absolute net lease requires the tenant to cover all property-related expenses, including taxes, insurance, maintenance, and major repairs like roof and structural issues.

dowidth.com

dowidth.com