Wellness real estate focuses on sustainable, health-enhancing environments designed to improve occupant well-being through features such as natural light, air quality, and green spaces. Commercial real estate involves properties used for business purposes, including office buildings, retail centers, and industrial spaces, emphasizing location, accessibility, and economic return. Explore the unique benefits and investment opportunities within wellness and commercial real estate sectors to make informed decisions.

Why it is important

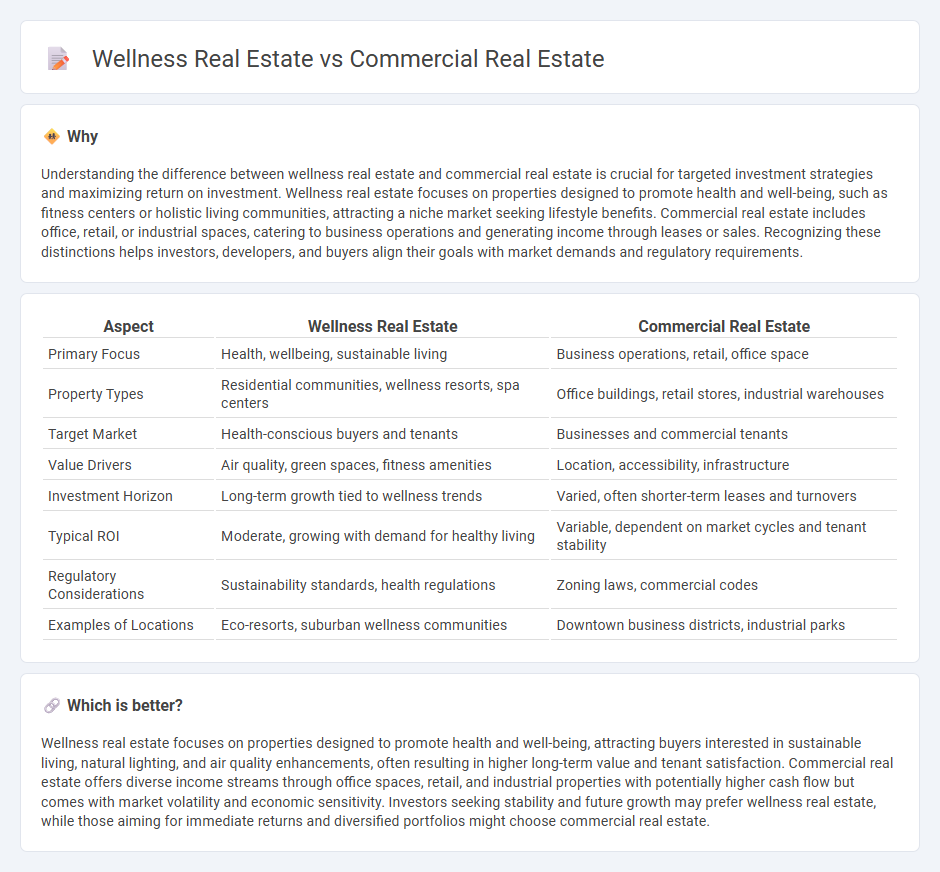

Understanding the difference between wellness real estate and commercial real estate is crucial for targeted investment strategies and maximizing return on investment. Wellness real estate focuses on properties designed to promote health and well-being, such as fitness centers or holistic living communities, attracting a niche market seeking lifestyle benefits. Commercial real estate includes office, retail, or industrial spaces, catering to business operations and generating income through leases or sales. Recognizing these distinctions helps investors, developers, and buyers align their goals with market demands and regulatory requirements.

Comparison Table

| Aspect | Wellness Real Estate | Commercial Real Estate |

|---|---|---|

| Primary Focus | Health, wellbeing, sustainable living | Business operations, retail, office space |

| Property Types | Residential communities, wellness resorts, spa centers | Office buildings, retail stores, industrial warehouses |

| Target Market | Health-conscious buyers and tenants | Businesses and commercial tenants |

| Value Drivers | Air quality, green spaces, fitness amenities | Location, accessibility, infrastructure |

| Investment Horizon | Long-term growth tied to wellness trends | Varied, often shorter-term leases and turnovers |

| Typical ROI | Moderate, growing with demand for healthy living | Variable, dependent on market cycles and tenant stability |

| Regulatory Considerations | Sustainability standards, health regulations | Zoning laws, commercial codes |

| Examples of Locations | Eco-resorts, suburban wellness communities | Downtown business districts, industrial parks |

Which is better?

Wellness real estate focuses on properties designed to promote health and well-being, attracting buyers interested in sustainable living, natural lighting, and air quality enhancements, often resulting in higher long-term value and tenant satisfaction. Commercial real estate offers diverse income streams through office spaces, retail, and industrial properties with potentially higher cash flow but comes with market volatility and economic sensitivity. Investors seeking stability and future growth may prefer wellness real estate, while those aiming for immediate returns and diversified portfolios might choose commercial real estate.

Connection

Wellness real estate integrates health-focused features such as air quality, natural light, and fitness amenities, enhancing occupant well-being and productivity in commercial real estate settings. This connection drives demand for healthier work environments, influencing commercial property design and leasing strategies. Market trends show investors prioritizing wellness-certified commercial spaces due to higher tenant satisfaction and long-term value retention.

Key Terms

Commercial Real Estate:

Commercial real estate encompasses properties used for business purposes, including office buildings, retail spaces, warehouses, and industrial buildings, driving economic activity and investment opportunities. This sector is characterized by its diverse market demand, long-term leases, and potential for significant rental income and capital appreciation. Explore deeper insights into commercial real estate market trends, investment strategies, and growth potential.

Lease Agreement

Lease agreements in commercial real estate typically emphasize long-term occupancy, high rental rates, and tenant responsibilities for maintenance and utilities. In wellness real estate, leases often include clauses tailored to health-focused businesses, such as spa operations or fitness centers, emphasizing flexible terms and compliance with wellness industry standards. Explore detailed lease agreement structures to maximize benefits in each sector.

Cap Rate

Commercial real estate often exhibits cap rates ranging between 4% and 10%, influenced by location, property type, and tenant stability. Wellness real estate, a growing niche, tends to have slightly lower cap rates around 5% to 8% due to its specialized focus on health-oriented facilities such as fitness centers, medical offices, and wellness resorts. Explore the nuances of cap rates in these sectors to make informed investment decisions.

Source and External Links

Harwich, MA Commercial Real Estate for Sale | Crexi.com - Comprehensive listings of commercial properties for sale in Harwich, MA, including retail, office, and multifamily options with photos and broker contact details.

Cape Cod, MA Commercial Real Estate for Lease and Sale - PropertyShark provides a searchable database of 28 commercial properties for lease and sale across Cape Cod, covering offices, retail, and industrial spaces.

Harwich, MA Commercial Real Estate for Lease - LoopNet - Features 8 commercial properties for rent in Harwich, with details on average building size and availability.

dowidth.com

dowidth.com