Fractional ownership platforms allow investors to buy specific shares of individual properties, providing direct equity and potential income from rental yields, while REITs (Real Estate Investment Trusts) offer pooled investments in diversified real estate portfolios traded on stock exchanges. Fractional ownership delivers more control and transparency over property choices, whereas REITs provide liquidity and professional management with lower entry costs. Discover how combining these approaches can optimize real estate investment strategies.

Why it is important

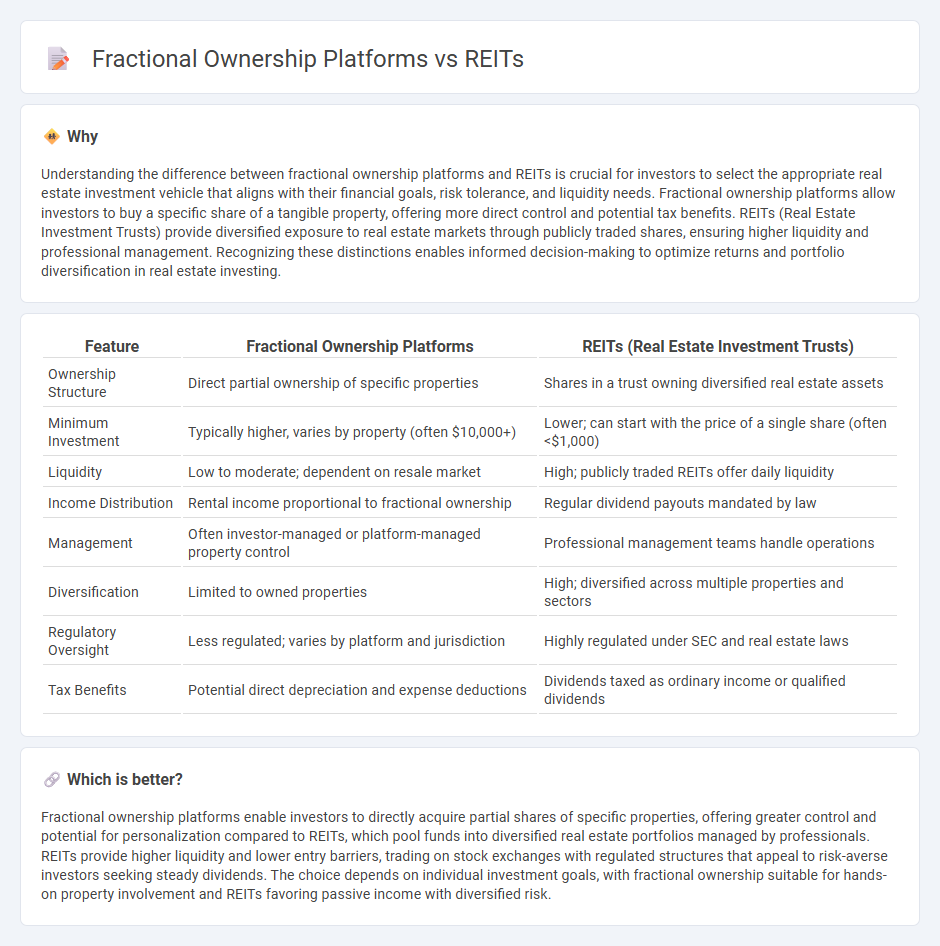

Understanding the difference between fractional ownership platforms and REITs is crucial for investors to select the appropriate real estate investment vehicle that aligns with their financial goals, risk tolerance, and liquidity needs. Fractional ownership platforms allow investors to buy a specific share of a tangible property, offering more direct control and potential tax benefits. REITs (Real Estate Investment Trusts) provide diversified exposure to real estate markets through publicly traded shares, ensuring higher liquidity and professional management. Recognizing these distinctions enables informed decision-making to optimize returns and portfolio diversification in real estate investing.

Comparison Table

| Feature | Fractional Ownership Platforms | REITs (Real Estate Investment Trusts) |

|---|---|---|

| Ownership Structure | Direct partial ownership of specific properties | Shares in a trust owning diversified real estate assets |

| Minimum Investment | Typically higher, varies by property (often $10,000+) | Lower; can start with the price of a single share (often <$1,000) |

| Liquidity | Low to moderate; dependent on resale market | High; publicly traded REITs offer daily liquidity |

| Income Distribution | Rental income proportional to fractional ownership | Regular dividend payouts mandated by law |

| Management | Often investor-managed or platform-managed property control | Professional management teams handle operations |

| Diversification | Limited to owned properties | High; diversified across multiple properties and sectors |

| Regulatory Oversight | Less regulated; varies by platform and jurisdiction | Highly regulated under SEC and real estate laws |

| Tax Benefits | Potential direct depreciation and expense deductions | Dividends taxed as ordinary income or qualified dividends |

Which is better?

Fractional ownership platforms enable investors to directly acquire partial shares of specific properties, offering greater control and potential for personalization compared to REITs, which pool funds into diversified real estate portfolios managed by professionals. REITs provide higher liquidity and lower entry barriers, trading on stock exchanges with regulated structures that appeal to risk-averse investors seeking steady dividends. The choice depends on individual investment goals, with fractional ownership suitable for hands-on property involvement and REITs favoring passive income with diversified risk.

Connection

Fractional ownership platforms and Real Estate Investment Trusts (REITs) both democratize real estate investment by allowing multiple investors to own shares of property assets without full ownership responsibilities. These platforms and REITs enhance liquidity and accessibility in real estate markets by pooling capital from individual investors to acquire and manage diversified property portfolios. By leveraging technology and regulatory frameworks, fractional ownership platforms often operate similarly to REITs, providing regular income and potential capital appreciation to investors.

Key Terms

Liquidity

REITs offer high liquidity by allowing investors to buy and sell shares on public stock exchanges, enabling quick access to cash compared to fractional ownership platforms, which often have limited secondary market options and longer holding periods. Fractional ownership platforms provide direct asset exposure but may require holding until a predefined sale event or investor buyout. Explore the nuances of liquidity in real estate investments for better portfolio decisions.

Ownership Structure

REITs (Real Estate Investment Trusts) offer investors shares in a professionally managed portfolio of real estate assets, providing liquidity through public markets and regulatory oversight under the SEC. Fractional ownership platforms allow direct investment in individual properties by dividing asset ownership into smaller shares, often with less liquidity and fewer regulatory requirements. Explore detailed comparisons of ownership structures and benefits to determine the best option for real estate investment.

Regulatory Oversight

REITs operate under strict regulatory oversight by the SEC, ensuring transparency, investor protection, and compliance with established financial standards. Fractional ownership platforms, often regulated under crowdfunding or securities laws, face varying levels of oversight that depend on jurisdiction and platform structure. Explore more to understand the regulatory nuances distinguishing these investment options.

Source and External Links

Real estate investment trust - Wikipedia - A REIT is a company that owns and usually operates income-producing real estate such as office buildings, shopping centers, apartments, or warehouses, and can be publicly traded or private, with two main types: equity REITs and mortgage REITs.

Real Estate Investment Trusts (REITs) | Investor.gov - REITs allow individuals to invest in large-scale, income-producing real estate like malls, apartments, or warehouses without having to buy properties themselves, and they can be publicly traded or non-traded.

What's a REIT (Real Estate Investment Trust)? - Nareit - A REIT is a company that owns, operates, or finances income-producing real estate, offering investors regular income streams, diversification, and potential long-term capital appreciation, often trading on major stock exchanges.

dowidth.com

dowidth.com