Lease-to-own models allow tenants to rent a property with the option to purchase it later, combining lease payments with equity accumulation, while installment sales involve buyers making structured payments directly toward ownership over time. Both methods provide alternatives to traditional mortgage financing, easing entry for those with credit challenges or limited upfront capital. Explore how these options can impact your real estate investment strategy and homeowner journey.

Why it is important

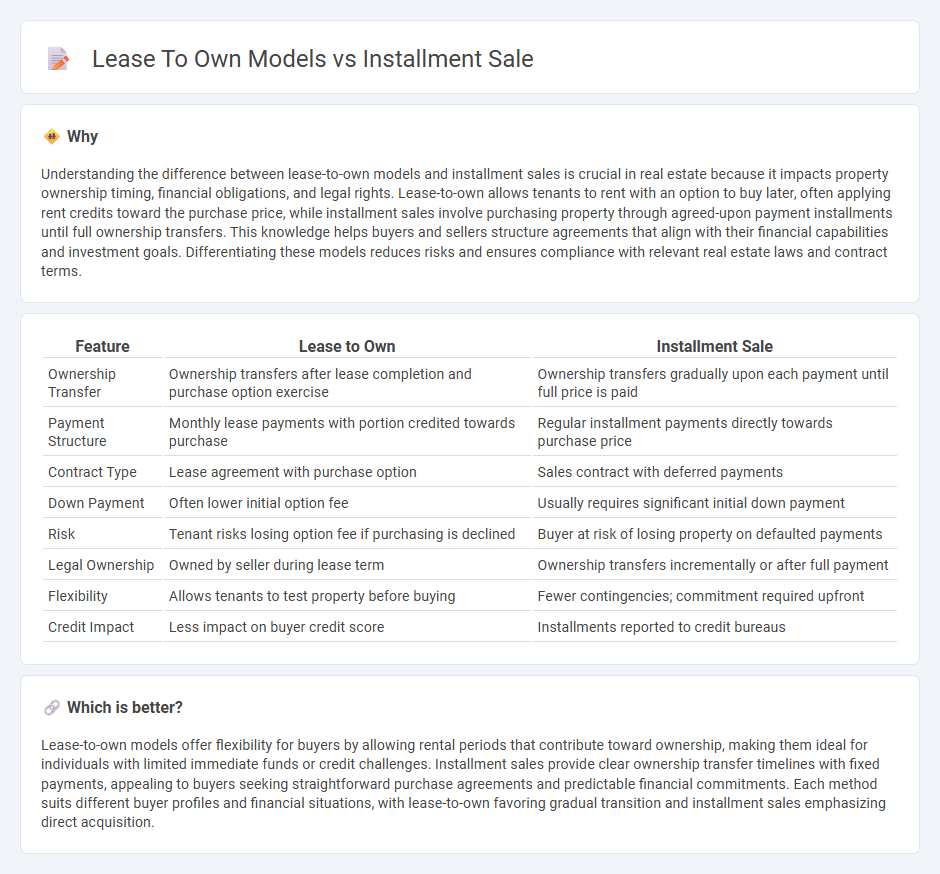

Understanding the difference between lease-to-own models and installment sales is crucial in real estate because it impacts property ownership timing, financial obligations, and legal rights. Lease-to-own allows tenants to rent with an option to buy later, often applying rent credits toward the purchase price, while installment sales involve purchasing property through agreed-upon payment installments until full ownership transfers. This knowledge helps buyers and sellers structure agreements that align with their financial capabilities and investment goals. Differentiating these models reduces risks and ensures compliance with relevant real estate laws and contract terms.

Comparison Table

| Feature | Lease to Own | Installment Sale |

|---|---|---|

| Ownership Transfer | Ownership transfers after lease completion and purchase option exercise | Ownership transfers gradually upon each payment until full price is paid |

| Payment Structure | Monthly lease payments with portion credited towards purchase | Regular installment payments directly towards purchase price |

| Contract Type | Lease agreement with purchase option | Sales contract with deferred payments |

| Down Payment | Often lower initial option fee | Usually requires significant initial down payment |

| Risk | Tenant risks losing option fee if purchasing is declined | Buyer at risk of losing property on defaulted payments |

| Legal Ownership | Owned by seller during lease term | Ownership transfers incrementally or after full payment |

| Flexibility | Allows tenants to test property before buying | Fewer contingencies; commitment required upfront |

| Credit Impact | Less impact on buyer credit score | Installments reported to credit bureaus |

Which is better?

Lease-to-own models offer flexibility for buyers by allowing rental periods that contribute toward ownership, making them ideal for individuals with limited immediate funds or credit challenges. Installment sales provide clear ownership transfer timelines with fixed payments, appealing to buyers seeking straightforward purchase agreements and predictable financial commitments. Each method suits different buyer profiles and financial situations, with lease-to-own favoring gradual transition and installment sales emphasizing direct acquisition.

Connection

Lease-to-own models and installment sales are closely connected through their shared goal of facilitating property acquisition without immediate full payment. Both arrangements allow buyers to gradually build equity while making periodic payments, with lease-to-own involving rental agreements that convert to ownership and installment sales emphasizing direct purchase through scheduled payments. This synergy provides flexible financing options, attracting buyers who may not qualify for traditional mortgages.

Key Terms

Ownership transfer

Installment sale models involve the transfer of ownership to the buyer once all payments are completed, legally recognizing the buyer as the owner during the payment period. Lease-to-own agreements typically allow the lessee to use the asset while making payments, with ownership transferring only after fulfilling specific contract terms, often including an option to purchase. Explore detailed differences in ownership transfer timelines and legal implications between installment sales and lease-to-own models.

Down payment

Installment sale models typically require a larger down payment compared to lease-to-own agreements, which often feature lower upfront costs to attract customers with limited initial capital. The higher down payment in installment sales serves to reduce financing risk and accelerate equity build-up for the buyer, while lease-to-own structures prioritize affordability and flexibility. Explore detailed comparisons to understand which model aligns best with your financial strategy.

Purchase option

Installment sale models involve the buyer making scheduled payments to gradually acquire ownership, with the purchase option clearly defined by the remaining balance. Lease-to-own models operate as rental agreements with an option to purchase at the end of the lease term, often including a predetermined purchase price or a portion of rental payments credited toward ownership. Explore the advantages and nuances of each purchase option to determine the best fit for your financial goals.

Source and External Links

How to Save Tax with an Installment Sale - This article discusses how an installment sale can help reduce tax liabilities by spreading payments over time, particularly for business or real estate transactions.

Installment Sale | Wex - Provides a legal definition of an installment sale, outlining that it involves receiving payments after the year of sale, and explains the rules under the Internal Revenue Code.

Structured Installment Sales - Describes a structured installment sale as a method to defer capital gains taxes by receiving payments through an annuity, beneficial for real estate or property sales.

dowidth.com

dowidth.com