Automated valuation models (AVMs) leverage algorithms and extensive datasets to quickly estimate property values with high accuracy and efficiency. Hybrid appraisals combine AVM data with professional appraiser insights, enhancing valuation reliability through human expertise. Explore how integrating technology and traditional appraisal methods revolutionizes real estate valuation accuracy and decision-making.

Why it is important

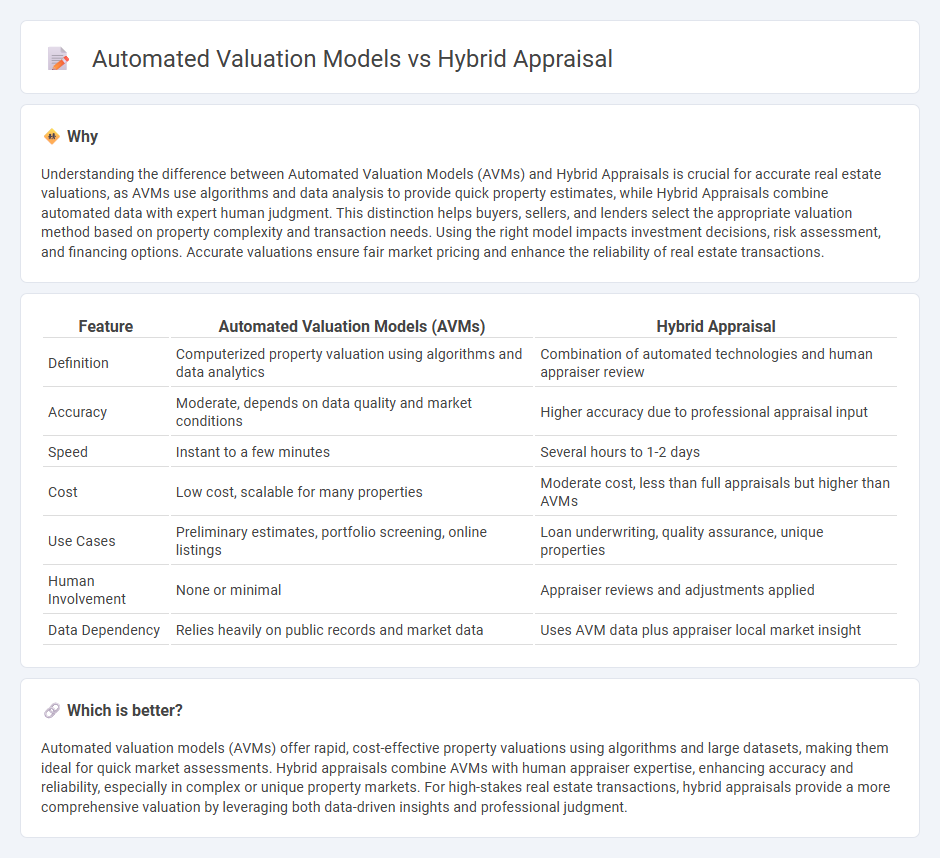

Understanding the difference between Automated Valuation Models (AVMs) and Hybrid Appraisals is crucial for accurate real estate valuations, as AVMs use algorithms and data analysis to provide quick property estimates, while Hybrid Appraisals combine automated data with expert human judgment. This distinction helps buyers, sellers, and lenders select the appropriate valuation method based on property complexity and transaction needs. Using the right model impacts investment decisions, risk assessment, and financing options. Accurate valuations ensure fair market pricing and enhance the reliability of real estate transactions.

Comparison Table

| Feature | Automated Valuation Models (AVMs) | Hybrid Appraisal |

|---|---|---|

| Definition | Computerized property valuation using algorithms and data analytics | Combination of automated technologies and human appraiser review |

| Accuracy | Moderate, depends on data quality and market conditions | Higher accuracy due to professional appraisal input |

| Speed | Instant to a few minutes | Several hours to 1-2 days |

| Cost | Low cost, scalable for many properties | Moderate cost, less than full appraisals but higher than AVMs |

| Use Cases | Preliminary estimates, portfolio screening, online listings | Loan underwriting, quality assurance, unique properties |

| Human Involvement | None or minimal | Appraiser reviews and adjustments applied |

| Data Dependency | Relies heavily on public records and market data | Uses AVM data plus appraiser local market insight |

Which is better?

Automated valuation models (AVMs) offer rapid, cost-effective property valuations using algorithms and large datasets, making them ideal for quick market assessments. Hybrid appraisals combine AVMs with human appraiser expertise, enhancing accuracy and reliability, especially in complex or unique property markets. For high-stakes real estate transactions, hybrid appraisals provide a more comprehensive valuation by leveraging both data-driven insights and professional judgment.

Connection

Automated Valuation Models (AVMs) utilize algorithms and extensive property data to generate rapid property value estimates, while Hybrid Appraisals combine AVM data with traditional appraiser insights for enhanced accuracy. Real estate professionals leverage this connection to streamline valuation processes and improve market analysis reliability. The integration of AVMs and hybrid approaches optimizes property assessments by balancing technological efficiency with expert judgment.

Key Terms

Valuation Methodology

Hybrid appraisal combines traditional appraiser expertise with Automated Valuation Models (AVMs) to deliver more accurate property valuations by leveraging both human insight and data-driven algorithms. AVMs rely solely on statistical models and vast datasets, enabling rapid valuations but sometimes lacking nuanced local market understanding. Explore the differences in valuation methodology to determine which model best suits your real estate needs.

Human Involvement

Hybrid appraisal combines expert human judgment with data-driven insights, enhancing valuation accuracy by incorporating nuanced market conditions and property-specific factors. Automated valuation models (AVMs) rely solely on algorithms and large datasets, providing rapid estimates but lacking the contextual understanding of human appraisers. Discover how the balance of human involvement and technology impacts real estate valuation effectiveness by learning more.

Data Sources

Hybrid appraisal combines traditional appraiser expertise with automated valuation model (AVM) technology, leveraging multiple data sources such as recent sales, property characteristics, and market trends for enhanced accuracy. AVMs primarily rely on large datasets including public records, MLS data, and historical transaction prices, often lacking the nuanced insight provided by human analysis. Explore how integrating diverse data sources improves valuation accuracy and reliability in property assessments.

Source and External Links

Hybrid Appraisals: Understanding the Basics - True Footage - A hybrid appraisal combines a traditional full appraisal with modern data-driven methods, where a licensed appraiser uses a third-party inspector's collected on-site data alongside market analysis to quickly and efficiently value a property, often used for refinancing or home equity lines of credit.

Definition of Hybrid Appraisal | Clear Capital - Hybrid appraisals involve a trained property data collector performing the property inspection and relaying details like photos and measurements to an appraiser, enabling faster and often cheaper valuations accepted by Fannie Mae (1004 Hybrid) and Freddie Mac (70H).

Hybrid Appraisals vs Traditional Appraisals - Visitcss - Developed as a cost- and time-saving alternative to traditional appraisals, hybrid appraisals use third-party inspection data combined with an appraiser's expertise and market information, making them especially effective in urban and suburban markets for certain loan types.

dowidth.com

dowidth.com