Build-to-rent developments focus on creating residential properties specifically designed for long-term rental, offering modern amenities and community features tailored to renters' needs. Purpose-built rental properties are constructed with the intent to serve as rental housing from inception, ensuring optimized layouts and management systems that enhance tenant satisfaction. Explore the key differences and benefits of these rental housing models to make informed real estate decisions.

Why it is important

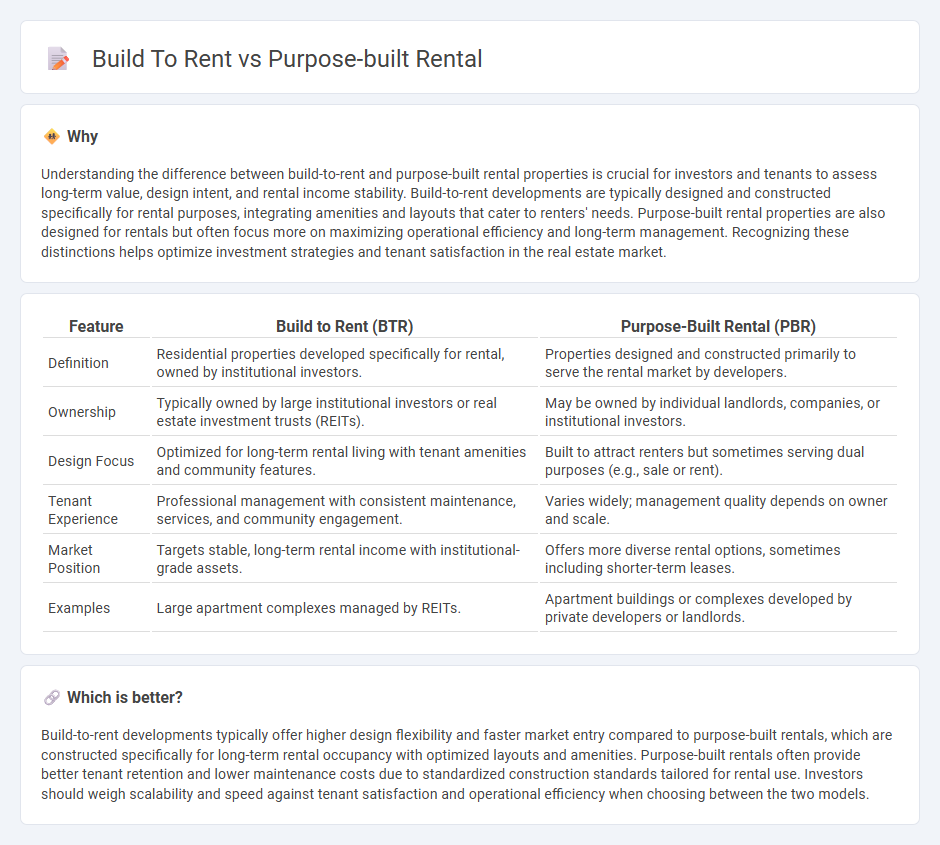

Understanding the difference between build-to-rent and purpose-built rental properties is crucial for investors and tenants to assess long-term value, design intent, and rental income stability. Build-to-rent developments are typically designed and constructed specifically for rental purposes, integrating amenities and layouts that cater to renters' needs. Purpose-built rental properties are also designed for rentals but often focus more on maximizing operational efficiency and long-term management. Recognizing these distinctions helps optimize investment strategies and tenant satisfaction in the real estate market.

Comparison Table

| Feature | Build to Rent (BTR) | Purpose-Built Rental (PBR) |

|---|---|---|

| Definition | Residential properties developed specifically for rental, owned by institutional investors. | Properties designed and constructed primarily to serve the rental market by developers. |

| Ownership | Typically owned by large institutional investors or real estate investment trusts (REITs). | May be owned by individual landlords, companies, or institutional investors. |

| Design Focus | Optimized for long-term rental living with tenant amenities and community features. | Built to attract renters but sometimes serving dual purposes (e.g., sale or rent). |

| Tenant Experience | Professional management with consistent maintenance, services, and community engagement. | Varies widely; management quality depends on owner and scale. |

| Market Position | Targets stable, long-term rental income with institutional-grade assets. | Offers more diverse rental options, sometimes including shorter-term leases. |

| Examples | Large apartment complexes managed by REITs. | Apartment buildings or complexes developed by private developers or landlords. |

Which is better?

Build-to-rent developments typically offer higher design flexibility and faster market entry compared to purpose-built rentals, which are constructed specifically for long-term rental occupancy with optimized layouts and amenities. Purpose-built rentals often provide better tenant retention and lower maintenance costs due to standardized construction standards tailored for rental use. Investors should weigh scalability and speed against tenant satisfaction and operational efficiency when choosing between the two models.

Connection

Build-to-rent and purpose-built rental properties both focus on providing residential units specifically designed for long-term rental markets, enhancing tenant satisfaction and investment stability. These developments prioritize durable construction, modern amenities, and community-focused layouts, aligning with demand trends for quality rental housing. Institutional investors increasingly target build-to-rent projects due to predictable cash flows and reduced vacancy risks inherent in purpose-built rental assets.

Key Terms

Ownership Structure

Purpose-built rental properties are typically owned and managed by institutional investors or real estate firms specializing in long-term residential leasing, providing stable income streams and professional oversight. Build-to-rent developments, on the other hand, involve dedicated construction projects specifically designed for rental occupancy, often backed by large-scale developers and investment funds that retain ownership post-construction. Explore the distinct ownership models and investment strategies driving these rental property types to make informed real estate decisions.

Development Intent

Purpose-built rental properties are specifically designed and constructed to serve as rental housing from inception, emphasizing long-term tenant needs and operational efficiency. Build to rent developments are part of broader real estate projects where residential units are developed primarily for renting rather than selling, often integrating mixed-use elements to enhance community appeal. Explore the key differences in development intent and strategic advantages to make informed investment decisions.

Tenant Demographics

Purpose-built rental properties typically attract young professionals and small families seeking affordable, community-oriented living environments with shared amenities, whereas build-to-rent developments often target a broader demographic including retirees and higher-income renters due to their premium features and strategic locations. Tenant demographics in purpose-built rentals tend to be more transient and rent-sensitive, while build-to-rent tenants generally exhibit longer lease durations and higher disposable income. Discover how understanding these demographic differences can optimize investment strategies and tenant retention.

Source and External Links

What are the key features of purpose-built rental properties? - Purpose-built rentals are constructed specifically to be rental units, featuring tailored layouts, dedicated amenities, personalized services, community living aspects, and technological systems that optimize tenant comfort and property management operations.

Real World Examples of Purpose Built Rentals in Major Cities - These rentals offer more stable landlord income with evolving trends incorporating smart home tech, sustainable practices, mixed-use developments, and amenities designed for urban tenant satisfaction and longevity.

Single-Family Rentals | The New Era of Build-to-Rent - Purpose-built single-family rentals are communities designed exclusively for renting, often including multifamily-style amenities and located in high-demand markets, catering to long-term renters seeking suburban style living with community benefits.

dowidth.com

dowidth.com