Proptech startups revolutionize real estate by leveraging technology for seamless property search, virtual tours, and blockchain-based transactions. Mortgage lenders remain essential by offering financing solutions with competitive rates and personalized loan options. Explore how Proptech innovations and traditional mortgage lending converge to transform the homebuying experience.

Why it is important

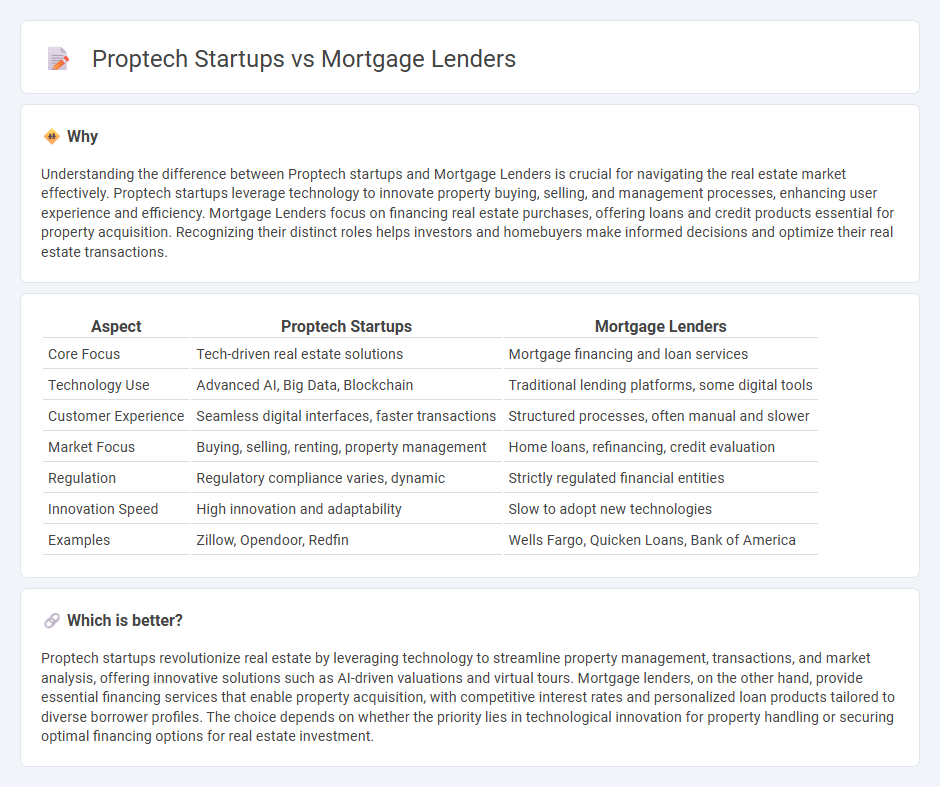

Understanding the difference between Proptech startups and Mortgage Lenders is crucial for navigating the real estate market effectively. Proptech startups leverage technology to innovate property buying, selling, and management processes, enhancing user experience and efficiency. Mortgage Lenders focus on financing real estate purchases, offering loans and credit products essential for property acquisition. Recognizing their distinct roles helps investors and homebuyers make informed decisions and optimize their real estate transactions.

Comparison Table

| Aspect | Proptech Startups | Mortgage Lenders |

|---|---|---|

| Core Focus | Tech-driven real estate solutions | Mortgage financing and loan services |

| Technology Use | Advanced AI, Big Data, Blockchain | Traditional lending platforms, some digital tools |

| Customer Experience | Seamless digital interfaces, faster transactions | Structured processes, often manual and slower |

| Market Focus | Buying, selling, renting, property management | Home loans, refinancing, credit evaluation |

| Regulation | Regulatory compliance varies, dynamic | Strictly regulated financial entities |

| Innovation Speed | High innovation and adaptability | Slow to adopt new technologies |

| Examples | Zillow, Opendoor, Redfin | Wells Fargo, Quicken Loans, Bank of America |

Which is better?

Proptech startups revolutionize real estate by leveraging technology to streamline property management, transactions, and market analysis, offering innovative solutions such as AI-driven valuations and virtual tours. Mortgage lenders, on the other hand, provide essential financing services that enable property acquisition, with competitive interest rates and personalized loan products tailored to diverse borrower profiles. The choice depends on whether the priority lies in technological innovation for property handling or securing optimal financing options for real estate investment.

Connection

Proptech startups leverage innovative technologies like AI, blockchain, and big data analytics to streamline property transactions and enhance customer experience in real estate. Mortgage lenders benefit from these advancements by accessing more accurate credit assessments, automated underwriting processes, and faster loan approvals. This symbiotic relationship accelerates the home-buying process, reduces costs, and improves transparency for borrowers and investors alike.

Key Terms

Underwriting

Mortgage lenders leverage traditional underwriting models relying on extensive credit history, income verification, and risk assessment by human underwriters to approve loans, ensuring compliance and minimizing default risk. Proptech startups utilize AI-driven algorithms, big data, and alternative data sources such as social media, rental payment history, and utility bills to streamline underwriting, reduce processing time, and improve credit accessibility for underserved borrowers. Explore the latest innovations in underwriting technologies and their impact on mortgage approvals to understand the evolving landscape better.

Digital Platforms

Mortgage lenders are increasingly integrating digital platforms to streamline loan processing, enhance customer experience, and expedite approvals through automated underwriting systems. Proptech startups leverage cutting-edge technologies such as AI-driven property valuation, blockchain for secure transactions, and mobile apps that connect buyers directly with sellers, revolutionizing traditional real estate practices. Discover how these innovations are reshaping the mortgage landscape and real estate industry by exploring the latest trends in digital platforms.

Loan Origination

Mortgage lenders leverage extensive experience and established regulatory frameworks to streamline loan origination, ensuring accuracy and compliance in the underwriting process. Proptech startups utilize advanced AI-driven algorithms and digital platforms to offer faster, more transparent application experiences with real-time credit assessments. Explore how these evolving approaches are transforming loan origination efficiency and customer satisfaction.

Source and External Links

Best Mortgage Lenders Near Houston - This article lists top mortgage lenders in Houston, including credit unions and local companies, offering various loan options.

Texas United Mortgage - Offers conventional, FHA, VA, and USDA loans with refinance options and competitive rates for homebuyers in Houston.

Texas Premier Mortgage - A top choice for Houston home loans, providing conventional, FHA, VA, jumbo, and other specialized mortgage options.

dowidth.com

dowidth.com