Value-add real estate investments target properties with potential for significant improvements, enabling investors to increase cash flow and property value through renovations, re-leasing, or operational enhancements. Core-plus investments focus on stable, income-generating properties in strong markets with moderate growth potential and lower risk profiles. Explore detailed comparisons and strategies to determine the best fit for your portfolio.

Why it is important

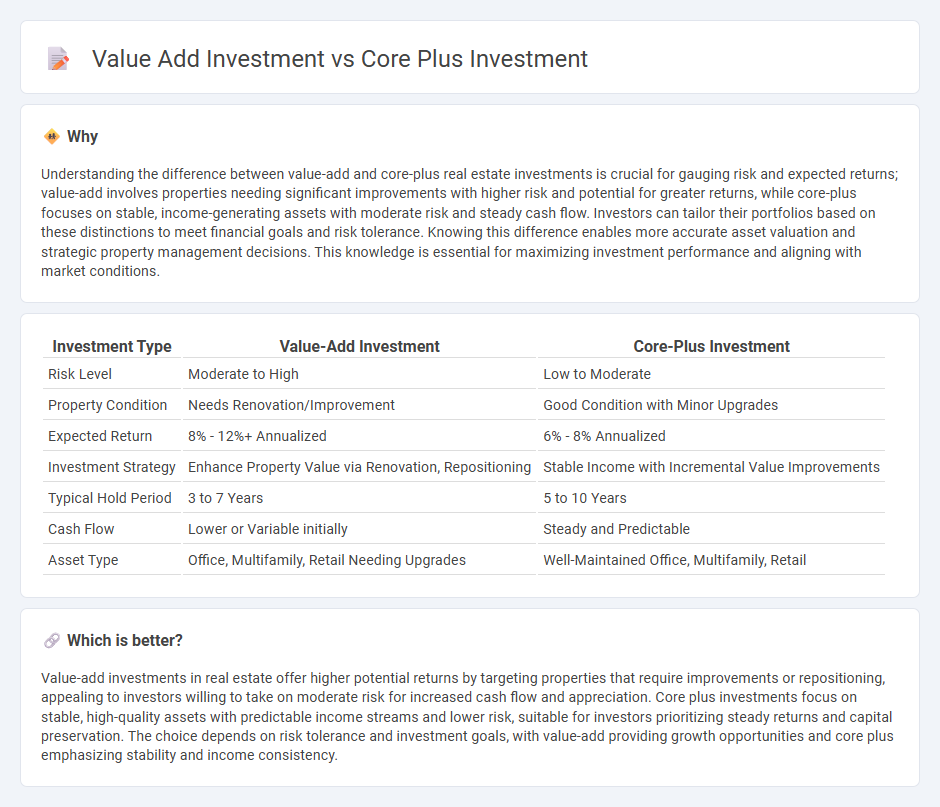

Understanding the difference between value-add and core-plus real estate investments is crucial for gauging risk and expected returns; value-add involves properties needing significant improvements with higher risk and potential for greater returns, while core-plus focuses on stable, income-generating assets with moderate risk and steady cash flow. Investors can tailor their portfolios based on these distinctions to meet financial goals and risk tolerance. Knowing this difference enables more accurate asset valuation and strategic property management decisions. This knowledge is essential for maximizing investment performance and aligning with market conditions.

Comparison Table

| Investment Type | Value-Add Investment | Core-Plus Investment |

|---|---|---|

| Risk Level | Moderate to High | Low to Moderate |

| Property Condition | Needs Renovation/Improvement | Good Condition with Minor Upgrades |

| Expected Return | 8% - 12%+ Annualized | 6% - 8% Annualized |

| Investment Strategy | Enhance Property Value via Renovation, Repositioning | Stable Income with Incremental Value Improvements |

| Typical Hold Period | 3 to 7 Years | 5 to 10 Years |

| Cash Flow | Lower or Variable initially | Steady and Predictable |

| Asset Type | Office, Multifamily, Retail Needing Upgrades | Well-Maintained Office, Multifamily, Retail |

Which is better?

Value-add investments in real estate offer higher potential returns by targeting properties that require improvements or repositioning, appealing to investors willing to take on moderate risk for increased cash flow and appreciation. Core plus investments focus on stable, high-quality assets with predictable income streams and lower risk, suitable for investors prioritizing steady returns and capital preservation. The choice depends on risk tolerance and investment goals, with value-add providing growth opportunities and core plus emphasizing stability and income consistency.

Connection

Value-add investment and core plus investment in real estate are connected through their focus on properties that offer potential for income growth and increased value through strategic improvements or management enhancements. Core plus investments typically involve stabilized assets with moderate risk and some upside potential, whereas value-add investments target properties requiring significant renovations or repositioning to achieve higher returns. Both strategies cater to investors seeking to balance risk and reward by leveraging property improvement to enhance cash flow and long-term appreciation.

Key Terms

Risk Profile

Core plus investments typically exhibit lower risk profiles due to their stable, income-generating properties with minor enhancement potential, whereas value-add investments involve moderately higher risk, targeting assets requiring significant improvements to boost cash flow and asset value. Core plus assets maintain consistent occupancy and resilient market demand, while value-add investments depend heavily on market timing and management execution for successful repositioning. Explore deeper insights into risk factors and strategic choices between these investment types to optimize portfolio performance.

Capital Improvements

Core plus investments typically involve properties in stable locations with moderate risk, requiring limited capital improvements primarily for maintenance and minor upgrades. Value add investments target assets with higher risk profiles, where substantial capital improvements such as renovations, rebranding, or operational enhancements aim to increase property value and cash flow significantly. Explore detailed strategies and examples to understand how capital improvements impact returns in both investment types.

Cash Flow

Core plus investments typically generate stable cash flow with moderate risk by targeting well-maintained properties in prime locations that may require minor improvements. Value-add investments aim to significantly increase cash flow through property upgrades and operational enhancements, involving higher risk but potentially greater returns. Explore our detailed analysis to understand which strategy aligns best with your cash flow goals.

Source and External Links

What's the Difference Between Core and Core Plus Real Estate Funds - Core plus real estate funds invest in properties similar to core assets but with a slight increase in risk, often due to factors like leverage or building quality.

Core Plus - PGIM - The Core Plus Fixed Income Strategy seeks to outperform broad market indexes by leveraging sector allocation, subsector/security selection, and duration management.

What are Core, Core Plus, Value Add and Opportunistic Investments? - Core plus real estate investments typically involve moderate risk, leveraging between 45% and 60% to achieve returns of 8% to 10% annually through income and light property improvements.

dowidth.com

dowidth.com