Single family rentals offer investors stable cash flow through long-term leases and attract tenants seeking homeownership alternatives, while retail properties provide higher income potential due to commercial leases and diverse tenant mixes. Market demand for residential living spaces remains consistent, but retail properties benefit from economic growth and consumer spending trends. Explore deeper insights into the advantages and challenges of single family rentals versus retail property investments to make informed decisions.

Why it is important

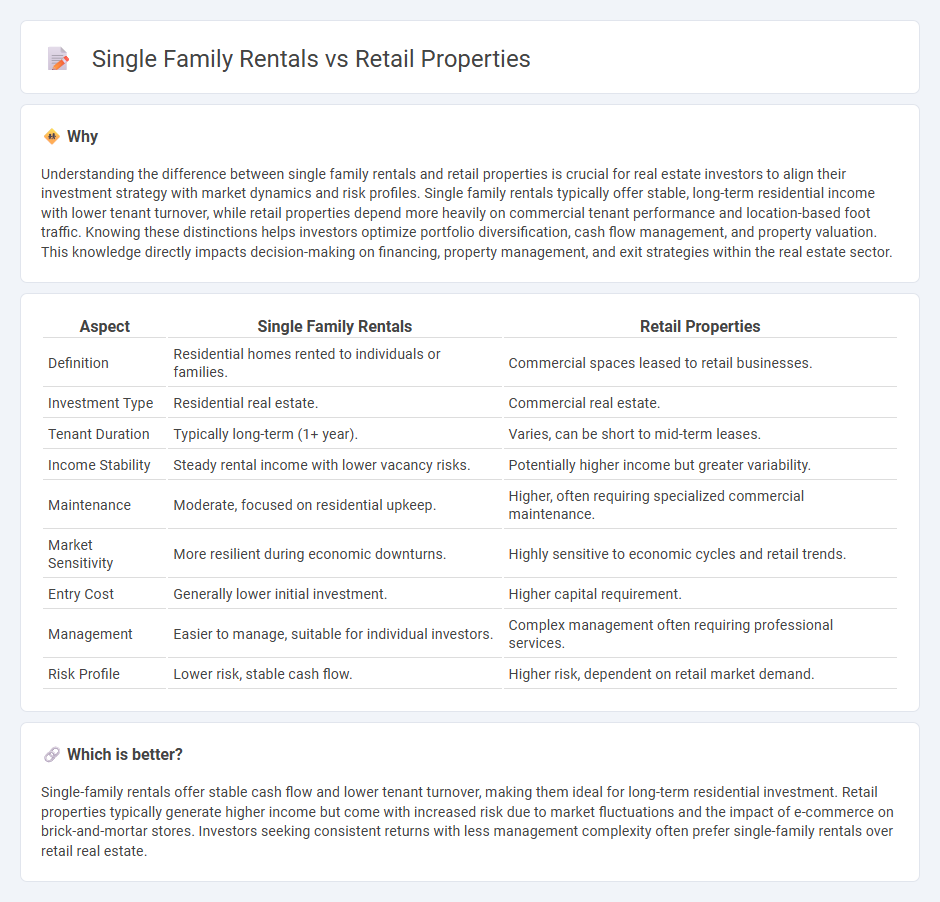

Understanding the difference between single family rentals and retail properties is crucial for real estate investors to align their investment strategy with market dynamics and risk profiles. Single family rentals typically offer stable, long-term residential income with lower tenant turnover, while retail properties depend more heavily on commercial tenant performance and location-based foot traffic. Knowing these distinctions helps investors optimize portfolio diversification, cash flow management, and property valuation. This knowledge directly impacts decision-making on financing, property management, and exit strategies within the real estate sector.

Comparison Table

| Aspect | Single Family Rentals | Retail Properties |

|---|---|---|

| Definition | Residential homes rented to individuals or families. | Commercial spaces leased to retail businesses. |

| Investment Type | Residential real estate. | Commercial real estate. |

| Tenant Duration | Typically long-term (1+ year). | Varies, can be short to mid-term leases. |

| Income Stability | Steady rental income with lower vacancy risks. | Potentially higher income but greater variability. |

| Maintenance | Moderate, focused on residential upkeep. | Higher, often requiring specialized commercial maintenance. |

| Market Sensitivity | More resilient during economic downturns. | Highly sensitive to economic cycles and retail trends. |

| Entry Cost | Generally lower initial investment. | Higher capital requirement. |

| Management | Easier to manage, suitable for individual investors. | Complex management often requiring professional services. |

| Risk Profile | Lower risk, stable cash flow. | Higher risk, dependent on retail market demand. |

Which is better?

Single-family rentals offer stable cash flow and lower tenant turnover, making them ideal for long-term residential investment. Retail properties typically generate higher income but come with increased risk due to market fluctuations and the impact of e-commerce on brick-and-mortar stores. Investors seeking consistent returns with less management complexity often prefer single-family rentals over retail real estate.

Connection

Single family rentals and retail properties are connected through their shared role in local economic ecosystems, where residential demand drives consumer traffic to retail locations. Investors often diversify portfolios by including both asset types, leveraging steady rental income from single family homes alongside commercial revenue from retail leases. Market trends such as urbanization and demographic shifts influence occupancy rates and property values in both sectors, highlighting their interdependence.

Key Terms

Lease Structure

Retail properties typically involve long-term, triple net leases where tenants cover property expenses such as taxes, insurance, and maintenance, reducing landlord risk and providing predictable income. Single family rentals often operate on shorter lease terms with landlords responsible for maintenance and property expenses, leading to higher management involvement and variability in cash flow. Explore detailed comparisons of lease structures to optimize your real estate investment strategy.

Tenant Mix

Retail properties benefit from a diverse tenant mix that includes anchor stores, specialty shops, and service providers, which helps distribute risk and attract varied customer demographics. Single-family rentals usually rely on a homogeneous tenant base, primarily long-term residential tenants, offering steady income but less diversification. Explore how tenant mix impacts investment stability and returns for retail versus single-family rental properties.

Cash Flow

Retail properties typically generate higher cash flow from multiple tenant leases and diverse revenue streams, while single family rentals offer steady, predictable income with lower management complexities. Vacancy rates and tenant turnover differ significantly, impacting overall net operating income and long-term profitability. Explore detailed comparisons to optimize your real estate investment strategy for maximum cash flow benefits.

Source and External Links

Raleigh, NC Retail Properties For Sale - CityFeet - Raleigh offers a wide range of retail properties for sale, including strip centers and freestanding buildings, with average prices around $376-$402 per square foot and varied sizes, representing attractive investment opportunities in a growing city with strong demand driven by universities and corporations.

Retail Stores & Storefronts for Sale in Raleigh, NC | Crexi.com - This platform lists various retail commercial real estate options in Raleigh, including value-add opportunities and properties with long-term tenants, featuring offerings from small storefronts to larger retail sites suitable for investment or business use.

Available Retail Space | Do Business | Downtown Raleigh, NC - Downtown Raleigh presents multiple available retail spaces located on prominent streets such as Fayetteville Street, Martin Street, and Glenwood Avenue, providing diverse leasing opportunities in a vibrant urban setting.

dowidth.com

dowidth.com