Escrow crowdfunding allows investors to pool funds directly into specific real estate projects with funds held securely until project milestones are met, offering greater control and transparency. Real Estate Investment Trusts (REITs) provide access to diversified property portfolios through publicly traded shares, enabling liquidity and professional management without direct involvement in property decisions. Discover how these distinct investment vehicles can align with your real estate portfolio goals.

Why it is important

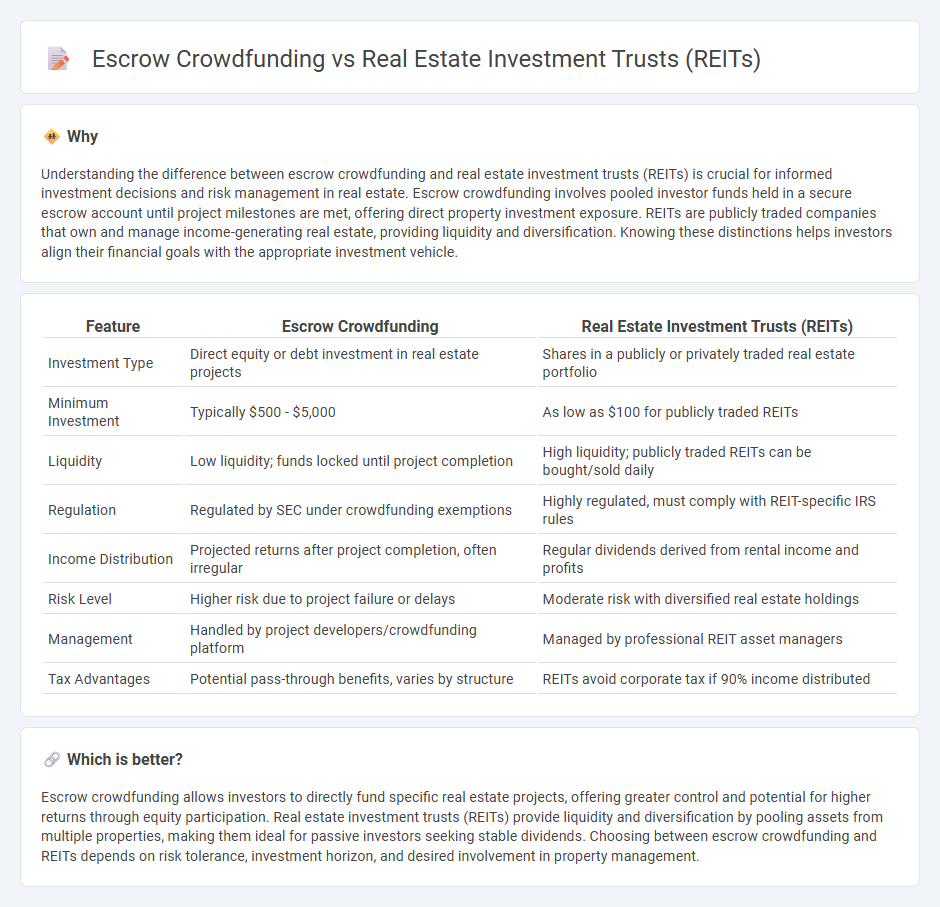

Understanding the difference between escrow crowdfunding and real estate investment trusts (REITs) is crucial for informed investment decisions and risk management in real estate. Escrow crowdfunding involves pooled investor funds held in a secure escrow account until project milestones are met, offering direct property investment exposure. REITs are publicly traded companies that own and manage income-generating real estate, providing liquidity and diversification. Knowing these distinctions helps investors align their financial goals with the appropriate investment vehicle.

Comparison Table

| Feature | Escrow Crowdfunding | Real Estate Investment Trusts (REITs) |

|---|---|---|

| Investment Type | Direct equity or debt investment in real estate projects | Shares in a publicly or privately traded real estate portfolio |

| Minimum Investment | Typically $500 - $5,000 | As low as $100 for publicly traded REITs |

| Liquidity | Low liquidity; funds locked until project completion | High liquidity; publicly traded REITs can be bought/sold daily |

| Regulation | Regulated by SEC under crowdfunding exemptions | Highly regulated, must comply with REIT-specific IRS rules |

| Income Distribution | Projected returns after project completion, often irregular | Regular dividends derived from rental income and profits |

| Risk Level | Higher risk due to project failure or delays | Moderate risk with diversified real estate holdings |

| Management | Handled by project developers/crowdfunding platform | Managed by professional REIT asset managers |

| Tax Advantages | Potential pass-through benefits, varies by structure | REITs avoid corporate tax if 90% income distributed |

Which is better?

Escrow crowdfunding allows investors to directly fund specific real estate projects, offering greater control and potential for higher returns through equity participation. Real estate investment trusts (REITs) provide liquidity and diversification by pooling assets from multiple properties, making them ideal for passive investors seeking stable dividends. Choosing between escrow crowdfunding and REITs depends on risk tolerance, investment horizon, and desired involvement in property management.

Connection

Escrow crowdfunding and real estate investment trusts (REITs) both offer investors access to real estate markets with lower capital requirements and increased liquidity. Escrow crowdfunding platforms collect and hold investors' funds securely until project milestones are met, while REITs pool capital to invest in a diversified portfolio of real estate assets, distributing income to shareholders. Both methods democratize real estate investment, reducing barriers and enhancing transparency through regulated structures.

Key Terms

Liquidity

Real Estate Investment Trusts (REITs) offer high liquidity as they are often traded on major stock exchanges, allowing investors to buy or sell shares quickly. Escrow crowdfunding, in contrast, typically involves longer lock-in periods where funds are held until project milestones are met, reducing immediate access to capital. Explore detailed comparisons to understand which investment aligns better with your liquidity preferences.

Ownership structure

Real Estate Investment Trusts (REITs) offer investors shares in a professionally managed portfolio of income-generating properties, providing indirect ownership and liquidity through public or private markets. Escrow crowdfunding allows multiple investors to pool funds directly into a specific real estate project, granting proportional ownership rights with investors holding a stake in the actual property. Explore the distinct ownership structures and benefits of REITs and escrow crowdfunding to make informed investment decisions.

Regulatory framework

Real estate investment trusts (REITs) operate under stringent regulatory frameworks established by the Securities and Exchange Commission (SEC), ensuring transparency and investor protection through requirements like audited financial statements and periodic disclosures. Escrow crowdfunding platforms are governed by specific regulations such as the JOBS Act, allowing smaller investors to participate in real estate projects with escrow accounts safeguarding funds until project milestones are met. Explore deeper insights into how these regulatory environments impact investor security and market accessibility.

Source and External Links

Real estate investment trust - Wikipedia - A real estate investment trust (REIT) is a company that owns and operates income-producing real estate, including properties such as offices, apartments, warehouses, hospitals, and shopping centers, offering investors a way to invest in real estate without owning properties directly.

What's a REIT (Real Estate Investment Trust)? - Nareit - REITs are publicly traded companies that own, operate, or finance income-producing real estate and provide investors with regular income streams, diversification, and long-term capital appreciation.

Real Estate Investment Trusts (REITs) | Investor.gov - REITs allow individuals to invest in large-scale income-producing real estate by owning shares of companies that typically operate commercial properties like malls, hotels, and warehouses, often providing dividend income from rents without requiring direct property ownership.

dowidth.com

dowidth.com