Opportunity Zones offer tax incentives to investors who invest in designated low-income communities, aiming to spur economic growth through capital gains deferral and exclusion. Empowerment Zones provide targeted grants and tax credits to businesses and residents within economically distressed areas to stimulate job creation and community development. Discover the key differences and benefits to determine which program aligns best with your real estate investment goals.

Why it is important

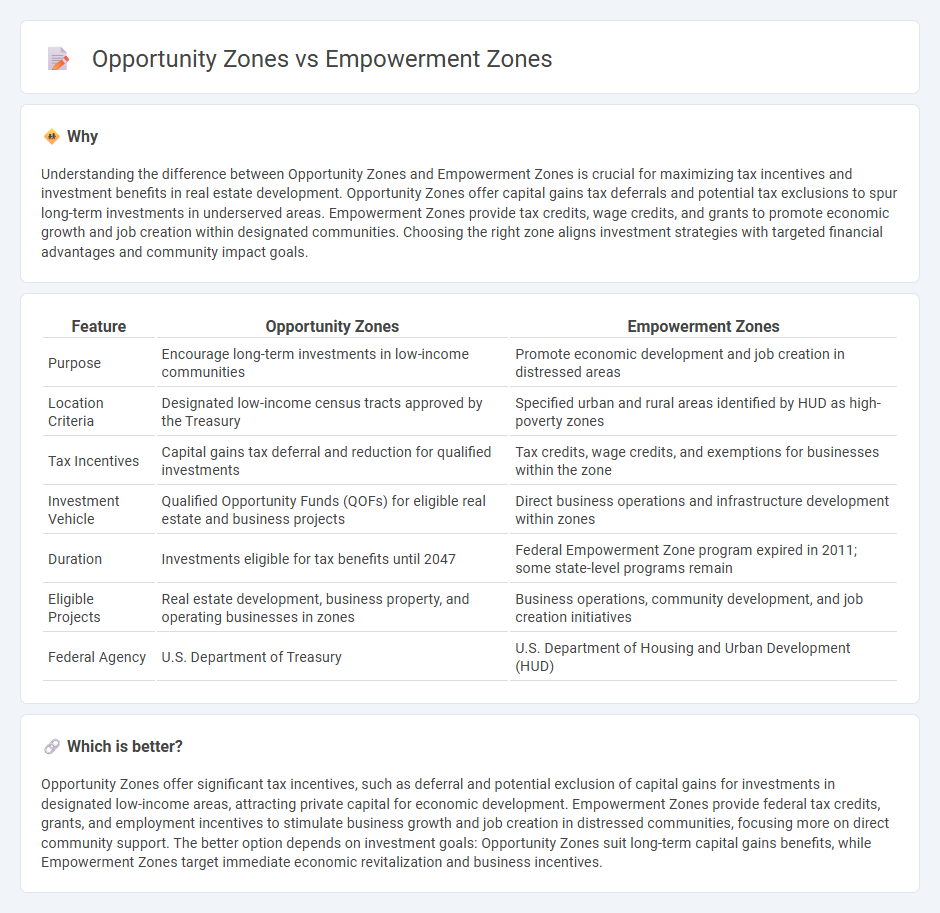

Understanding the difference between Opportunity Zones and Empowerment Zones is crucial for maximizing tax incentives and investment benefits in real estate development. Opportunity Zones offer capital gains tax deferrals and potential tax exclusions to spur long-term investments in underserved areas. Empowerment Zones provide tax credits, wage credits, and grants to promote economic growth and job creation within designated communities. Choosing the right zone aligns investment strategies with targeted financial advantages and community impact goals.

Comparison Table

| Feature | Opportunity Zones | Empowerment Zones |

|---|---|---|

| Purpose | Encourage long-term investments in low-income communities | Promote economic development and job creation in distressed areas |

| Location Criteria | Designated low-income census tracts approved by the Treasury | Specified urban and rural areas identified by HUD as high-poverty zones |

| Tax Incentives | Capital gains tax deferral and reduction for qualified investments | Tax credits, wage credits, and exemptions for businesses within the zone |

| Investment Vehicle | Qualified Opportunity Funds (QOFs) for eligible real estate and business projects | Direct business operations and infrastructure development within zones |

| Duration | Investments eligible for tax benefits until 2047 | Federal Empowerment Zone program expired in 2011; some state-level programs remain |

| Eligible Projects | Real estate development, business property, and operating businesses in zones | Business operations, community development, and job creation initiatives |

| Federal Agency | U.S. Department of Treasury | U.S. Department of Housing and Urban Development (HUD) |

Which is better?

Opportunity Zones offer significant tax incentives, such as deferral and potential exclusion of capital gains for investments in designated low-income areas, attracting private capital for economic development. Empowerment Zones provide federal tax credits, grants, and employment incentives to stimulate business growth and job creation in distressed communities, focusing more on direct community support. The better option depends on investment goals: Opportunity Zones suit long-term capital gains benefits, while Empowerment Zones target immediate economic revitalization and business incentives.

Connection

Opportunity Zones and Empowerment Zones are connected through their shared goal of stimulating economic development in distressed communities by offering tax incentives to investors and businesses. Opportunity Zones provide capital gains tax deferrals and exclusions for investments in designated low-income areas, while Empowerment Zones offer tax credits, grants, and other federal assistance to promote job creation and business growth. Both programs strategically target economically disadvantaged regions to attract private investment and foster sustainable community revitalization.

Key Terms

Tax Incentives

Empowerment Zones offer businesses tax credits, wage subsidies, and capital gains tax deferrals to stimulate economic growth in distressed areas, while Opportunity Zones primarily provide capital gains tax deferrals and potential exclusions for investments held over 10 years. Both zones aim to attract investments and job creation but differ in eligibility requirements and the scope of tax benefits. Explore the specific tax advantages each zone offers to maximize your investment returns.

Geographic Designation

Empowerment Zones and Opportunity Zones are distinct geographic designations created to stimulate economic development and investment in underprivileged areas. Empowerment Zones, designated by the federal government under the Community Renewal Tax Relief Act, target urban and rural areas with high poverty rates, offering tax incentives and grants to encourage businesses and job creation. Explore further to understand the specific benefits and eligibility criteria for each zone type.

Economic Development

Empowerment Zones and Opportunity Zones are both government initiatives aimed at spurring economic development in distressed areas, but they differ in structure and incentives. Empowerment Zones, established under the Community Renewal Tax Relief Act, offer tax credits and grants targeted at businesses and residents to stimulate employment and affordable housing, while Opportunity Zones, created by the Tax Cuts and Jobs Act, provide tax deferrals and exclusions to investors who reinvest capital gains in designated low-income communities. Explore further to understand how each program uniquely drives business growth and community revitalization.

dowidth.com

dowidth.com