House hacking involves buying a residential property and generating rental income to offset mortgage costs, offering individual investors direct control and potential tax benefits. Syndication pools resources from multiple investors to collectively purchase larger real estate assets, providing access to diversified opportunities and professional management. Explore the key differences between house hacking and syndication to determine the best investment strategy for your goals.

Why it is important

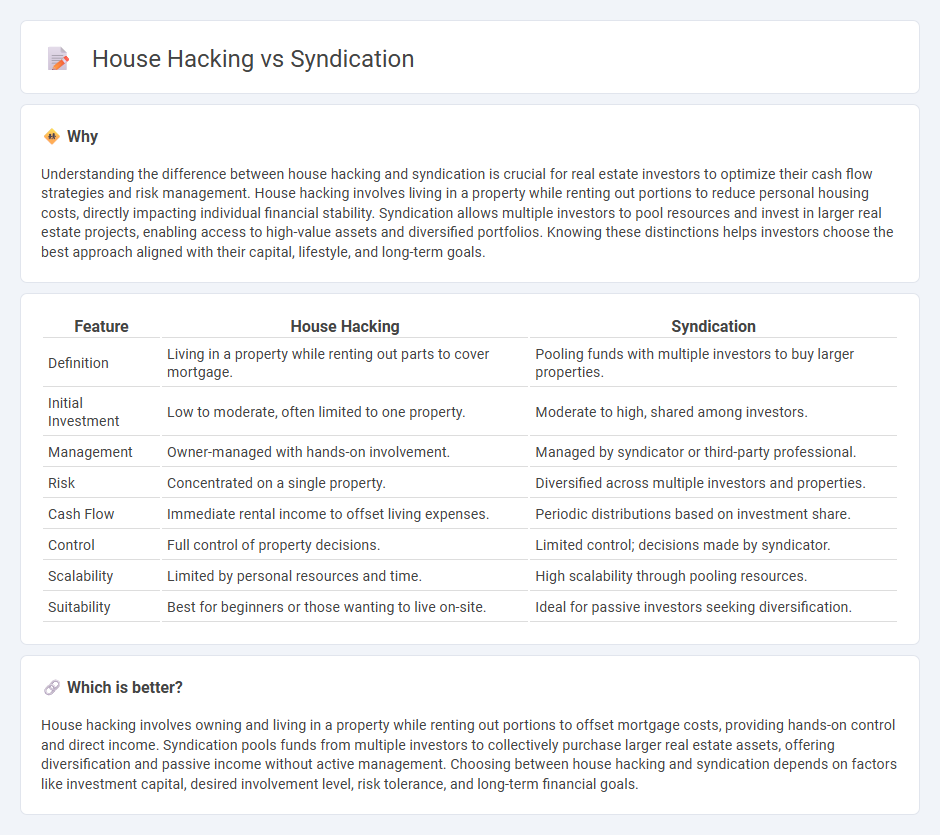

Understanding the difference between house hacking and syndication is crucial for real estate investors to optimize their cash flow strategies and risk management. House hacking involves living in a property while renting out portions to reduce personal housing costs, directly impacting individual financial stability. Syndication allows multiple investors to pool resources and invest in larger real estate projects, enabling access to high-value assets and diversified portfolios. Knowing these distinctions helps investors choose the best approach aligned with their capital, lifestyle, and long-term goals.

Comparison Table

| Feature | House Hacking | Syndication |

|---|---|---|

| Definition | Living in a property while renting out parts to cover mortgage. | Pooling funds with multiple investors to buy larger properties. |

| Initial Investment | Low to moderate, often limited to one property. | Moderate to high, shared among investors. |

| Management | Owner-managed with hands-on involvement. | Managed by syndicator or third-party professional. |

| Risk | Concentrated on a single property. | Diversified across multiple investors and properties. |

| Cash Flow | Immediate rental income to offset living expenses. | Periodic distributions based on investment share. |

| Control | Full control of property decisions. | Limited control; decisions made by syndicator. |

| Scalability | Limited by personal resources and time. | High scalability through pooling resources. |

| Suitability | Best for beginners or those wanting to live on-site. | Ideal for passive investors seeking diversification. |

Which is better?

House hacking involves owning and living in a property while renting out portions to offset mortgage costs, providing hands-on control and direct income. Syndication pools funds from multiple investors to collectively purchase larger real estate assets, offering diversification and passive income without active management. Choosing between house hacking and syndication depends on factors like investment capital, desired involvement level, risk tolerance, and long-term financial goals.

Connection

House hacking allows investors to live in a property while renting out portions to cover mortgage costs, creating immediate cash flow and building equity. Syndication pools funds from multiple investors to acquire larger real estate assets, leveraging shared capital for higher returns. Combining house hacking with syndication strategies enables novice investors to gain hands-on experience while participating in scalable investment opportunities.

Key Terms

Ownership Structure

Syndication involves multiple investors pooling capital to acquire a property, creating a shared ownership structure where returns and responsibilities are divided based on investment stakes. House hacking means an individual owner lives in one unit of a multi-unit property while renting out the others, maintaining sole ownership and control over the asset. Explore detailed comparisons of ownership structures to determine which strategy aligns with your investment goals.

Capital Investment

Syndication involves pooling capital from multiple investors to acquire high-value real estate, enabling access to larger projects while distributing financial risks. House hacking requires an individual to purchase a property, live in one unit, and rent out others to offset mortgage costs and build equity more actively. Explore detailed comparisons to determine which capital investment strategy aligns best with your financial goals.

Cash Flow Distribution

Syndication pools capital from multiple investors to acquire larger properties, enabling diversified cash flow distribution based on equity shares. House hacking involves owning and living in a property while renting out portions to cover mortgage costs and generate positive monthly cash flow. Explore the intricacies of cash flow distribution in both strategies to optimize your real estate investment returns.

Source and External Links

What Is Syndication? (Including Benefits and Types) - Syndication in broadcasting is a model where television or radio program rights are sold to multiple stations, allowing content producers to maximize profits and broadcast stations to access diverse programming beyond network-affiliated content.

Broadcast syndication | EBSCO Research Starters - Broadcast syndication involves licensing TV or radio programs to many stations instead of one network, including first-run and off-network syndication, a major revenue source especially for reruns and older shows like Seinfeld and Friends.

Real Estate Syndication Guide & How Passive Investors Profit - Real estate syndication is pooling investor capital to collectively purchase property or portfolios, with a sponsor managing the deal and investors sharing in income and appreciation without handling the full price or workload.

dowidth.com

dowidth.com