House hacking maximizes investment by allowing homeowners to generate rental income by living in one part of their property while renting out others, reducing personal housing costs. Lease options provide flexibility for tenants to control property with a potential purchase in the future, combining rental benefits with buying opportunities. Discover the unique advantages and strategic uses of house hacking and lease options to optimize your real estate investments.

Why it is important

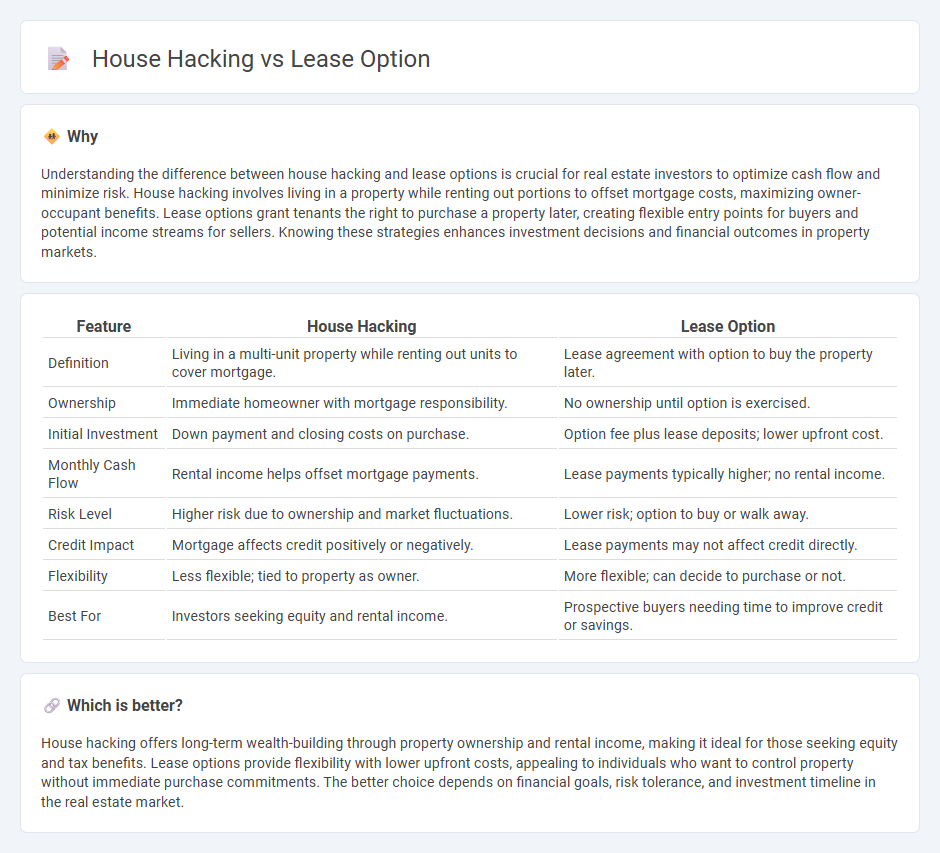

Understanding the difference between house hacking and lease options is crucial for real estate investors to optimize cash flow and minimize risk. House hacking involves living in a property while renting out portions to offset mortgage costs, maximizing owner-occupant benefits. Lease options grant tenants the right to purchase a property later, creating flexible entry points for buyers and potential income streams for sellers. Knowing these strategies enhances investment decisions and financial outcomes in property markets.

Comparison Table

| Feature | House Hacking | Lease Option |

|---|---|---|

| Definition | Living in a multi-unit property while renting out units to cover mortgage. | Lease agreement with option to buy the property later. |

| Ownership | Immediate homeowner with mortgage responsibility. | No ownership until option is exercised. |

| Initial Investment | Down payment and closing costs on purchase. | Option fee plus lease deposits; lower upfront cost. |

| Monthly Cash Flow | Rental income helps offset mortgage payments. | Lease payments typically higher; no rental income. |

| Risk Level | Higher risk due to ownership and market fluctuations. | Lower risk; option to buy or walk away. |

| Credit Impact | Mortgage affects credit positively or negatively. | Lease payments may not affect credit directly. |

| Flexibility | Less flexible; tied to property as owner. | More flexible; can decide to purchase or not. |

| Best For | Investors seeking equity and rental income. | Prospective buyers needing time to improve credit or savings. |

Which is better?

House hacking offers long-term wealth-building through property ownership and rental income, making it ideal for those seeking equity and tax benefits. Lease options provide flexibility with lower upfront costs, appealing to individuals who want to control property without immediate purchase commitments. The better choice depends on financial goals, risk tolerance, and investment timeline in the real estate market.

Connection

House hacking and lease options intersect as strategic real estate investment techniques that maximize cash flow and property control. House hacking involves living in a property while renting out portions, generating income to offset mortgage costs. Lease options allow tenants to control a property with the option to purchase later, often complementing house hacking by providing flexibility and long-term investment potential without immediate full ownership.

Key Terms

Lease Option: Option Fee

The option fee in a lease option is a non-refundable payment made by the tenant-buyer to secure the right to purchase the property at a predetermined price within a specified time frame, typically ranging from 1% to 5% of the home's purchase price. This fee often contributes toward the down payment if the tenant exercises the purchase option but is forfeited if they choose not to buy. Explore more about how option fees impact your investment strategy and homeownership opportunities.

Lease Option: Purchase Price

A lease option allows buyers to lock in a purchase price upfront, providing flexibility to buy the property later at a predetermined rate, often advantageous in rising markets. This strategy minimizes initial investment while securing potential equity growth without immediate full ownership. Explore how choosing a lease option can strategically position you for future home ownership with controlled costs.

House Hacking: Owner-Occupied Financing

House hacking leverages owner-occupied financing, allowing homeowners to purchase multi-unit properties with lower down payments, typically as low as 3-5%, by living in one unit while renting out the others. This strategy maximizes cash flow and builds equity simultaneously, benefiting from favorable mortgage rates and owner-occupant loan programs like FHA or VA loans. Explore the full potential of house hacking to boost your financial freedom and investment growth.

Source and External Links

Lease Option: Definition and How It Works - Rocket Mortgage - A lease option allows a tenant to rent a home before deciding to purchase it, providing flexibility and the opportunity to test the property over time.

Lease-Option Purchases - National Association of REALTORS - Lease options are contractual agreements where tenants rent a property with the option to purchase it after a specified period, often involving an upfront option fee.

Lease-option - Wikipedia - A lease option is a contract used in real estate that gives the renter the option to buy a property at the end of the lease, without binding them to the purchase.

dowidth.com

dowidth.com