Short term rental arbitrage involves leasing properties and renting them out on platforms like Airbnb without owning the asset, minimizing upfront investment and offering flexibility in different markets. Vacation rental ownership requires purchasing property to generate income through short-term stays, providing long-term equity and potential appreciation. Explore the benefits and challenges of each model to determine the best strategy for your real estate goals.

Why it is important

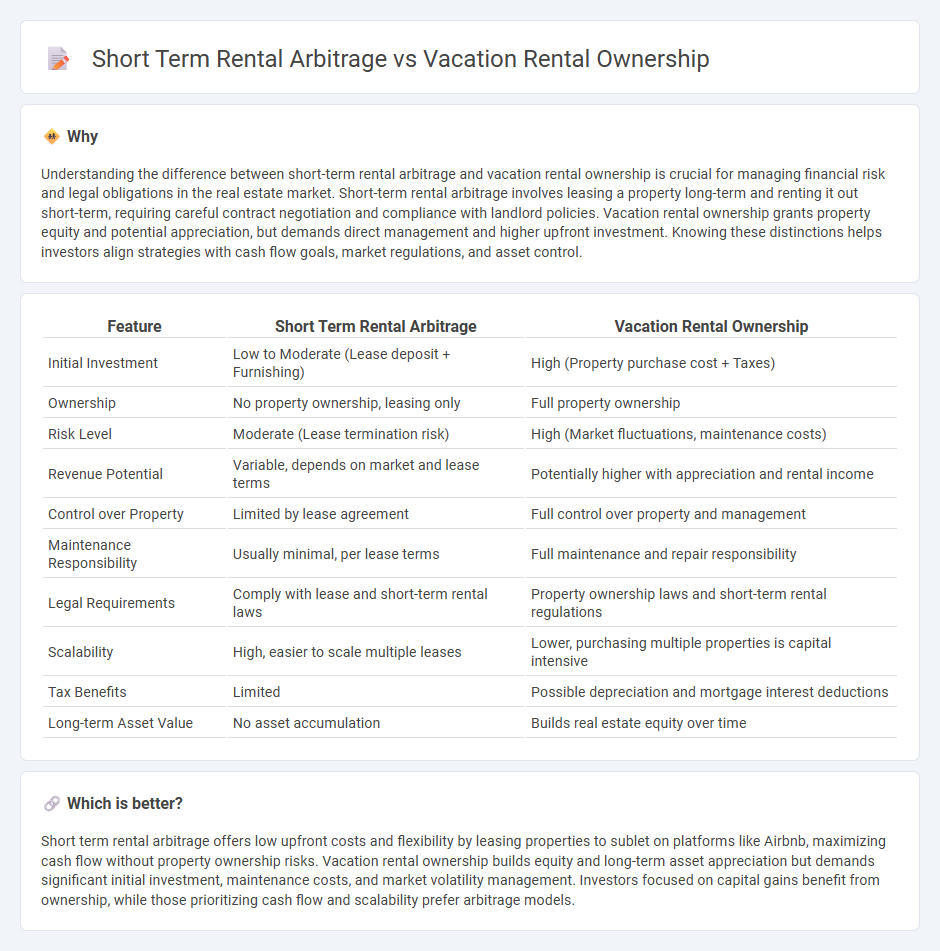

Understanding the difference between short-term rental arbitrage and vacation rental ownership is crucial for managing financial risk and legal obligations in the real estate market. Short-term rental arbitrage involves leasing a property long-term and renting it out short-term, requiring careful contract negotiation and compliance with landlord policies. Vacation rental ownership grants property equity and potential appreciation, but demands direct management and higher upfront investment. Knowing these distinctions helps investors align strategies with cash flow goals, market regulations, and asset control.

Comparison Table

| Feature | Short Term Rental Arbitrage | Vacation Rental Ownership |

|---|---|---|

| Initial Investment | Low to Moderate (Lease deposit + Furnishing) | High (Property purchase cost + Taxes) |

| Ownership | No property ownership, leasing only | Full property ownership |

| Risk Level | Moderate (Lease termination risk) | High (Market fluctuations, maintenance costs) |

| Revenue Potential | Variable, depends on market and lease terms | Potentially higher with appreciation and rental income |

| Control over Property | Limited by lease agreement | Full control over property and management |

| Maintenance Responsibility | Usually minimal, per lease terms | Full maintenance and repair responsibility |

| Legal Requirements | Comply with lease and short-term rental laws | Property ownership laws and short-term rental regulations |

| Scalability | High, easier to scale multiple leases | Lower, purchasing multiple properties is capital intensive |

| Tax Benefits | Limited | Possible depreciation and mortgage interest deductions |

| Long-term Asset Value | No asset accumulation | Builds real estate equity over time |

Which is better?

Short term rental arbitrage offers low upfront costs and flexibility by leasing properties to sublet on platforms like Airbnb, maximizing cash flow without property ownership risks. Vacation rental ownership builds equity and long-term asset appreciation but demands significant initial investment, maintenance costs, and market volatility management. Investors focused on capital gains benefit from ownership, while those prioritizing cash flow and scalability prefer arbitrage models.

Connection

Short term rental arbitrage and vacation rental ownership both leverage the lucrative vacation rental market to generate income through property leasing and management. Arbitrage involves renting properties long-term and subleasing them as short-term rentals, while ownership entails directly purchasing and managing vacation properties for rental purposes. This connection allows investors to capitalize on fluctuating tourism demand and optimize rental revenue without necessarily owning the property.

Key Terms

Property Ownership

Vacation rental ownership provides long-term asset appreciation and full control over property modifications, ensuring sustained equity growth and personalized management benefits. Property owners can leverage tax advantages, rental income stability, and the ability to customize guest experiences for higher returns compared to short-term rental arbitrage, which lacks equity building due to leased property limitations. Explore the detailed financial and operational implications of property ownership versus rental arbitrage to make an informed investment choice.

Lease Agreement

Vacation rental ownership involves a lease agreement that grants property ownership rights, allowing complete control over rental terms and property modifications. In contrast, short-term rental arbitrage relies on securing a sublease agreement from the property owner, which limits alterations and requires strict adherence to the primary lease terms. Explore detailed lease agreement comparisons to understand risks and legalities for each approach.

Cash Flow

Vacation rental ownership generates consistent cash flow through asset appreciation and rental income, leveraging equity build-up over time. Short-term rental arbitrage maximizes immediate cash flow by leasing properties beneath market rental value, minimizing upfront investment and operational risks. Explore detailed strategies and financial models to optimize cash flow in both approaches.

Source and External Links

Pros and Cons of Owning a Vacation Rental Property - This video discusses the advantages and disadvantages of vacation rental property ownership, including income generation and high upfront costs.

7 Considerations to Make Before Buying a Vacation Home - This article provides tips for successfully maintaining a vacation rental property by considering expenses and rental income.

The Pros and Cons of Owning a Vacation Rental Property - This blog post highlights the benefits and risks of owning a vacation rental, including regulatory changes and market fluctuations.

dowidth.com

dowidth.com