Short-term rental arbitrage involves leasing a property and subletting it on platforms like Airbnb to generate higher rental income without owning the asset. Lease option combines leasing with the contractual right to purchase the property later, offering potential equity gain and long-term investment security. Explore more to understand which strategy aligns best with your real estate investment goals.

Why it is important

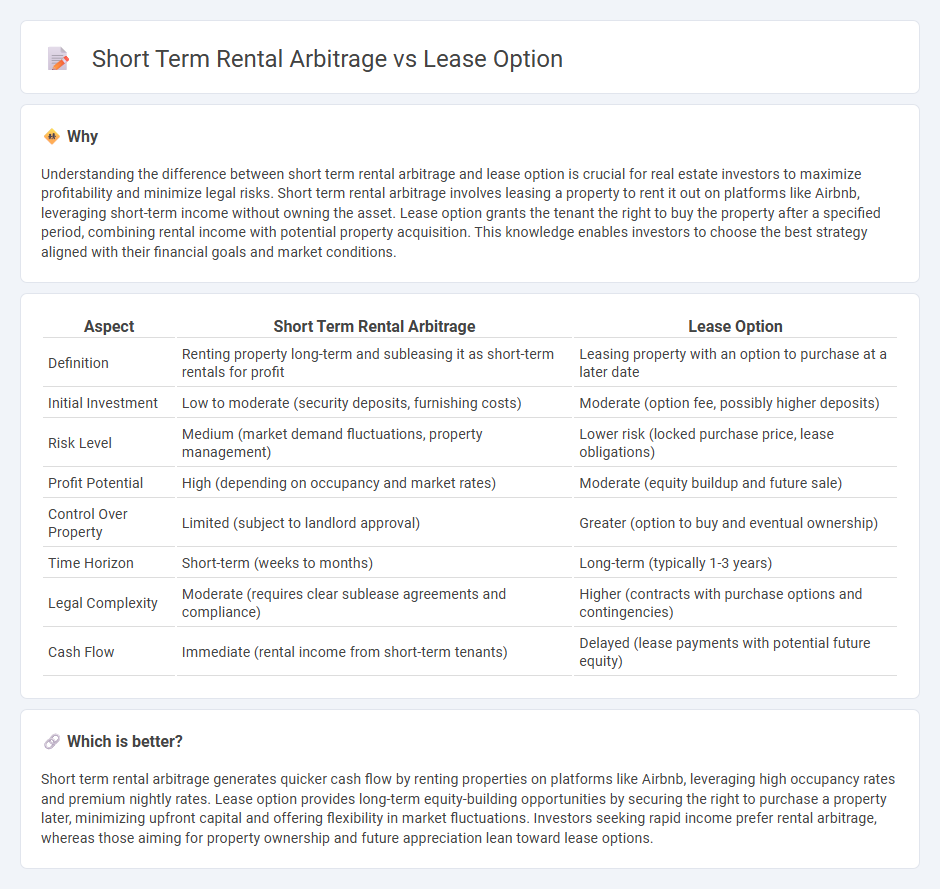

Understanding the difference between short term rental arbitrage and lease option is crucial for real estate investors to maximize profitability and minimize legal risks. Short term rental arbitrage involves leasing a property to rent it out on platforms like Airbnb, leveraging short-term income without owning the asset. Lease option grants the tenant the right to buy the property after a specified period, combining rental income with potential property acquisition. This knowledge enables investors to choose the best strategy aligned with their financial goals and market conditions.

Comparison Table

| Aspect | Short Term Rental Arbitrage | Lease Option |

|---|---|---|

| Definition | Renting property long-term and subleasing it as short-term rentals for profit | Leasing property with an option to purchase at a later date |

| Initial Investment | Low to moderate (security deposits, furnishing costs) | Moderate (option fee, possibly higher deposits) |

| Risk Level | Medium (market demand fluctuations, property management) | Lower risk (locked purchase price, lease obligations) |

| Profit Potential | High (depending on occupancy and market rates) | Moderate (equity buildup and future sale) |

| Control Over Property | Limited (subject to landlord approval) | Greater (option to buy and eventual ownership) |

| Time Horizon | Short-term (weeks to months) | Long-term (typically 1-3 years) |

| Legal Complexity | Moderate (requires clear sublease agreements and compliance) | Higher (contracts with purchase options and contingencies) |

| Cash Flow | Immediate (rental income from short-term tenants) | Delayed (lease payments with potential future equity) |

Which is better?

Short term rental arbitrage generates quicker cash flow by renting properties on platforms like Airbnb, leveraging high occupancy rates and premium nightly rates. Lease option provides long-term equity-building opportunities by securing the right to purchase a property later, minimizing upfront capital and offering flexibility in market fluctuations. Investors seeking rapid income prefer rental arbitrage, whereas those aiming for property ownership and future appreciation lean toward lease options.

Connection

Short term rental arbitrage leverages lease options by securing property control without ownership, allowing renters to sublease for profit while minimizing upfront investment. Lease option agreements grant tenants the right to lease with an option to purchase, providing flexibility and potential property appreciation benefits. Combining these strategies enables real estate investors to optimize cash flow and portfolio growth with reduced financial risk.

Key Terms

Purchase Option

Lease option agreements provide tenants with the right to purchase the property after a specified lease period, combining rental income with potential equity gain, unlike short term rental arbitrage which primarily capitalizes on rental income without ownership benefits. Purchase options in lease agreements offer flexibility for tenants to lock in a future buying price, creating opportunities for investment and control that short term rental arbitrage lacks. Explore detailed comparisons to understand how a lease option can strategically benefit your real estate investment portfolio.

Master Lease

Master lease agreements enable investors to control entire properties by leasing them from owners and relisting units to tenants, providing predictable cash flow and reduced risk compared to traditional lease options. Unlike short-term rental arbitrage, master leases often involve longer contract terms and greater operational control, allowing for optimized property management and income stability. Explore the advantages and practical applications of master leases to maximize real estate investment returns.

Cash Flow

Lease option agreements offer buyers the opportunity to control property with lower upfront costs and potential equity gain, enhancing cash flow through rental income and eventual property purchase. Short-term rental arbitrage leverages leasing an entire property to rent it out on platforms like Airbnb, often generating higher cash flow due to premium nightly rates despite higher turnover costs. Explore detailed strategies and financial models to optimize cash flow in lease options versus short-term rental arbitrage.

Source and External Links

Lease Option: Definition and How It Works - A lease option is a clause in a rental agreement that allows the tenant to buy the property at the end of the lease.

Lease-Option Purchases - Lease-option purchases, also known as rent-to-own agreements, allow tenants to lease a property with the option to purchase it after a specified period.

Lease-Option - A lease option is a type of contract that allows a tenant to purchase a property at the end of a rental period, but does not bind them to do so.

dowidth.com

dowidth.com