PropTech platforms leverage advanced technology to streamline real estate transactions, offering tools like virtual tours, AI-driven property valuations, and digital contracts that enhance buyer and seller experiences. Real estate crowdfunding enables multiple investors to pool funds online, providing access to diverse property investments without traditional barriers such as large capital requirements. Explore how these innovative models are transforming property investment and purchasing dynamics.

Why it is important

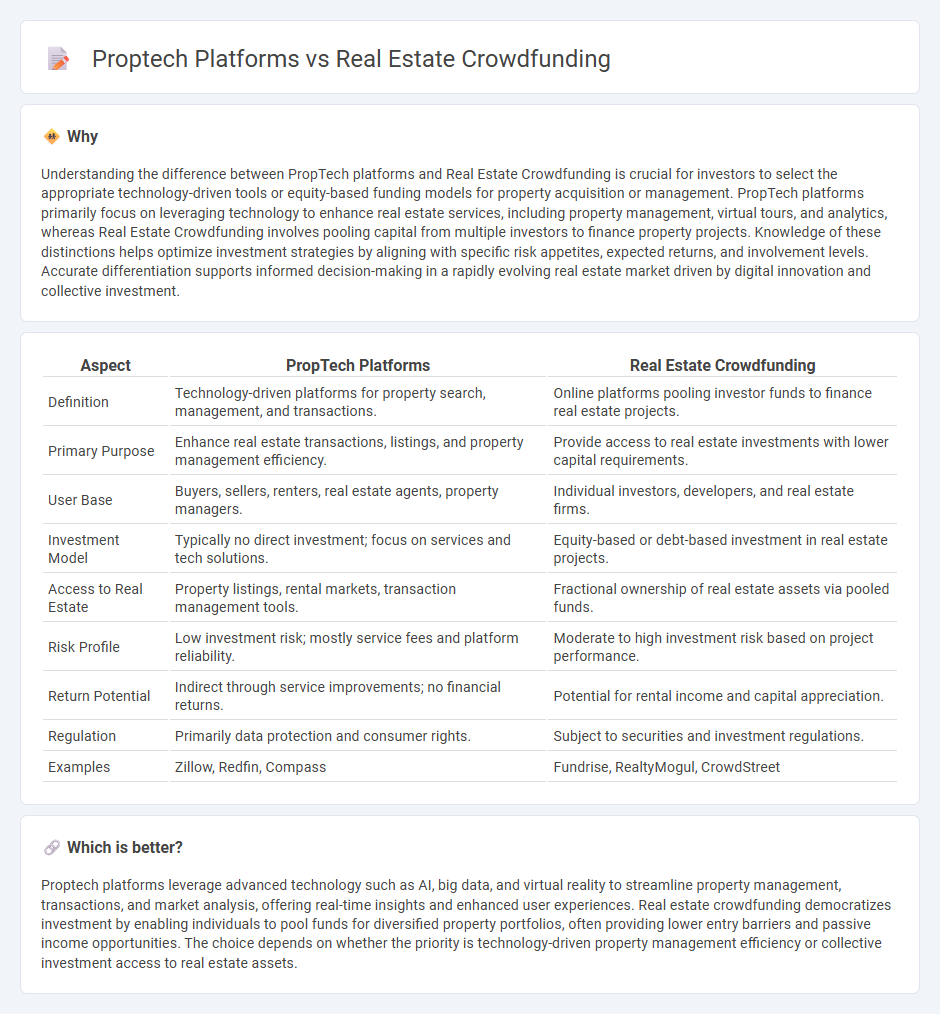

Understanding the difference between PropTech platforms and Real Estate Crowdfunding is crucial for investors to select the appropriate technology-driven tools or equity-based funding models for property acquisition or management. PropTech platforms primarily focus on leveraging technology to enhance real estate services, including property management, virtual tours, and analytics, whereas Real Estate Crowdfunding involves pooling capital from multiple investors to finance property projects. Knowledge of these distinctions helps optimize investment strategies by aligning with specific risk appetites, expected returns, and involvement levels. Accurate differentiation supports informed decision-making in a rapidly evolving real estate market driven by digital innovation and collective investment.

Comparison Table

| Aspect | PropTech Platforms | Real Estate Crowdfunding |

|---|---|---|

| Definition | Technology-driven platforms for property search, management, and transactions. | Online platforms pooling investor funds to finance real estate projects. |

| Primary Purpose | Enhance real estate transactions, listings, and property management efficiency. | Provide access to real estate investments with lower capital requirements. |

| User Base | Buyers, sellers, renters, real estate agents, property managers. | Individual investors, developers, and real estate firms. |

| Investment Model | Typically no direct investment; focus on services and tech solutions. | Equity-based or debt-based investment in real estate projects. |

| Access to Real Estate | Property listings, rental markets, transaction management tools. | Fractional ownership of real estate assets via pooled funds. |

| Risk Profile | Low investment risk; mostly service fees and platform reliability. | Moderate to high investment risk based on project performance. |

| Return Potential | Indirect through service improvements; no financial returns. | Potential for rental income and capital appreciation. |

| Regulation | Primarily data protection and consumer rights. | Subject to securities and investment regulations. |

| Examples | Zillow, Redfin, Compass | Fundrise, RealtyMogul, CrowdStreet |

Which is better?

Proptech platforms leverage advanced technology such as AI, big data, and virtual reality to streamline property management, transactions, and market analysis, offering real-time insights and enhanced user experiences. Real estate crowdfunding democratizes investment by enabling individuals to pool funds for diversified property portfolios, often providing lower entry barriers and passive income opportunities. The choice depends on whether the priority is technology-driven property management efficiency or collective investment access to real estate assets.

Connection

Proptech platforms leverage digital technology to streamline real estate transactions, asset management, and investment processes, making property ownership more accessible and efficient. Real Estate Crowdfunding utilizes these platforms to pool capital from multiple investors, enabling fractional ownership in diverse real estate projects. This synergy enhances transparency, liquidity, and market reach, transforming traditional real estate investment models.

Key Terms

Investment Model

Real estate crowdfunding platforms enable multiple investors to pool funds directly into specific properties, offering fractional ownership and access to diverse portfolios with lower capital requirements. Proptech platforms often integrate advanced technologies such as AI-driven analytics and blockchain to streamline transactions and improve transparency, while facilitating both direct and indirect investment models. Explore the nuances of these investment approaches to optimize your property portfolio and maximize returns.

Technology Integration

Real estate crowdfunding platforms leverage technology to pool funds from multiple investors, democratizing access to property investments through user-friendly digital interfaces and blockchain security. Proptech platforms integrate advanced technologies such as AI-driven property valuations, virtual reality tours, and IoT-enabled building management systems to enhance operational efficiency and customer experience. Discover how technology integration differentiates these real estate innovations and transforms investment strategies.

Ownership Structure

Real estate crowdfunding platforms enable fractional ownership where multiple investors pool funds to acquire properties, often via limited liability companies or trusts, democratizing access to real estate investments. Proptech platforms typically emphasize technology-driven property management and transactions, with ownership structures varying from individual holdings to institutional portfolios. Explore the nuances of ownership frameworks in real estate tech by learning more about each approach's legal and financial intricacies.

Source and External Links

Crowdfunding - National Association of Realtors - Real estate crowdfunding involves pooling money from many investors to fund a project and earn passive income without the legwork of traditional investing, with popular platforms including Crowdstreet, Fundrise, and YieldStreet.

Crowdfunding real estate: What to know - Rocket Mortgage - Real estate crowdfunding allows investors to co-invest via online platforms in residential and commercial properties they couldn't afford alone, helping diversify portfolios easily while providing access to investment opportunities for both accredited and nonaccredited investors.

Your Direct Access To Private Market Investing - Crowd Street - Crowd Street offers curated, professionally vetted commercial real estate deals sourced through a network of over 300 operators, enabling investors to easily browse, invest, and manage their portfolios online.

dowidth.com

dowidth.com