Smart contracts leverage blockchain technology to automate and secure real estate transactions by eliminating intermediaries and reducing processing time. Escrow services provide a trusted third party to hold funds and documents during the transaction, ensuring compliance and protection for buyers and sellers. Explore the advantages and differences between smart contracts and escrow services in real estate to make informed decisions.

Why it is important

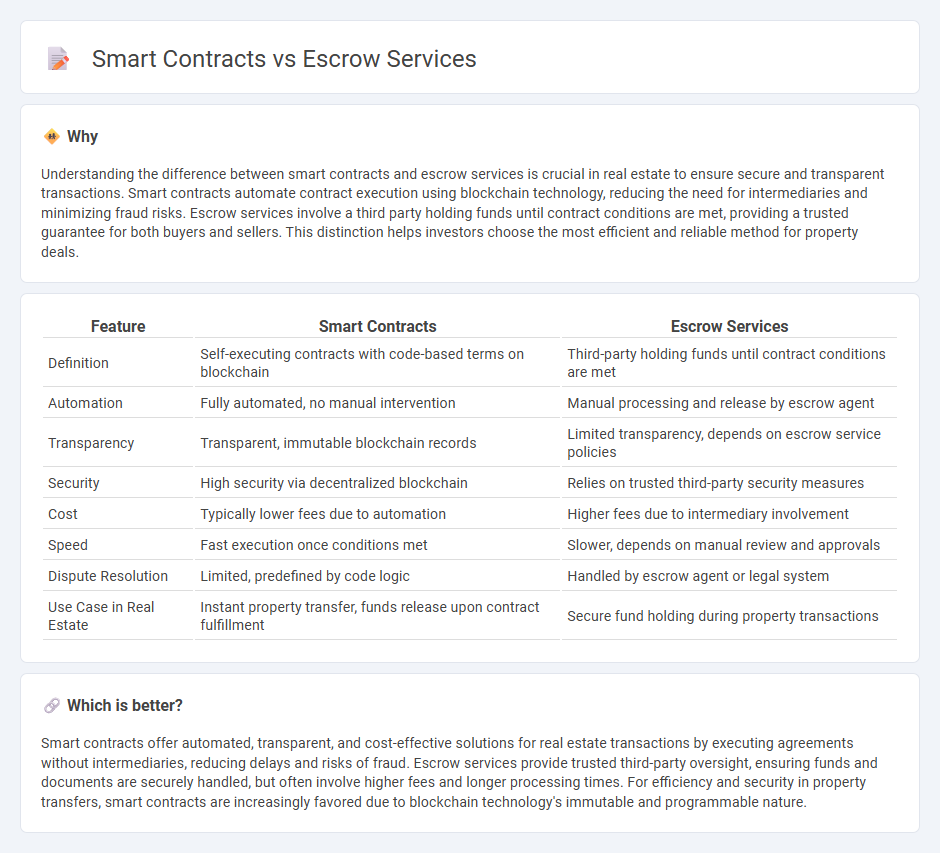

Understanding the difference between smart contracts and escrow services is crucial in real estate to ensure secure and transparent transactions. Smart contracts automate contract execution using blockchain technology, reducing the need for intermediaries and minimizing fraud risks. Escrow services involve a third party holding funds until contract conditions are met, providing a trusted guarantee for both buyers and sellers. This distinction helps investors choose the most efficient and reliable method for property deals.

Comparison Table

| Feature | Smart Contracts | Escrow Services |

|---|---|---|

| Definition | Self-executing contracts with code-based terms on blockchain | Third-party holding funds until contract conditions are met |

| Automation | Fully automated, no manual intervention | Manual processing and release by escrow agent |

| Transparency | Transparent, immutable blockchain records | Limited transparency, depends on escrow service policies |

| Security | High security via decentralized blockchain | Relies on trusted third-party security measures |

| Cost | Typically lower fees due to automation | Higher fees due to intermediary involvement |

| Speed | Fast execution once conditions met | Slower, depends on manual review and approvals |

| Dispute Resolution | Limited, predefined by code logic | Handled by escrow agent or legal system |

| Use Case in Real Estate | Instant property transfer, funds release upon contract fulfillment | Secure fund holding during property transactions |

Which is better?

Smart contracts offer automated, transparent, and cost-effective solutions for real estate transactions by executing agreements without intermediaries, reducing delays and risks of fraud. Escrow services provide trusted third-party oversight, ensuring funds and documents are securely handled, but often involve higher fees and longer processing times. For efficiency and security in property transfers, smart contracts are increasingly favored due to blockchain technology's immutable and programmable nature.

Connection

Smart contracts streamline real estate transactions by automatically executing agreements when predefined conditions are met, reducing the need for intermediaries. Escrow services benefit from this automation by securing funds and property titles until all contractual obligations are satisfied, enhancing transparency and trust. The integration of smart contracts with escrow processes accelerates closing times and minimizes fraud risks in real estate deals.

Key Terms

Third-party intermediary

Escrow services rely on a trusted third-party intermediary to manage and secure funds during transactions, ensuring both buyer and seller fulfill their obligations before releasing payments. In contrast, smart contracts execute automatically based on pre-defined rules encoded on a blockchain, eliminating the need for intermediaries and reducing risks of human error or bias. Discover how choosing between escrow services and smart contracts can impact security and efficiency in your transactions.

Automated execution

Escrow services provide a trusted third party to hold assets until contractual conditions are met, ensuring secure transactions without direct automation. Smart contracts utilize blockchain technology to automate execution by self-verifying and enforcing terms without intermediaries, significantly reducing delays and human error. Explore how automated execution through smart contracts can transform secure agreements and streamline trust in digital transactions.

Funds disbursement

Escrow services ensure secure funds disbursement by acting as a trusted third party holding payments until contractual conditions are met, minimizing risk for both buyers and sellers. Smart contracts automate funds release through self-executing code on blockchain platforms, enhancing efficiency and transparency by eliminating intermediaries. Explore how these technologies transform financial transactions and fund management in modern agreements.

Source and External Links

Orange County Escrow Services - Provides secure real estate escrow transactions with precision and peace of mind in Orange County.

Escrow.com - Offers secure online payment processing, protecting buyers and sellers in transactions by holding funds until goods or services are accepted.

BOK Financial Escrow Services - Provides dedicated assistance for all escrow needs, including acquisitions and bankruptcy resolutions with a streamlined approach.

dowidth.com

dowidth.com