Micro flipping involves quickly buying, renovating, and selling properties for a small profit within days or weeks, targeting minimal holding costs and fast turnover. Wholesaling real estate focuses on securing a property under contract and assigning that contract to an end buyer without owning the property, enabling investors to earn fees with little capital investment. Explore the key differences and strategies of micro flipping versus wholesaling to maximize your real estate investment returns.

Why it is important

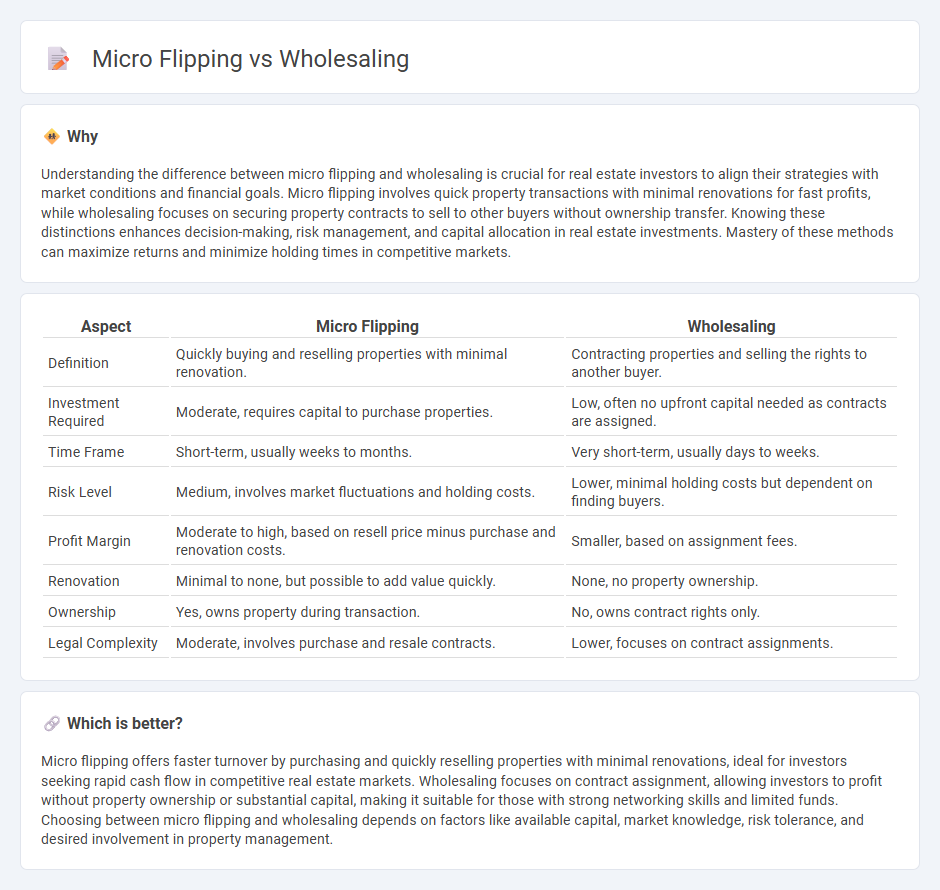

Understanding the difference between micro flipping and wholesaling is crucial for real estate investors to align their strategies with market conditions and financial goals. Micro flipping involves quick property transactions with minimal renovations for fast profits, while wholesaling focuses on securing property contracts to sell to other buyers without ownership transfer. Knowing these distinctions enhances decision-making, risk management, and capital allocation in real estate investments. Mastery of these methods can maximize returns and minimize holding times in competitive markets.

Comparison Table

| Aspect | Micro Flipping | Wholesaling |

|---|---|---|

| Definition | Quickly buying and reselling properties with minimal renovation. | Contracting properties and selling the rights to another buyer. |

| Investment Required | Moderate, requires capital to purchase properties. | Low, often no upfront capital needed as contracts are assigned. |

| Time Frame | Short-term, usually weeks to months. | Very short-term, usually days to weeks. |

| Risk Level | Medium, involves market fluctuations and holding costs. | Lower, minimal holding costs but dependent on finding buyers. |

| Profit Margin | Moderate to high, based on resell price minus purchase and renovation costs. | Smaller, based on assignment fees. |

| Renovation | Minimal to none, but possible to add value quickly. | None, no property ownership. |

| Ownership | Yes, owns property during transaction. | No, owns contract rights only. |

| Legal Complexity | Moderate, involves purchase and resale contracts. | Lower, focuses on contract assignments. |

Which is better?

Micro flipping offers faster turnover by purchasing and quickly reselling properties with minimal renovations, ideal for investors seeking rapid cash flow in competitive real estate markets. Wholesaling focuses on contract assignment, allowing investors to profit without property ownership or substantial capital, making it suitable for those with strong networking skills and limited funds. Choosing between micro flipping and wholesaling depends on factors like available capital, market knowledge, risk tolerance, and desired involvement in property management.

Connection

Micro flipping and wholesaling are connected through their focus on rapid real estate transactions aimed at generating quick profits with minimal investment. Both strategies involve securing contracts or properties below market value and quickly transferring them to end buyers or investors without extensive renovations. This approach minimizes holding costs and market risks while maximizing cash flow in competitive real estate markets.

Key Terms

Assignment Contract

Wholesaling involves securing a property under contract and selling the contractual rights to another buyer without taking ownership, often using an Assignment Contract to transfer those rights quickly. Micro flipping focuses on rapidly reselling purchased contracts, frequently utilizing Assignment Contracts to expedite transactions and minimize holding time. Discover more about how Assignment Contracts streamline these strategies and optimize real estate investing.

Double Closing

Double closing in wholesaling involves simultaneously buying and selling a property to avoid assignment fees, facilitating quick profit without property ownership. Micro flipping leverages rapid digital transactions, often using virtual contracts and minimal capital to flip properties multiple times within short periods. Explore the nuances of double closing and micro flipping to enhance your real estate investment strategies.

Digital Transactions

Wholesaling involves securing contracts for bulk property sales, often requiring significant capital and traditional face-to-face negotiations, whereas micro flipping centers on quick, low-cost transactions executed digitally through online platforms and mobile apps. Digital transactions in micro flipping streamline processes with e-signatures, instant funding, and automated marketing tools, maximizing speed and scalability. Explore our detailed comparison to understand how digital innovation is transforming property investment strategies.

Source and External Links

Wholesaling - Wholesaling involves purchasing goods in bulk from manufacturers or sources and selling them to retailers or other wholesalers at a price that allows for profit.

Wholesaling: How to Start a Wholesale Business in 2025 - This guide provides steps and insights on starting a wholesale business, including choosing products, finding suppliers, and marketing.

Wholesale Real Estate: A Beginner's Guide - Real estate wholesaling is a strategy where a wholesaler contracts a property and sells the contract to an investor, earning a profit without purchasing the property.

dowidth.com

dowidth.com