Escrow crowdfunding and land banking represent two distinct real estate investment strategies focused on asset security and long-term value appreciation. Escrow crowdfunding pools funds from multiple investors into a secure escrow account, facilitating transparent property transactions with minimized risk. Explore these innovative approaches to optimize your real estate portfolio and investment potential.

Why it is important

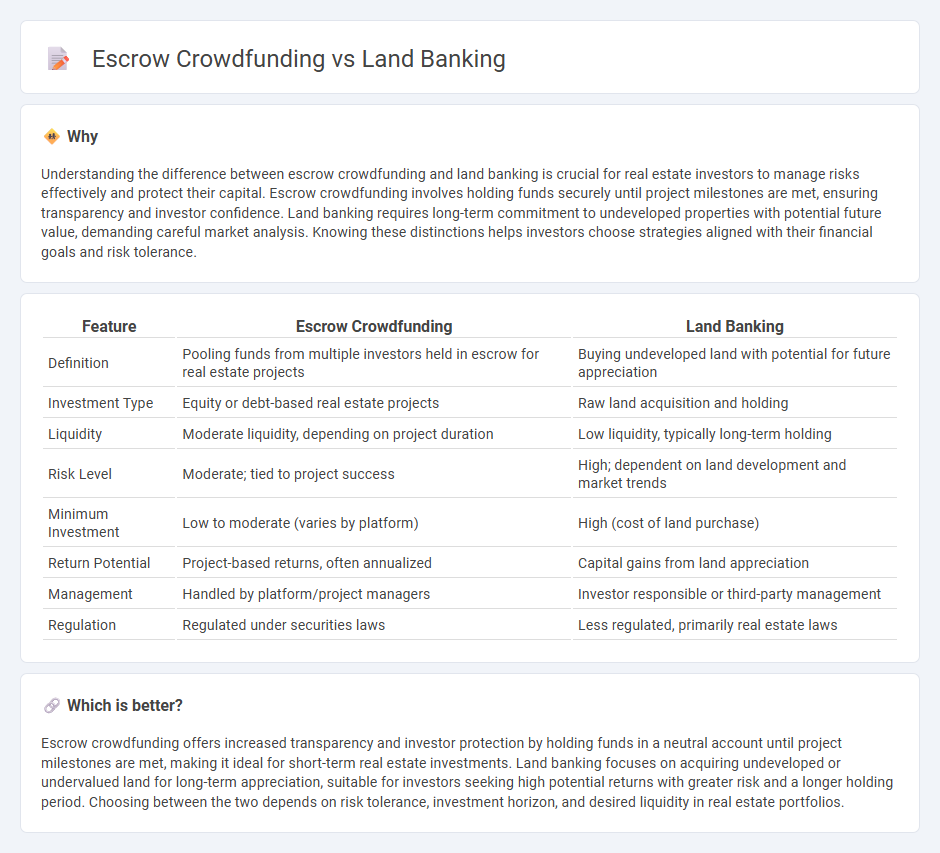

Understanding the difference between escrow crowdfunding and land banking is crucial for real estate investors to manage risks effectively and protect their capital. Escrow crowdfunding involves holding funds securely until project milestones are met, ensuring transparency and investor confidence. Land banking requires long-term commitment to undeveloped properties with potential future value, demanding careful market analysis. Knowing these distinctions helps investors choose strategies aligned with their financial goals and risk tolerance.

Comparison Table

| Feature | Escrow Crowdfunding | Land Banking |

|---|---|---|

| Definition | Pooling funds from multiple investors held in escrow for real estate projects | Buying undeveloped land with potential for future appreciation |

| Investment Type | Equity or debt-based real estate projects | Raw land acquisition and holding |

| Liquidity | Moderate liquidity, depending on project duration | Low liquidity, typically long-term holding |

| Risk Level | Moderate; tied to project success | High; dependent on land development and market trends |

| Minimum Investment | Low to moderate (varies by platform) | High (cost of land purchase) |

| Return Potential | Project-based returns, often annualized | Capital gains from land appreciation |

| Management | Handled by platform/project managers | Investor responsible or third-party management |

| Regulation | Regulated under securities laws | Less regulated, primarily real estate laws |

Which is better?

Escrow crowdfunding offers increased transparency and investor protection by holding funds in a neutral account until project milestones are met, making it ideal for short-term real estate investments. Land banking focuses on acquiring undeveloped or undervalued land for long-term appreciation, suitable for investors seeking high potential returns with greater risk and a longer holding period. Choosing between the two depends on risk tolerance, investment horizon, and desired liquidity in real estate portfolios.

Connection

Escrow crowdfunding and land banking intersect in real estate by providing secure investment frameworks for pooling funds to acquire and hold undeveloped land parcels. Escrow services ensure transparent transaction management by safeguarding investor capital until project milestones are met, while land banking enables strategic property accumulation for future development or resale. This synergy supports collective investment approaches, mitigating risks and maximizing returns in long-term real estate ventures.

Key Terms

**Land Banking:**

Land banking involves purchasing undeveloped land with the expectation of future appreciation, offering investors a long-term investment avenue with potential high returns. This strategy contrasts with escrow crowdfunding, where multiple investors pool funds via an escrow account to finance specific projects, typically involving less risk and shorter timelines. Explore more about how land banking can build wealth through strategic real estate investments.

Appreciation

Land banking investments often capitalize on long-term appreciation as undeveloped properties increase in value over time due to urban expansion and infrastructure development. Escrow crowdfunding, meanwhile, provides a secure, intermediate holding of funds during a property transaction, ensuring investor protection but less direct impact on property appreciation. Explore deeper insights into how appreciation drives returns differently in land banking and escrow crowdfunding models.

Zoning

Land banking involves purchasing and holding undeveloped land anticipating future zoning changes that increase its value, while escrow crowdfunding pools investor funds to acquire land with specific zoning goals confirmed before investment. Zoning regulations directly impact land use, influencing the potential return on investment for land banking by allowing rezoning from agricultural to residential or commercial purposes. Explore our detailed comparison to understand how zoning considerations affect risk and profitability in land banking versus escrow crowdfunding models.

Source and External Links

Land Banking: A Sound Approach to Residential Real Estate - This webpage discusses land banking as a strategy involving private credit vehicles to manage and develop land, benefiting both land bankers and developers.

Land Banking - Land banking is the practice of aggregating parcels of land for future sale or development, involving both private investment schemes and quasi-governmental entities like municipal land banks.

Land Banking - This webpage describes land banking as a process to protect and preserve land until development aligns with community goals, often involving local governments and nonprofit entities in Colorado.

dowidth.com

dowidth.com