Micro-flipping in real estate involves quickly buying and selling properties for a small profit margin, capitalizing on market trends and minor renovations. Lease options allow tenants to rent a property with the option to purchase it later, providing flexibility and potential equity buildup. Explore these strategies to determine which suits your investment goals and market conditions.

Why it is important

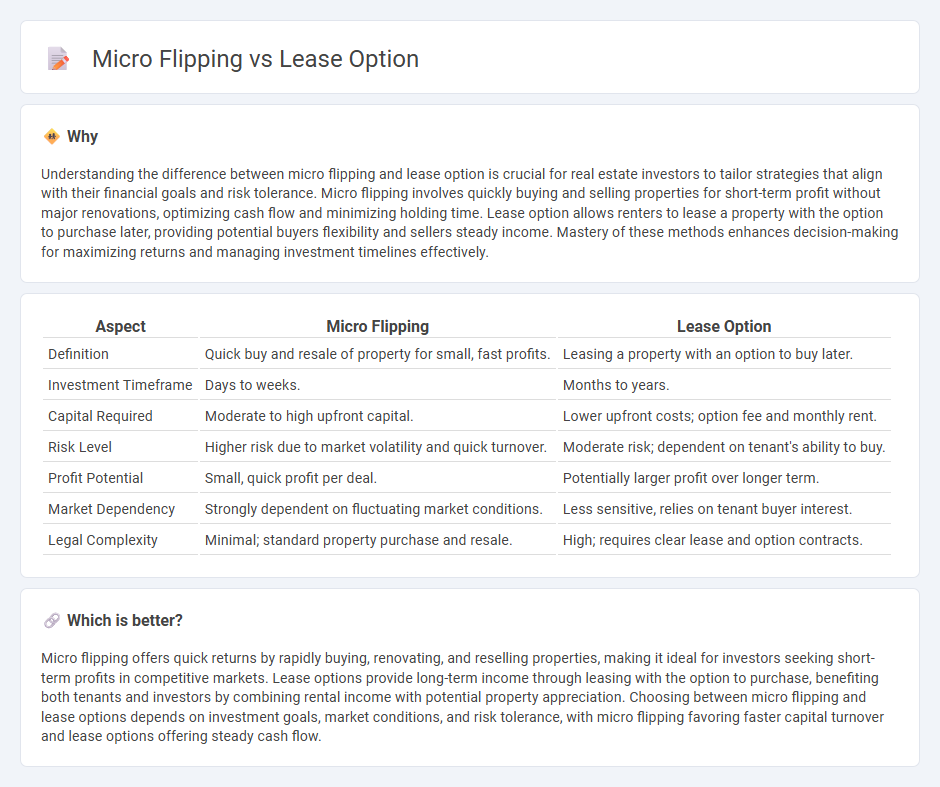

Understanding the difference between micro flipping and lease option is crucial for real estate investors to tailor strategies that align with their financial goals and risk tolerance. Micro flipping involves quickly buying and selling properties for short-term profit without major renovations, optimizing cash flow and minimizing holding time. Lease option allows renters to lease a property with the option to purchase later, providing potential buyers flexibility and sellers steady income. Mastery of these methods enhances decision-making for maximizing returns and managing investment timelines effectively.

Comparison Table

| Aspect | Micro Flipping | Lease Option |

|---|---|---|

| Definition | Quick buy and resale of property for small, fast profits. | Leasing a property with an option to buy later. |

| Investment Timeframe | Days to weeks. | Months to years. |

| Capital Required | Moderate to high upfront capital. | Lower upfront costs; option fee and monthly rent. |

| Risk Level | Higher risk due to market volatility and quick turnover. | Moderate risk; dependent on tenant's ability to buy. |

| Profit Potential | Small, quick profit per deal. | Potentially larger profit over longer term. |

| Market Dependency | Strongly dependent on fluctuating market conditions. | Less sensitive, relies on tenant buyer interest. |

| Legal Complexity | Minimal; standard property purchase and resale. | High; requires clear lease and option contracts. |

Which is better?

Micro flipping offers quick returns by rapidly buying, renovating, and reselling properties, making it ideal for investors seeking short-term profits in competitive markets. Lease options provide long-term income through leasing with the option to purchase, benefiting both tenants and investors by combining rental income with potential property appreciation. Choosing between micro flipping and lease options depends on investment goals, market conditions, and risk tolerance, with micro flipping favoring faster capital turnover and lease options offering steady cash flow.

Connection

Micro flipping and lease options are connected through their shared focus on maximizing real estate investment returns with minimal upfront capital. Micro flipping involves quickly buying and selling properties for a small profit margin, often leveraging lease options to control properties without full ownership. Lease options provide investors with the right to lease a property with an option to purchase, enabling strategic flexibility in micro flipping by minimizing risk and enhancing cash flow opportunities.

Key Terms

Purchase Agreement

A lease option involves a Purchase Agreement granting the tenant the right, but not the obligation, to buy the property within a specified time, often including a portion of rent applied to the purchase price. Micro flipping uses Purchase Agreements to quickly assign property rights to another buyer for a profit, typically without extensive renovations or holding periods. Explore further details on how Purchase Agreements function uniquely in both strategies to maximize investment potential.

Assignment Fee

Lease option and micro flipping both offer unique ways to generate income through real estate without full property ownership, but they differ significantly in their approach to assignment fees. Lease options typically involve a tenant-buyer paying an upfront option fee, which the seller assigns to another buyer through an assignment fee; this fee can vary widely based on the property and market conditions but often ranges from $1,000 to $5,000. Explore the detailed mechanics and profit potentials of assignment fees in lease options versus micro flipping to enhance your investment strategy.

Option to Buy

Option to Buy in lease options grants tenants the right to purchase the property at a predetermined price within a specific timeframe, providing flexibility and potential equity gain without immediate full ownership. Micro flipping involves acquiring properties through quick transactions, often leveraging minimal capital and short-term holding strategies to secure rapid profits from market appreciation or improvements. Explore the advantages and practical applications of Option to Buy in lease options to enhance your real estate investment strategy.

Source and External Links

Lease option: Definition and how it works - Rocket Mortgage - A lease option is a rental agreement clause allowing tenants to rent a home with the option to buy it at lease end, typically requiring an upfront option fee and possibly rent credits toward the purchase price, giving tenants flexibility to buy or walk away.

Lease-Option Purchases - National Association of REALTORS(r) - This agreement lets tenants lease a property while paying an option fee for the right to purchase it later, often locking in a future buy price and crediting part of the rent toward the purchase.

Lease-option - Wikipedia - A lease option contract provides tenants the choice to purchase the property after a rental period, differing from lease purchases which bind both parties to complete the sale.

dowidth.com

dowidth.com