Build to rent properties offer long-term leasing opportunities with stable income and reduced tenant turnover, appealing to investors focused on consistent cash flow and property management efficiency. Short-term rental properties cater to travelers seeking flexible stays, often generating higher nightly rates but involving more frequent tenant changes and increased maintenance. Explore the key differences and investment potentials between build to rent and short-term rental properties to determine the best fit for your real estate portfolio.

Why it is important

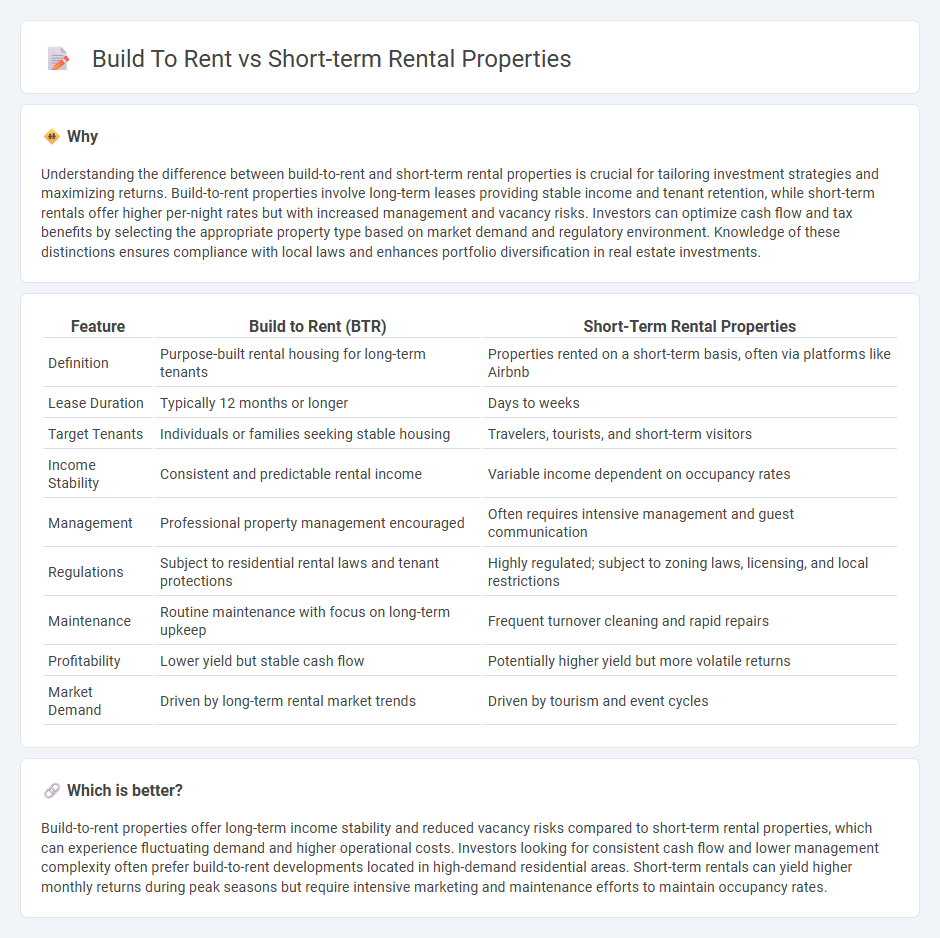

Understanding the difference between build-to-rent and short-term rental properties is crucial for tailoring investment strategies and maximizing returns. Build-to-rent properties involve long-term leases providing stable income and tenant retention, while short-term rentals offer higher per-night rates but with increased management and vacancy risks. Investors can optimize cash flow and tax benefits by selecting the appropriate property type based on market demand and regulatory environment. Knowledge of these distinctions ensures compliance with local laws and enhances portfolio diversification in real estate investments.

Comparison Table

| Feature | Build to Rent (BTR) | Short-Term Rental Properties |

|---|---|---|

| Definition | Purpose-built rental housing for long-term tenants | Properties rented on a short-term basis, often via platforms like Airbnb |

| Lease Duration | Typically 12 months or longer | Days to weeks |

| Target Tenants | Individuals or families seeking stable housing | Travelers, tourists, and short-term visitors |

| Income Stability | Consistent and predictable rental income | Variable income dependent on occupancy rates |

| Management | Professional property management encouraged | Often requires intensive management and guest communication |

| Regulations | Subject to residential rental laws and tenant protections | Highly regulated; subject to zoning laws, licensing, and local restrictions |

| Maintenance | Routine maintenance with focus on long-term upkeep | Frequent turnover cleaning and rapid repairs |

| Profitability | Lower yield but stable cash flow | Potentially higher yield but more volatile returns |

| Market Demand | Driven by long-term rental market trends | Driven by tourism and event cycles |

Which is better?

Build-to-rent properties offer long-term income stability and reduced vacancy risks compared to short-term rental properties, which can experience fluctuating demand and higher operational costs. Investors looking for consistent cash flow and lower management complexity often prefer build-to-rent developments located in high-demand residential areas. Short-term rentals can yield higher monthly returns during peak seasons but require intensive marketing and maintenance efforts to maintain occupancy rates.

Connection

Build-to-rent properties are designed for long-term tenants seeking stability, while short-term rental properties cater to transient occupants seeking flexible stays. Both real estate models capitalize on rental income but target distinct market demands through tailored property management strategies. Investment in either approach requires understanding local zoning laws, market trends, and tenant preferences to optimize occupancy rates and revenue.

Key Terms

Occupancy Rate

Short-term rental properties often experience fluctuating occupancy rates influenced by seasonality, local events, and tourism trends, leading to higher variability in rental income. Build-to-rent developments typically secure more stable occupancy rates due to long-term leases and consistent tenant demand, resulting in predictable cash flow. Explore the detailed differences in occupancy dynamics between these rental models to optimize your investment strategy.

Lease Duration

Short-term rental properties offer flexible lease durations, typically ranging from a few days to several months, catering primarily to travelers and temporary residents. Build-to-rent developments emphasize long-term leases, often spanning 12 months or more, targeting stable, long-term tenants seeking consistent housing solutions. Explore more about how lease duration impacts investment strategies in rental property sectors.

Property Management

Short-term rental properties require dynamic property management strategies focused on frequent guest turnover, marketing, and maintaining high cleanliness standards to maximize occupancy and revenue. Build-to-rent developments emphasize long-term tenant retention, steady income streams, and comprehensive maintenance services tailored to residential needs. Explore in-depth comparisons of property management approaches to optimize your rental investment decisions.

Source and External Links

What is Considered a Short-Term Rental? - This article provides an overview of short-term rentals, including types such as entire homes, accessory dwellings, and rooms, and clarifies how they are classified based on occupancy and rental duration.

Short-Term Vacation Rentals - This webpage explains the regulations for short-term vacation rentals in the City of Ventura, including the need for a permit and the collection of transient occupancy tax.

Short-Term & Temporary Housing - Extended Stay America offers furnished temporary housing suites with amenities like fully equipped kitchens, free Wi-Fi, and housekeeping services, ideal for business travel or relocation.

dowidth.com

dowidth.com