Leaseback programs involve property owners selling their real estate to an investor while simultaneously leasing it back, allowing them to maintain operational control with steady rental income. Master leases grant a single tenant the right to lease and operate multiple properties from the landlord, often streamlining management and tenant responsibility under one contract. Explore the advantages and key differences between leaseback programs and master leases to determine the best approach for your real estate investment strategy.

Why it is important

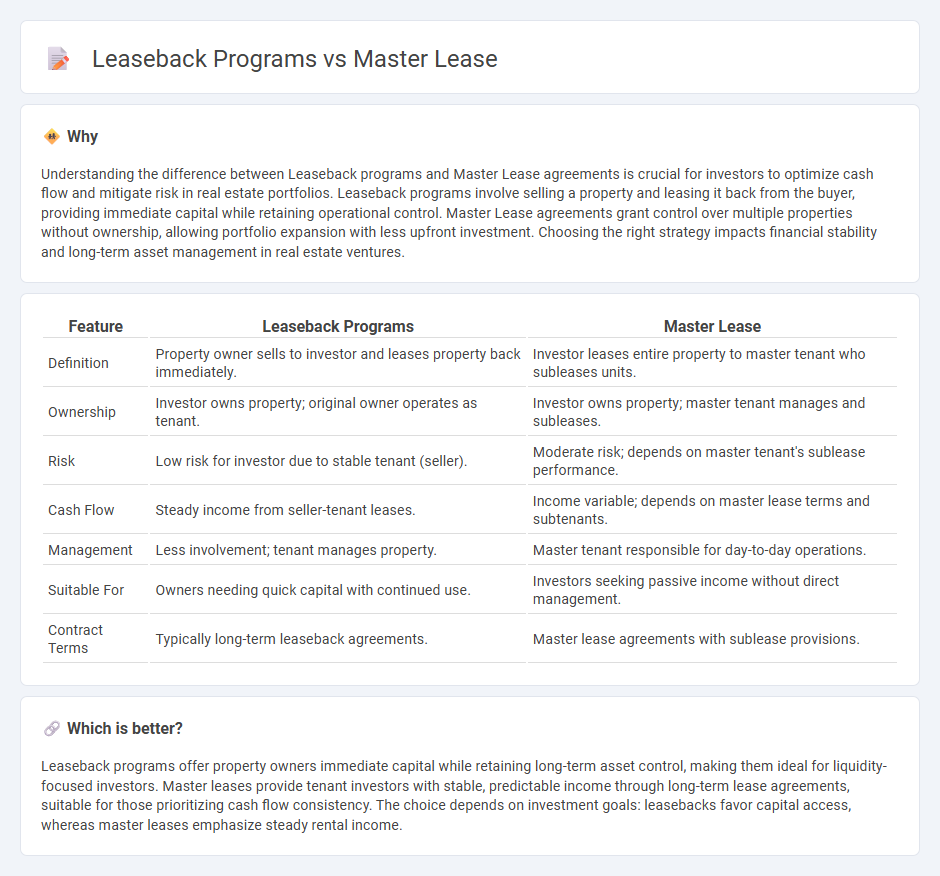

Understanding the difference between Leaseback programs and Master Lease agreements is crucial for investors to optimize cash flow and mitigate risk in real estate portfolios. Leaseback programs involve selling a property and leasing it back from the buyer, providing immediate capital while retaining operational control. Master Lease agreements grant control over multiple properties without ownership, allowing portfolio expansion with less upfront investment. Choosing the right strategy impacts financial stability and long-term asset management in real estate ventures.

Comparison Table

| Feature | Leaseback Programs | Master Lease |

|---|---|---|

| Definition | Property owner sells to investor and leases property back immediately. | Investor leases entire property to master tenant who subleases units. |

| Ownership | Investor owns property; original owner operates as tenant. | Investor owns property; master tenant manages and subleases. |

| Risk | Low risk for investor due to stable tenant (seller). | Moderate risk; depends on master tenant's sublease performance. |

| Cash Flow | Steady income from seller-tenant leases. | Income variable; depends on master lease terms and subtenants. |

| Management | Less involvement; tenant manages property. | Master tenant responsible for day-to-day operations. |

| Suitable For | Owners needing quick capital with continued use. | Investors seeking passive income without direct management. |

| Contract Terms | Typically long-term leaseback agreements. | Master lease agreements with sublease provisions. |

Which is better?

Leaseback programs offer property owners immediate capital while retaining long-term asset control, making them ideal for liquidity-focused investors. Master leases provide tenant investors with stable, predictable income through long-term lease agreements, suitable for those prioritizing cash flow consistency. The choice depends on investment goals: leasebacks favor capital access, whereas master leases emphasize steady rental income.

Connection

Leaseback programs and master lease agreements are connected through their shared focus on long-term property control and income stability for investors. In leaseback programs, property owners sell assets and immediately lease them back, often under a master lease that consolidates multiple leases into a single, comprehensive agreement. This connection streamlines management and ensures consistent cash flow by enabling investors to maintain operational control while benefiting from guaranteed rental income.

Key Terms

Control vs. Ownership

Master lease programs grant tenants control over multiple units under a single agreement, streamlining management and cash flow while the property owner retains ownership, beneficial for investors seeking passive income. Leaseback programs transfer property ownership to an investor who leases it back to the previous owner or tenant, optimizing capital liquidity and tax benefits while ceding operational control. Discover how these arrangements impact investment strategy and financial outcomes in real estate portfolios.

Subletting Rights

Master lease agreements typically grant the tenant full subletting rights, allowing them to lease the property to third parties under negotiated terms. Leaseback programs often restrict subletting to preserve the property's value and control, limiting the tenant's ability to transfer occupancy. Explore deeper distinctions and legal implications of subletting rights in these programs to optimize your leasing strategy.

Income Stream Structure

Master lease programs involve a single, long-term lease agreement where the master tenant subleases individual units, providing a stable and predictable income stream with reduced management responsibilities. Leaseback programs sell a property to an investor while immediately leasing it back to the seller, generating steady rental income combined with potential tax benefits and capital recovery. Explore deeper insights on income stream structures and decide which program aligns best with your financial goals.

Source and External Links

Master Lease - A master lease is a real estate agreement where a tenant leases a property from an owner and then subleases it, managing responsibilities and potential profits.

What Is a Master Lease in Real Estate? - This agreement allows a lessee to modify and manage a property, subleasing it to occupant tenants for rental income, while the owner retains no other responsibilities.

Master Lease Agreement: Everything You Need To Know - A master lease is a contractual arrangement between a property owner and a tenant, offering tailored terms for rent, expenses, and lease duration.

dowidth.com

dowidth.com