Ghost listings refer to properties that are marketed without being officially listed on the Multiple Listing Service (MLS), often to create a sense of exclusivity or test the market quietly. Foreclosure listings, on the other hand, are properties repossessed by lenders due to the owner's default on mortgage payments and are typically sold at discounted prices through auctions or real estate agents. Explore our detailed analysis to understand the strategic advantages and risks associated with ghost listings versus foreclosure properties in today's real estate market.

Why it is important

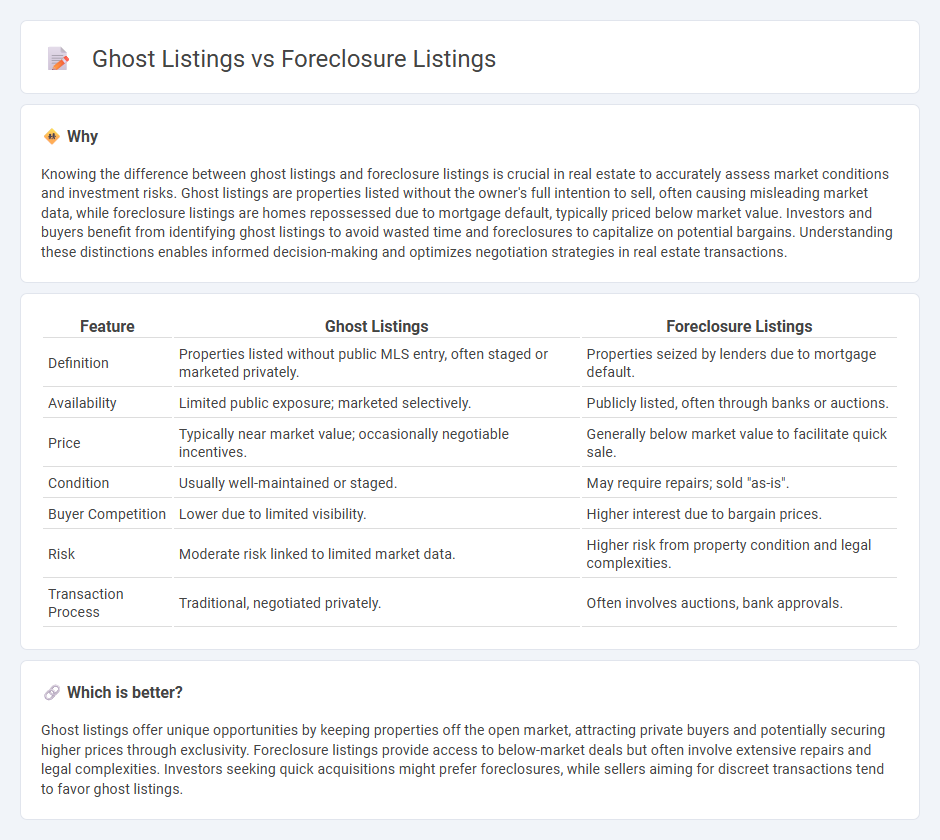

Knowing the difference between ghost listings and foreclosure listings is crucial in real estate to accurately assess market conditions and investment risks. Ghost listings are properties listed without the owner's full intention to sell, often causing misleading market data, while foreclosure listings are homes repossessed due to mortgage default, typically priced below market value. Investors and buyers benefit from identifying ghost listings to avoid wasted time and foreclosures to capitalize on potential bargains. Understanding these distinctions enables informed decision-making and optimizes negotiation strategies in real estate transactions.

Comparison Table

| Feature | Ghost Listings | Foreclosure Listings |

|---|---|---|

| Definition | Properties listed without public MLS entry, often staged or marketed privately. | Properties seized by lenders due to mortgage default. |

| Availability | Limited public exposure; marketed selectively. | Publicly listed, often through banks or auctions. |

| Price | Typically near market value; occasionally negotiable incentives. | Generally below market value to facilitate quick sale. |

| Condition | Usually well-maintained or staged. | May require repairs; sold "as-is". |

| Buyer Competition | Lower due to limited visibility. | Higher interest due to bargain prices. |

| Risk | Moderate risk linked to limited market data. | Higher risk from property condition and legal complexities. |

| Transaction Process | Traditional, negotiated privately. | Often involves auctions, bank approvals. |

Which is better?

Ghost listings offer unique opportunities by keeping properties off the open market, attracting private buyers and potentially securing higher prices through exclusivity. Foreclosure listings provide access to below-market deals but often involve extensive repairs and legal complexities. Investors seeking quick acquisitions might prefer foreclosures, while sellers aiming for discreet transactions tend to favor ghost listings.

Connection

Ghost listings often mask foreclosure properties, creating hidden opportunities in the real estate market. Foreclosure listings behind ghost listings reveal distressed assets that sellers prefer to discreetly market to avoid stigma and rapid price drops. Understanding the interplay between these listings helps investors identify undervalued properties and potential bargains.

Key Terms

Legal ownership

Foreclosure listings detail properties undergoing legal processes where ownership may transfer due to mortgage default, providing public records of bank or lender claims. Ghost listings lack formal legal ownership disclosure, often used to test market interest or conceal property details, raising concerns in transparency and buyer protection. Explore more on the legal implications and risks associated with these types of listings.

Market availability

Foreclosure listings represent properties officially available on the market due to lender repossession, typically attracting motivated buyers through public listings. Ghost listings are properties marketed by sellers but deliberately kept off public platforms to create exclusivity or test the market quietly, resulting in limited accessibility for most buyers. Explore the distinctions further to better navigate real estate opportunities and market strategies.

Property disclosure

Foreclosure listings typically include formal property disclosures mandated by law to inform buyers of any existing liens, damages, or legal issues tied to the property. Ghost listings, often marketed discreetly or off-the-record, may lack comprehensive disclosure, increasing risks for prospective buyers unaware of potential defects or financial encumbrances. Explore detailed insights on property disclosure differences in foreclosure and ghost listings to make informed real estate decisions.

Source and External Links

Alabama Foreclosure Homes For Sale - Offers a list of foreclosure homes for sale in Alabama, including properties in Birmingham and Montgomery.

Realtor.com Foreclosures - Provides foreclosure listings across various cities in the U.S., allowing users to browse photos and property details.

MLS.com Foreclosure Listings - Allows users to search for foreclosure listings by selecting a state, including Alabama and other locations.

dowidth.com

dowidth.com