Automated Valuation Models (AVMs) utilize complex algorithms and vast datasets to provide rapid, data-driven property valuations, enhancing efficiency and consistency in real estate assessments. Desktop Appraisals involve licensed appraisers who analyze property data remotely, incorporating expert judgment alongside market trends for more nuanced valuations. Explore the key differences and advantages of AVMs versus Desktop Appraisals to determine the best approach for accurate property valuation.

Why it is important

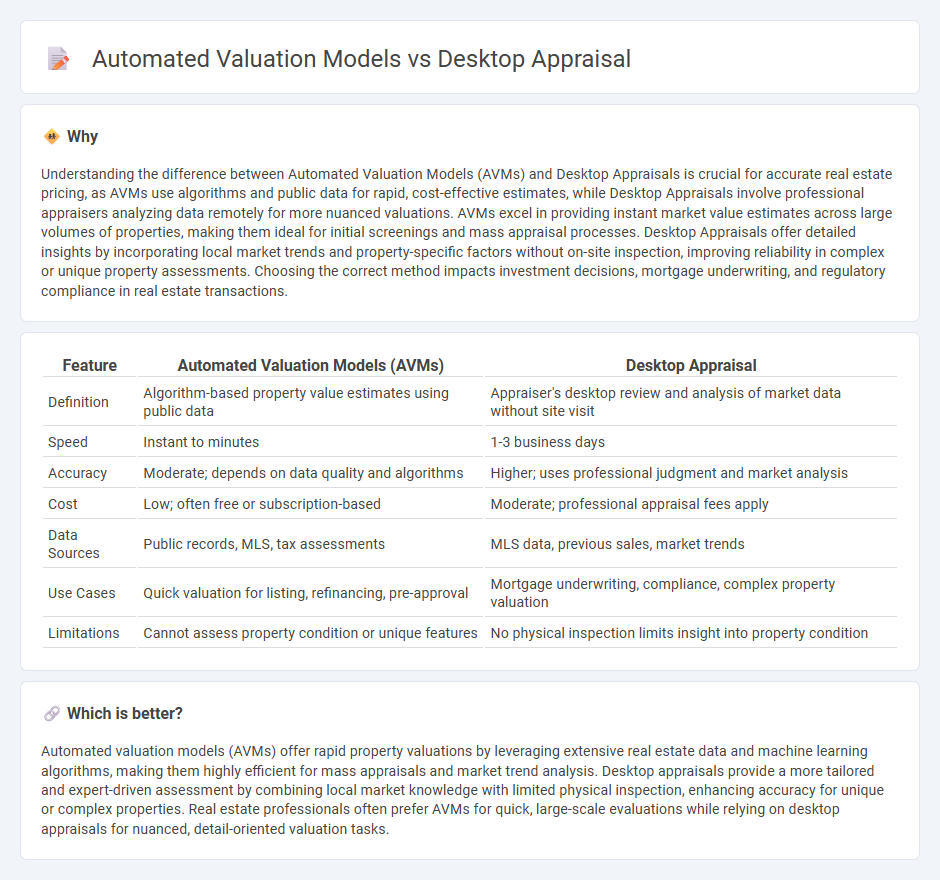

Understanding the difference between Automated Valuation Models (AVMs) and Desktop Appraisals is crucial for accurate real estate pricing, as AVMs use algorithms and public data for rapid, cost-effective estimates, while Desktop Appraisals involve professional appraisers analyzing data remotely for more nuanced valuations. AVMs excel in providing instant market value estimates across large volumes of properties, making them ideal for initial screenings and mass appraisal processes. Desktop Appraisals offer detailed insights by incorporating local market trends and property-specific factors without on-site inspection, improving reliability in complex or unique property assessments. Choosing the correct method impacts investment decisions, mortgage underwriting, and regulatory compliance in real estate transactions.

Comparison Table

| Feature | Automated Valuation Models (AVMs) | Desktop Appraisal |

|---|---|---|

| Definition | Algorithm-based property value estimates using public data | Appraiser's desktop review and analysis of market data without site visit |

| Speed | Instant to minutes | 1-3 business days |

| Accuracy | Moderate; depends on data quality and algorithms | Higher; uses professional judgment and market analysis |

| Cost | Low; often free or subscription-based | Moderate; professional appraisal fees apply |

| Data Sources | Public records, MLS, tax assessments | MLS data, previous sales, market trends |

| Use Cases | Quick valuation for listing, refinancing, pre-approval | Mortgage underwriting, compliance, complex property valuation |

| Limitations | Cannot assess property condition or unique features | No physical inspection limits insight into property condition |

Which is better?

Automated valuation models (AVMs) offer rapid property valuations by leveraging extensive real estate data and machine learning algorithms, making them highly efficient for mass appraisals and market trend analysis. Desktop appraisals provide a more tailored and expert-driven assessment by combining local market knowledge with limited physical inspection, enhancing accuracy for unique or complex properties. Real estate professionals often prefer AVMs for quick, large-scale evaluations while relying on desktop appraisals for nuanced, detail-oriented valuation tasks.

Connection

Automated Valuation Models (AVMs) leverage algorithms and extensive property data to generate instant property value estimates, which serve as the core input for Desktop Appraisals conducted remotely by appraisers without physical property inspection. Desktop Appraisals enhance the efficiency of real estate valuations by integrating AVM data with local market analysis, public records, and recent sales to provide a reliable and timely appraisal report. The synergy between AVMs and Desktop Appraisals reduces appraisal costs and turnaround times while maintaining accuracy and compliance with regulatory standards.

Key Terms

Human Valuation

Desktop appraisal relies on expert human valuation, incorporating market trends, property condition, and neighborhood nuances for a comprehensive analysis. Automated valuation models (AVMs) use algorithms and large datasets to generate quick property value estimates but may lack context sensitivity and local insight. Explore the strengths and limitations of human valuation compared to AVMs to understand which method suits your real estate needs.

Algorithmic Analysis

Desktop appraisal leverages human expertise combined with data inputs to produce property valuations, emphasizing nuanced judgment and market knowledge. Automated valuation models (AVMs) rely entirely on algorithmic analysis, using large datasets and machine learning techniques to estimate property values quickly and consistently. Explore the detailed differences in accuracy, data sources, and application scenarios to understand which valuation method suits your needs best.

Data Sources

Desktop appraisals rely on comprehensive public records, recent comparable sales, and local market trends to estimate property value accurately without physical inspection. Automated valuation models (AVMs) utilize large datasets including property tax assessments, historical sales data, and proprietary algorithms to generate rapid, data-driven valuations. Explore the differences in data sources and accuracy between desktop appraisals and AVMs to make informed valuation decisions.

Source and External Links

About desktop appraisals - Fannie Mae - Desktop appraisals use Fannie Mae Form 1004 (Desktop) where the appraiser develops an opinion of value remotely using data from various parties and public sources without physically inspecting the property, and must include a floor plan with dimensions.

Desktop Appraisals: Expert Tips for Success | McKissock - Desktop appraisals are property valuations done remotely using records like MLS listings and public data instead of an on-site inspection; used for refinance, pre-foreclosure, portfolio benchmarking, and other assignments where no physical inspection is required.

Desktop Appraisal | Cost Effective Property Valuation - Desktop appraisals offer a cost-effective valuation option done by credentialed appraisers who use images and local data without full physical inspections, meeting regulatory and credit risk policies.

dowidth.com

dowidth.com