Leaseback programs offer property owners a steady rental income by leasing their real estate to developers or operators for a fixed term, while short-term rentals provide higher income potential through platforms like Airbnb with frequent tenant turnovers. Leasebacks reduce management responsibilities and ensure guaranteed returns, whereas short-term rentals require active property management but capitalize on strong tourist demand and flexible pricing. Discover detailed insights on how these real estate strategies can optimize your investment portfolio.

Why it is important

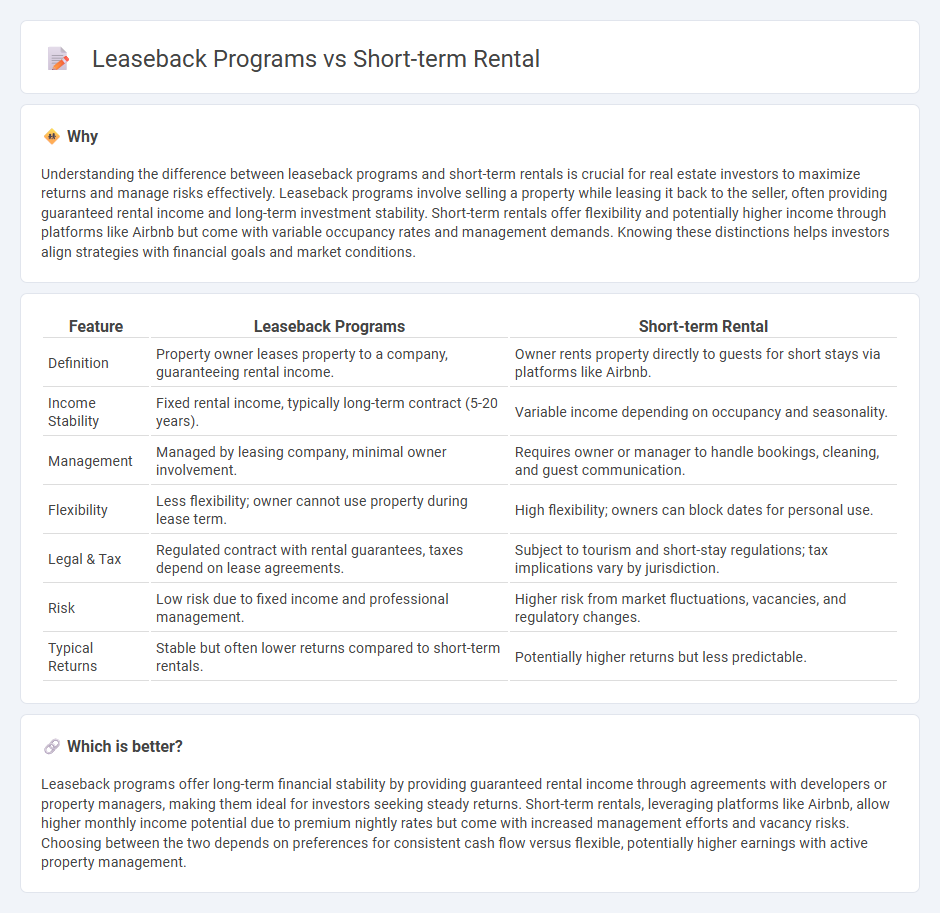

Understanding the difference between leaseback programs and short-term rentals is crucial for real estate investors to maximize returns and manage risks effectively. Leaseback programs involve selling a property while leasing it back to the seller, often providing guaranteed rental income and long-term investment stability. Short-term rentals offer flexibility and potentially higher income through platforms like Airbnb but come with variable occupancy rates and management demands. Knowing these distinctions helps investors align strategies with financial goals and market conditions.

Comparison Table

| Feature | Leaseback Programs | Short-term Rental |

|---|---|---|

| Definition | Property owner leases property to a company, guaranteeing rental income. | Owner rents property directly to guests for short stays via platforms like Airbnb. |

| Income Stability | Fixed rental income, typically long-term contract (5-20 years). | Variable income depending on occupancy and seasonality. |

| Management | Managed by leasing company, minimal owner involvement. | Requires owner or manager to handle bookings, cleaning, and guest communication. |

| Flexibility | Less flexibility; owner cannot use property during lease term. | High flexibility; owners can block dates for personal use. |

| Legal & Tax | Regulated contract with rental guarantees, taxes depend on lease agreements. | Subject to tourism and short-stay regulations; tax implications vary by jurisdiction. |

| Risk | Low risk due to fixed income and professional management. | Higher risk from market fluctuations, vacancies, and regulatory changes. |

| Typical Returns | Stable but often lower returns compared to short-term rentals. | Potentially higher returns but less predictable. |

Which is better?

Leaseback programs offer long-term financial stability by providing guaranteed rental income through agreements with developers or property managers, making them ideal for investors seeking steady returns. Short-term rentals, leveraging platforms like Airbnb, allow higher monthly income potential due to premium nightly rates but come with increased management efforts and vacancy risks. Choosing between the two depends on preferences for consistent cash flow versus flexible, potentially higher earnings with active property management.

Connection

Leaseback programs enable property owners to sell their real estate while retaining the right to lease it back, often targeting investors interested in generating steady rental income. Short-term rentals leverage leaseback arrangements by allowing property owners or investors to offer accommodation on platforms like Airbnb or VRBO, maximizing returns through flexible rental durations. This synergy enhances cash flow potential and diversifies income streams in the real estate market.

Key Terms

Occupancy Period

Short-term rental programs typically offer flexible occupancy periods ranging from a few days to several weeks, catering to tourists and transient visitors, whereas leaseback programs often involve fixed, long-term occupancy agreements, typically spanning several years, targeting investors seeking steady rental income. The variability in short-term rental occupancy allows for higher potential returns during peak seasons but requires active property management and marketing efforts. Explore our detailed analysis to understand which occupancy period best suits your investment goals.

Revenue Sharing

Short-term rental programs typically generate higher immediate income through dynamic pricing and frequent guest turnover, enhancing revenue sharing opportunities for property owners. Leaseback programs offer stable, long-term income by securing fixed payments from management companies, minimizing market volatility risks. Explore detailed comparisons to understand which revenue sharing model aligns best with your investment goals.

Property Management

Short-term rental property management involves dynamic pricing strategies, frequent guest turnover, and comprehensive marketing efforts to maximize occupancy and revenue. Leaseback programs provide a more stable income by leasing the property to a management company or investor for a fixed term, reducing operational hassles for owners. Explore the advantages and operational differences to determine which property management approach aligns best with your investment goals.

Source and External Links

Short-Term Rental Overview - This webpage provides an overview of short-term rentals, including their types and definitions.

Short-Term Rental - This page outlines the requirements and regulations for obtaining a short-term rental license in Chandler, Arizona.

Short Term Rentals - This resource explains the process of applying for a short-term rental permit in Spokane, including application fees and necessary documents.

dowidth.com

dowidth.com